From Tax Liability to Wealth Legacy: The Definitive 1031 Exchange Guide for Commercial Investors

📌 Key Takeaways

A 1031 exchange preserves equity by deferring capital gains taxes—but only when structured before closing and executed with compliance-grade precision.

Pre-Closing Setup Is Non-Negotiable: Engaging a qualified intermediary after closing triggers constructive receipt, causing immediate exchange failure and full tax liability.

Deadlines Are Absolute Statutory Requirements: The 45-day identification window and 180-day exchange period have zero exceptions—missing either deadline by even one day invalidates the entire exchange.

Replace Both Equity and Debt: To fully defer gains, replacement property must match or exceed both the relinquished property's value and any debt relieved to avoid mortgage boot.

QI Security Demands Legal Expertise: Attorney-led intermediaries with segregated accounts, adequate insurance, and decades of experience provide critical protection for potentially millions in exchange funds.

Texas Investors Face 20-35% Tax Exposure: With no state income tax, the federal tax burden—combining capital gains, NIIT, and depreciation recapture—typically consumes 20-35% of realized gains.

Prepared = preserved equity and compounding capital under your control.

Commercial property owners in Houston and Austin planning dispositions will gain the compliance framework needed here, preparing them for the detailed implementation steps that follow.

Commercial real estate creates wealth in two ways: income during ownership and equity at disposition. The moment a property is sold, however, taxes can siphon off a meaningful portion of that equity. When that tax bill meaningfully erodes purchasing power—often representing a significant percentage of the realized gain, typically between 20% and 35% depending on depreciation recapture and state tax liabilities—the decision often shifts from "just pay it" to "structure a 1031 exchange."

A 1031 exchange is not paperwork. It is wealth-preservation architecture that allows property owners to maintain control of their capital and direct their own investment decisions. Done correctly, it keeps capital working under your control. Done carelessly, it can trigger the very tax liability the exchange was meant to defer.

Think of equity like a bucket of water carried across a desert. If too much is spilled—taxes paid unnecessarily or triggered by noncompliance—less reaches the destination. The objective is to arrive with as much water intact as possible, remaining in your hands to deploy as you see fit.

This guide explains the rules, the timeline, and the pre-closing steps that protect equity for property owners making their own direct investment decisions—especially for exchangers operating in Houston, TX (and for readers also serving Austin, TX). The exchange must be structured before closing and executed with compliance-grade precision.

A Commercial 1031 Exchange, in Plain English

A 1031 exchange allows commercial property owners to defer capital gains taxes when selling one investment property and acquiring another—while maintaining direct ownership and control of both assets. The mechanism comes from Section 1031 of the Internal Revenue Code, which has permitted like-kind exchanges for real property since 1921.[^1]

The critical word is defer—not eliminate, not forgive. The tax obligation doesn't disappear; it transfers to the replacement property. Sell that replacement property without another exchange, and the original gain comes due along with any new appreciation.

Why does this matter for property owners acting as active sponsors or principals? Consider the purchasing power implications.

When you sell a $2 million commercial property with $500,000 in taxable gains, the total tax liability—comprising federal capital gains (up to 20%), the 3.8% Net Investment Income Tax, and 25% depreciation recapture—can meaningfully erode your proceeds. In many cases, this tax burden typically ranges from 20% to 30% of your realized gain, which directly reduces the net equity available for reinvestment.[^1] That's money that could have served as the down payment on a larger asset, funded improvements on a replacement property, or simply remained invested and compounding under your control.

After the Tax Cuts and Jobs Act of 2017, Section 1031 applies exclusively to real property held for investment or business use. Personal property, equipment, and other assets no longer qualify. For commercial real estate exchangers, this actually simplified matters—the focus is now squarely on real property transactions where you hold direct title.[^1]

The exchange also resets your depreciation schedule on the replacement property, though depreciation recapture remains a factor that your CPA should address during planning.

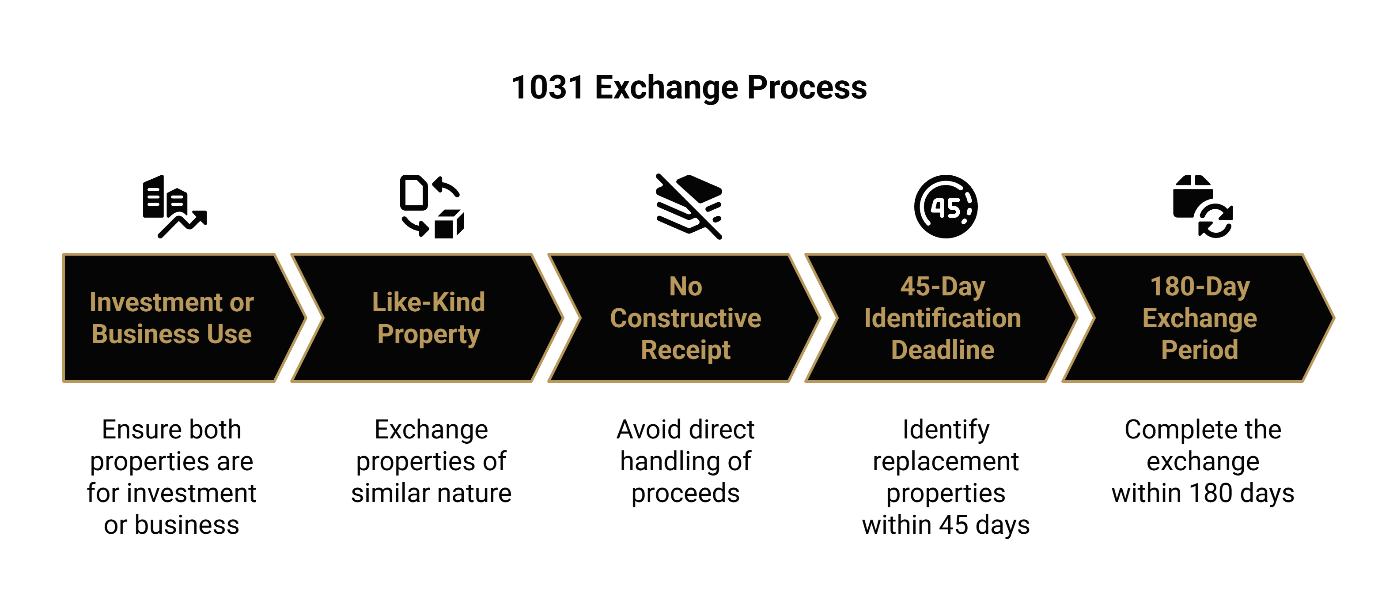

The 5 Non-Negotiables That Make or Break the Exchange

Every successful 1031 exchange rests on five requirements. Miss any one of them, and the IRS can invalidate the entire transaction—leaving you with an immediate tax bill and no recourse.

Requirement 1: Investment or Business Use

Both the property you're selling (the relinquished property) and the property you're acquiring (the replacement property) must be held for investment or productive use in a trade or business. Personal residences, vacation homes used primarily for personal enjoyment, and properties held primarily for resale don't qualify.

The distinction matters more than many exchangers realize. A property you've listed on short-term rental platforms might qualify if it's genuinely operated as a rental business (typically requiring limiting personal use to 14 days or 10% of rental days). A second home you occasionally rent might not. The facts and circumstances of your specific situation determine qualification—which is precisely why your CPA and qualified intermediary need to review your situation before closing.

Requirement 2: Like-Kind Property

For real property, the like-kind requirement is broader than most property owners expect. Commercial for commercial isn't required. You can exchange an office building for raw land, a retail center for an apartment complex, or a Houston industrial facility for Austin multifamily units—maintaining direct ownership throughout.

What matters is that both properties are real property held for investment or business purposes—not the property type, location, or quality.[^1]

Requirement 3: No Constructive Receipt

This is where exchanges fail most catastrophically, often due to a fundamental misunderstanding.

You cannot touch the proceeds. Not briefly. Not to "hold" them in your own account for a few days. Not even with the best intentions of immediately reinvesting.

The moment you have actual or constructive receipt of the funds, the exchange fails. This is precisely why a qualified intermediary holds the proceeds from the relinquished property sale. The QI is not optional infrastructure—they're the mechanism that keeps your funds secure, beyond your reach, and your exchange intact.

Given the stakes involved, the security and legal expertise of your intermediary matters enormously. Securitas 1031 takes its name from the Roman goddess of security and stability—a reminder that protecting your exchange funds requires more than administrative efficiency. It demands legal precision and secure fund handling backed by experienced attorneys.

Requirement 4: The 45-Day Identification Deadline

From the day your relinquished property closes, you have exactly 45 calendar days to identify potential replacement properties in writing to your qualified intermediary. Not 45 business days. Not "about six weeks." Forty-five calendar days, and the deadline doesn't extend for weekends or holidays.[^3]

The identification rules offer some flexibility in how many properties you can identify, but the deadline itself is absolute. Miss Day 45 by even one day, and your exchange fails.

Requirement 5: The 180-Day Exchange Period

You must close on your replacement property within 180 calendar days of selling your relinquished property—or by your tax return due date for that year, whichever comes first.[^3]

That tax return deadline catches some taxpayers off guard. If you sell your relinquished property in November, you might have less than 180 days before your April 15 filing deadline. Extensions can help, but this requires advance planning with your tax advisor.

Ready to protect your equity before your next closing?

The rules above aren't suggestions—they're the IRS requirements that determine whether your exchange succeeds or fails. If you're considering a 1031 exchange for an upcoming commercial transaction, schedule a free in-person consultation to review your specific situation.

Call 713-275-8112 or complete our contact form to speak directly with our Houston-based team of attorneys and tax professionals.

Step-by-Step Process: From LOI to Closing

Understanding the mechanics of a delayed exchange—the most common structure—helps property owners plan effectively and maintain control throughout the transaction.

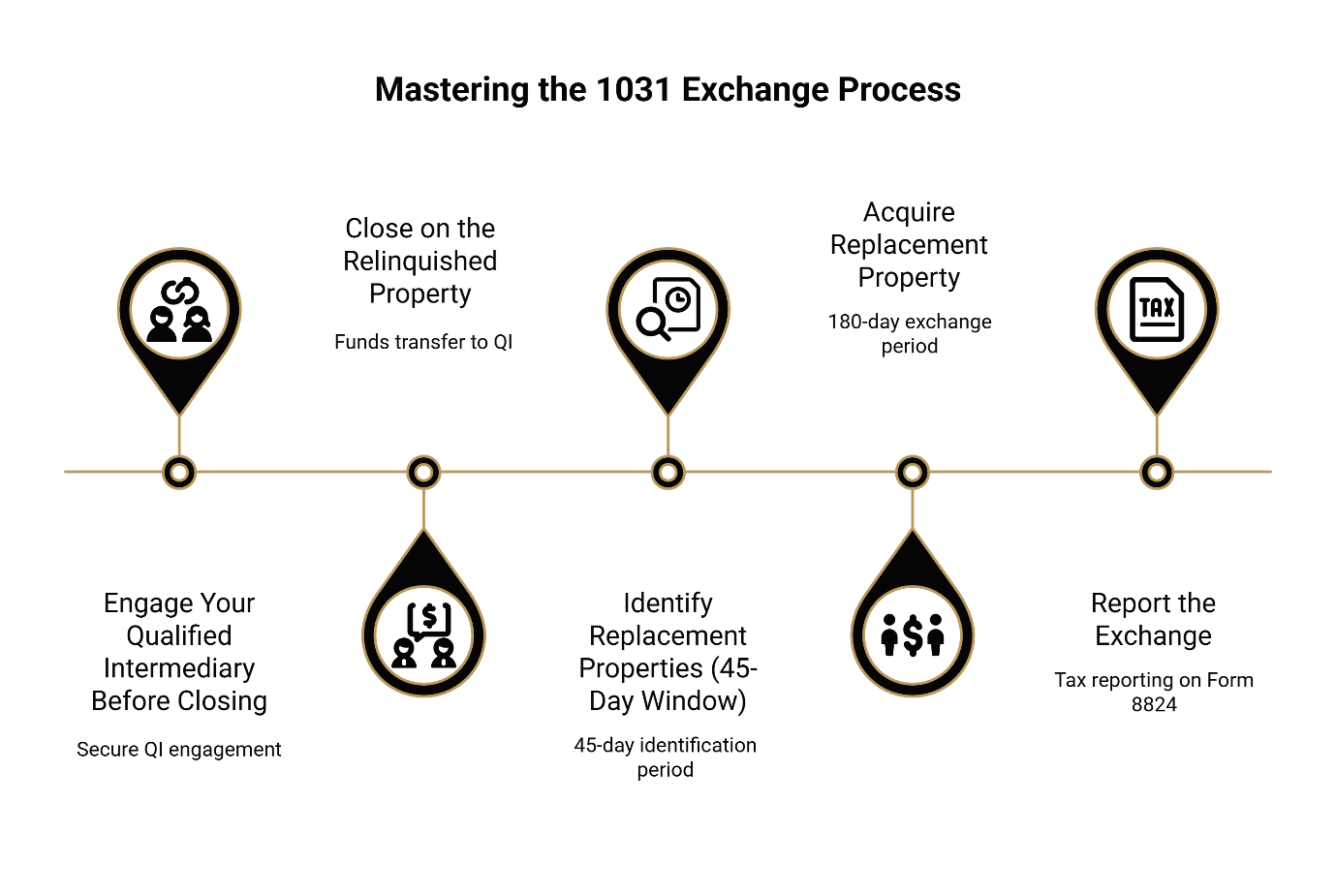

Step 0: Engage Your Qualified Intermediary Before Closing

This step happens before you close on your relinquished property sale. Your QI must be in place, with exchange documents executed, before the proceeds change hands. Trying to set up an exchange after closing is too late—you'll have constructive receipt of the funds, and the exchange fails before it begins.

The most common operational failure is waiting until the day of closing to "figure out the exchange." In many transactions, once proceeds are disbursed to the seller, the compliance risk becomes immediate. Treat the exchange like a pre-closing project plan, not a post-closing scramble.

The best practice is engaging your qualified intermediary when you accept an offer on your relinquished property, giving adequate time to prepare documentation and coordinate with the title company.

Step 1: Close on the Relinquished Property

At closing, the sale proceeds transfer directly to your qualified intermediary—not to you, not to your attorney's trust account, not anywhere you could access them. The QI holds these funds in a segregated account until you're ready to acquire your chosen replacement property.

Your settlement statement will reflect the exchange structure, and the title company coordinates directly with your QI to ensure proper fund handling. Throughout this process, you remain the taxpayer on record—the exchange structure simply defers recognition while you maintain decision-making authority over which replacement property to acquire.

Step 2: Identify Replacement Properties (The 45-Day Window)

The clock starts the day your relinquished property closes. During the next 45 days, you must provide written identification of potential replacement properties to your QI.

Identification is not "having a short list." It is a compliance deliverable with a deadline. The operational recommendation is to run the replacement search with contingency planning and manage it like any other critical business deliverable.

The 45-day identification rule offers three methods for identification:

Three-Property Rule: Identify up to three properties regardless of value

200% Rule: Identify any number of properties as long as their combined value doesn't exceed 200% of the relinquished property's sale price

95% Rule: Identify any number of properties if you acquire at least 95% of their combined value (rarely used due to its stringency)

Most exchangers use the three-property rule for its simplicity and flexibility. Identifying backup properties is essential—if your primary target falls through after Day 45, you can only acquire properties you've already identified. Avoid hope-based identification where properties are unlikely to actually transact.

Timeline discipline matters: Build internal checkpoints at Day 30 (verify replacement pipeline strength and prepare backup identifications), Day 40 (finalize identification package), and Day 44 (last internal checkpoint before the compliance deadline).

Step 3: Acquire Replacement Property

Once you've identified replacement properties, you work toward closing on one or more of them within the 180-day exchange period. Your QI releases the held funds directly to the closing, and the replacement property transfers to you—with you taking direct title and maintaining full ownership control.

To fully defer your gain, the replacement property must be equal or greater in value than the relinquished property, and you must reinvest all the equity and replace any debt relieved on the relinquished property. Taking cash out or acquiring a less valuable property results in boot—the taxable portion of your exchange.

The acquisition must occur within the exchange period and should be coordinated to avoid title and vesting issues. Align legal entity and vesting details early and confirm they match exchange requirements. This is where having a QI with legal expertise becomes invaluable—technical vesting issues can derail exchanges at the finish line.

Step 4: Report the Exchange

Your 1031 exchange gets reported on Form 8824, filed with your tax return for the year the exchange occurred. This form documents both the relinquished and replacement properties, the timeline, and the deferred gain calculations.

Your CPA handles the reporting, but maintaining complete documentation throughout the exchange—settlement statements, identification letters, QI records—makes their job easier and strengthens your position if questions arise later. [^2]

1031 Exchange Readiness Checklist

This checklist converts pre-closing anxiety into operational readiness. Use it to ensure nothing falls through the cracks.

Pre-Sale Planning

[ ] Confirm property is held for investment/business use (CPA review)

[ ] Engage a qualified intermediary before relinquished closing

[ ] Align entity/vesting strategy with counsel and CPA

[ ] Build a realistic transaction timeline and contingency plan

[ ] Verify you'll maintain direct ownership of replacement property

Document Readiness

[ ] Gather settlement statement and key closing documents

[ ] Assemble basis and depreciation history inputs (CPA-side)

[ ] Confirm LOI timeline and expected closing windows

[ ] Document replacement search criteria and constraints

Timeline Plan (Shot Clock Discipline)

[ ] Day 0: Closing occurs; exchange clock begins

[ ] Day 30: Verify replacement pipeline strength; prepare backup identifications

[ ] Day 40: Finalize identification package; confirm delivery method

[ ] Day 44: Last internal checkpoint before Day 45 compliance deadline

[ ] Day 45: Identification deadline (absolute)

[ ] Day 180: Replacement acquisition deadline

Replacement Search: Plan A + Plan B

[ ] Identify primary replacement options where you'll hold direct title

[ ] Identify credible backups that could realistically close

[ ] Avoid hope-based identification that is unlikely to transact

[ ] Confirm all identified properties meet like-kind requirements

Next-Step Tools

Estimate potential tax exposure with our calculator

Contact our team for execution support

Where Commercial Deals Go Sideways

Missed Deadlines

The 45-day and 180-day deadlines are statutory. There are no extensions for good faith efforts, market conditions, or circumstances beyond your control. Property owners who treat these deadlines casually—assuming they'll "probably find something" or that a few extra days won't matter—learn expensive lessons.

When Day 45 is missed, the exchange can fail, often converting a tax deferral plan into immediate recognition. The identification deadline is inflexible in ordinary operation.

Build your timeline backward from Day 45 and Day 180. Know your drop-dead dates before you list the relinquished property. Build redundancy into replacement identification and set internal alerts well before Day 45.

Title and Vesting Mismatches

The taxpayer who sells must be the same taxpayer who buys. This sounds obvious until you consider the variations that create problems: selling from an LLC but acquiring in your personal name, having a different entity structure between properties, or adding partners between transactions.

A frequent technical issue is that the entity selling and the entity buying must align with exchange requirements. Fixing this late can be difficult, especially in multi-party commercial closings. Vesting issues can sometimes be resolved, but they require advance planning. Discovering a mismatch at the replacement closing—with the 180-day deadline approaching—creates unnecessary stress and risk.

Verify entity and vesting in the earliest phase of transaction planning and keep counsel and CPA aligned. This is one area where working with a qualified intermediary led by experienced attorneys—rather than a purely administrative service—provides meaningful protection.

Replacement Deal Fallout After Day 45

You've identified three properties. Your preferred target falls through on Day 60. Your second choice has title issues. Suddenly you're scrambling toward your third option with limited time and leverage.

This scenario plays out regularly in competitive markets. The solution isn't hoping it won't happen—it's identifying backup properties you would genuinely acquire, not just placeholders. Having a viable Plan B and Plan C on your identification list provides genuine protection.

Even well-planned exchanges can run into market reality: the right replacement deal may not materialize quickly, or underwriting may slow down. Build a Plan A / Plan B strategy and identify backups early enough that they are still viable options.

QI Security Failures

Your qualified intermediary holds potentially millions of dollars of your equity. If they commingle funds, lack adequate insurance, or—in worst cases—become insolvent, your exchange funds could be at risk.

This isn't theoretical. QI failures have occurred, leaving exchangers without funds to complete their exchanges. Diligence on your QI selection isn't paranoia; it's prudent risk management. In commercial transactions, the proceeds can be large and time-sensitive, and the provider is effectively the bridge between proceeds and compliance execution.

How to Choose a Qualified Intermediary: Security-First Vetting

Choosing a qualified intermediary deserves the same diligence you'd apply to any fiduciary relationship—because that's essentially what it is. Treat the QI selection like counterparty risk evaluation.

The security of your exchange funds depends entirely on who holds them. This is why Securitas 1031's foundation as an attorney-led firm matters. With over 30 years of experience in real estate law and tax compliance, our team brings legal precision to every exchange—not just administrative processing.

Security Questions to Ask

Does the QI maintain segregated, client-by-client accounts?

Commingled accounts—where your funds mix with other clients' funds—create risk if the QI faces financial difficulties. Segregated accounts mean your money is identifiably yours.

What fidelity bond and errors & omissions coverage does the QI carry?

Adequate insurance protects against both theft and professional mistakes. Ask for coverage amounts and verify they're appropriate for your transaction size.

What internal controls govern fund access?

Who can authorize disbursements? Is there dual-control requiring multiple approvals? How are wire transfers verified to prevent fraud?

What legal credentials does the QI team hold?

Working with attorneys (JDs, LL.Ms in Taxation) rather than purely administrative staff means your exchange is structured with legal precision from the start. Charles H. Mansour, founder of Securitas 1031, holds a JD and an LL.M. in Taxation, bringing three decades of real estate and tax law experience to complex exchange scenarios.

How responsive is the QI under deadline pressure?

When you need documents signed on Day 44 or funds wired for an unexpected closing acceleration, will you reach a human who can act—or a voicemail tree? Ask about responsiveness expectations and escalation paths.

What experience exists with complex commercial scenarios?

Reverse and improvement exchanges can add complexity and time pressure. Working with a team that has handled 18,000+ closings means they've seen—and successfully navigated—the complications that can arise.

The Value of Local Accountability

National QI services exist, and some operate competently. But there's something to be said for working with professionals you can meet face-to-face, whose office is in your market, and who understand the local transaction environment.

In Houston's commercial real estate market, deals move quickly and closing timelines shift. Having a QI who answers the phone, knows the local title companies, and can walk you through complications in person provides a layer of support that matters when stakes are high.

The Federation of Exchange Accommodators provides industry standards and resources for evaluating QI qualifications.[^4]

Common Commercial Scenarios: An Overview

Beyond the standard delayed exchange, several structures address specific situations for property owners maintaining direct control of their assets. Each carries additional complexity and benefits from qualified guidance.

Reverse Exchange

Sometimes you find the perfect replacement property before your relinquished property sells. A reverse exchange allows you to acquire the replacement first, using an Exchange Accommodation Titleholder to "park" one of the properties while you complete the transaction.

Reverse exchanges require more capital and carry higher costs, but they solve the timing problem when opportunity and your sale timeline don't align. This structure may be considered when the replacement property must be acquired before the relinquished property can close, often driven by competitive acquisitions or short seller timelines. Throughout the process, you remain the beneficial owner making the investment decisions.

Construction/Improvement Exchange

Want to acquire land and construct improvements using exchange funds? A construction or improvement exchange allows exchange proceeds to fund construction on the replacement property before you take title.

The construction must be completed within the 180-day window, which limits how extensive improvements can be. Careful planning with your QI and contractors is essential. This structure allows property owners to create exactly the asset they want rather than settling for what's available on the market.

Estate Planning and Exiting Joint Ownership

One of the most powerful applications of 1031 exchanges involves estate planning and unwinding problematic ownership structures. If you're co-owner of a property with someone you'd prefer not to be in business with—whether that's a former spouse, sibling, or business partner—a 1031 exchange can provide the mechanism to exit that relationship while preserving your equity.

Similarly, property owners thinking about their heirs can use 1031 exchanges as part of a broader wealth transfer strategy. By continually exchanging into properties with stronger fundamentals or better locations, you build a more valuable estate to pass to the next generation. The stepped-up basis at death can eventually eliminate the deferred gain entirely, making the 1031 exchange a bridge to generational wealth transfer.

Partial Exchange and Boot

Not every exchange needs to be dollar-for-dollar. You can choose to take some cash out of the transaction—recognizing that portion as taxable boot—while still deferring gain on the reinvested equity.

This trade-off between immediate liquidity and tax deferral is a legitimate planning choice, though it requires understanding exactly how much boot you'll recognize and what the tax impact will be. When not all proceeds are reinvested (or debt replacement is not matched), taxable value can be triggered.

Non-Safe Harbor Structures

Some exchange structures fall outside the IRS safe harbor rules that provide the clearest compliance path. These can carry elevated audit risk and require sophisticated planning. If someone proposes a structure that sounds unusually creative, verify it with your tax advisor before proceeding. These structures can require heightened diligence and professional guidance—another area where working with attorney-led intermediaries provides additional protection.

For deeper exploration of any of these scenarios, the CCIM Institute offers coursework specifically designed for commercial real estate professionals.[^5]

Houston-First Perspectives: Local Context for Texas Property Owners

Texas commercial real estate operates in an environment that makes 1031 exchanges particularly relevant. For Texas investors, with no state income tax, the federal deferral represents the primary tax benefit—and that benefit can be substantial given Texas's active commercial markets.

Consider a scenario familiar to Houston-area property owners: You've held an industrial property near the Port for a decade. The market has appreciated significantly, and you're ready to redeploy that equity into multifamily assets in Austin's growing market. A properly executed 1031 exchange lets you make that strategic shift without surrendering a quarter or more of your equity to federal capital gains taxes—and you maintain direct ownership and control of the replacement asset.

The compliance challenge is not the city swap; it is the operational discipline: QI engagement before closing, identification on time, and acquisition within the exchange period.

A Note for Commercial Brokers

Brokers often find themselves in an awkward position with 1031 exchanges. Your clients ask questions, but you're not their tax advisor—and you shouldn't be.

The appropriate role is facilitating connections and protecting deal timelines. That means:

Knowing when to recommend your client speak with a qualified intermediary (ideally before listing)

Understanding enough about exchange mechanics to structure realistic timelines

Recognizing when a client's exchange plans might affect contingencies or closing dates

Never providing specific tax advice, even when asked directly

Practical broker-aligned actions include:

Encourage early coordination among seller, CPA, attorney, and QI once the disposition becomes likely

Use transaction timelines as project plans: Day 0 closing, Day 45 identification deadline, Day 180 exchange deadline

Avoid representing tax outcomes as guarantees; focus on process certainty and compliance hygiene

Your value is keeping the deal moving while ensuring your client has access to the specialized professionals who can address exchange mechanics properly. Build your credibility by understanding the process without overstepping into advice.

For professional development, explore our continuing education offerings designed specifically for real estate professionals.

Frequently Asked Questions

Can I do a 1031 exchange on commercial property?

Yes. Commercial property held for investment or business purposes qualifies for 1031 exchange treatment, including office buildings, retail centers, industrial facilities, multifamily apartment properties, and raw land held for investment. The property must be real property located in the United States, and it must be held for productive use in a trade or business or for investment—with you maintaining direct ownership throughout.[^1]

What counts as like-kind for real estate?

For real property, like-kind is broadly defined. Any real property held for investment or business use is generally like-kind to any other real property held for the same purpose. You can exchange commercial for residential, improved property for raw land, or a fee simple interest for certain long-term leasehold interests. The type, quality, or location of the real property doesn't affect like-kind status.[^1]

What happens if I miss the 45-day identification deadline?

The exchange fails completely. You cannot identify properties after Day 45, and the funds held by your qualified intermediary become taxable. There are no extensions, no exceptions for good faith efforts, and no workarounds. The 45-day deadline is absolute under IRS regulations, making advance planning and backup identifications essential.[^3]

Do I need a qualified intermediary?

For practical purposes, a qualified intermediary is essential infrastructure for any deferred exchange. The QI holds your proceeds, maintains the separation that prevents constructive receipt, and handles the documentation that supports your exchange. Attempting an exchange without a QI creates significant risk of constructive receipt—which would invalidate your exchange and trigger immediate taxation. The security and legal expertise of your intermediary directly impacts the success of your exchange.

Planning a commercial property transaction in the Houston area?

The difference between an exchange that preserves your wealth and one that triggers an immediate tax bill often comes down to the preparation that happens before closing. If you're considering selling commercial property, now is the time to understand your options.

Call 713-275-8112 to speak with our Houston-based team of attorneys and tax professionals, or schedule a consultation to review your specific situation before your next closing.

For a quick estimate of potential tax exposure, try our 1031 Exchange Calculator.

Disclaimer: This article is for general informational purposes only and does not constitute tax or legal advice. 1031 exchanges are highly fact-specific. Consult your CPA, attorney, and a qualified intermediary regarding your situation before acting.

About the Securitas1031 Insights Team

The Securitas1031 Insights Team provides educational resources for commercial real estate investors navigating tax-deferred exchanges. Our content is developed in collaboration with legal and tax professionals to ensure accuracy and practical relevance. All information is for educational purposes and should not replace professional advice.

Our Editorial Process

Our expert team uses AI tools to help organize and structure initial drafts. Every piece is then extensively rewritten, fact-checked, and enriched with first-hand insights and experience from our human Insights Team to ensure accuracy and clarity.

[^1]: IRS: Like-kind exchanges – Real estate tax tips

[^2]: IRS Publication 544: Sales and Other Dispositions of Assets

[^3]: 26 CFR §1.1031(k)-1 – Treatment of deferred exchanges