What Qualifies as Like-Kind Property? A Simple Checklist for Texas Investors

📌 Key Takeaways

Like-kind qualification for 1031 exchanges depends on property category and use, not matching building types or locations.

● Category Over Type: Real property held for investment or business generally qualifies as like-kind, allowing exchanges between industrial warehouses, multifamily units, raw land, and office buildings.

● Five Requirements Before Day 45: Replacement properties must pass real property status, investment use intent, U.S. situs, ownership structure alignment, and early validation requirements.

● Entity Structure Matters: Partnership interests and LLC shares don't qualify; direct co-ownership (Tenancy in Common) does, but entity holdings require drop-and-swap restructuring first.

● Construction Value Deadline: Improvement exchanges only receive tax-deferral credit for labor and materials actually in place by Day 180, not final project completion.

● Defer at 15-20% Threshold: When capital gains tax exceeds 15-20% of net equity, exchange friction becomes outweighed by wealth erosion from immediate taxation.

Validation weeks before identification prevents six-figure structural failures.

Texas real estate investors holding direct property ownership will gain clarity on qualification requirements here, preparing them for the detailed compliance checklist that follows.

Here's what many investors discover too late: on Day 44 of the 45-day identification period, uncertainty about "like-kind" qualification can stall or collapse an exchange. Not because the rules are mysterious, but because validation happened too late.

You've heard about 1031 exchanges. You know they can defer capital gains taxes. But there's a phrase that keeps tripping investors up: "like-kind property." Does that mean you can only swap an apartment building for another apartment building? A strip mall for another strip mall?

Here's what the IRS actually requires: Like-kind doesn't mean same-kind.

"The biggest myth in 1031 exchanges is that you must swap an apartment for an apartment. The IRS definition of 'like-kind' is far broader than most investors realize."

For real property held for investment or business use, the IRS definition of "like-kind" is surprisingly broad. That Houston industrial warehouse? It can generally be exchanged for Austin multifamily units. Hill Country ranch land can often become a downtown office building. The requirement isn't the property type—it's how you hold and use it.

This guide gives you a simple checklist and a printable matrix to confirm whether your potential replacement property likely qualifies, so you can validate before Day 45 and avoid a failed exchange.

The Simple Definition of "Like-Kind" in Plain English

Like-kind is a category test, not a matching game. The IRS doesn't require you to find a property that looks like yours. Instead, the test focuses on two factors: Is it real property? And is it held for investment or productive use in a trade or business?

Real property generally includes land and anything permanently attached to it—buildings, structures, and certain improvements. After the Tax Cuts and Jobs Act of 2017, Section 1031 exchanges are limited to real property; personal property like equipment, vehicles, and artwork no longer qualifies.[^1]

The second requirement matters just as much. Your relinquished property (the one you're selling) and your replacement property (the one you're acquiring) must both be held for investment or business use. A rental property qualifies. A commercial building you operate qualifies. Your personal residence does not—even if it's technically real estate.

Like-kind is about the category (real property used for investment or business), not matching the paint color (exact property type).

A Simple Checklist: Does Your Replacement Property Qualify?

Before you identify replacement properties, run through these five requirements. If any answer is "no" or "unsure," flag it for your Qualified Intermediary and CPA before proceeding.

Requirement 1: Is it real property?

Not stocks, bonds, mutual funds, REIT shares, or partnership interests. Not movable equipment or vehicles. Real property means land and permanent structures.

Requirement 2: Is it held for investment or business use?

Not your primary residence. Not a vacation home you use personally. The replacement must be acquired with the intent to hold for investment or use in your trade or business.

Requirement 3: Is it U.S. real property exchanged for U.S. real property?

Domestic real estate generally exchanges for domestic real estate. Foreign property is a "stop-and-check" item—consult your tax advisor before proceeding.

Requirement 4: Will the title and ownership structure align?

If you're selling as an individual, you generally need to acquire as an individual. Entity mismatches can disqualify an exchange. This structural requirement is where attorney-led guidance matters—ownership continuity is a technical requirement that requires precision. Flag early for your CPA and QI review, especially when entities, partners, or vesting changes are involved.

Requirement 5: Can you validate before Day 45?

You have 45 calendar days from closing to identify replacement properties. The safe approach is validation weeks before the deadline—ideally before you even list the relinquished property.

Contextual Reality Check: In a tight market, finding the right replacement property can take longer than expected. Start your search early and have backup options ready. Don't wait until closing day to involve your QI. And whatever you do, never touch the proceeds yourself, not even temporarily. Constructive receipt can disqualify your entire exchange.[^2]

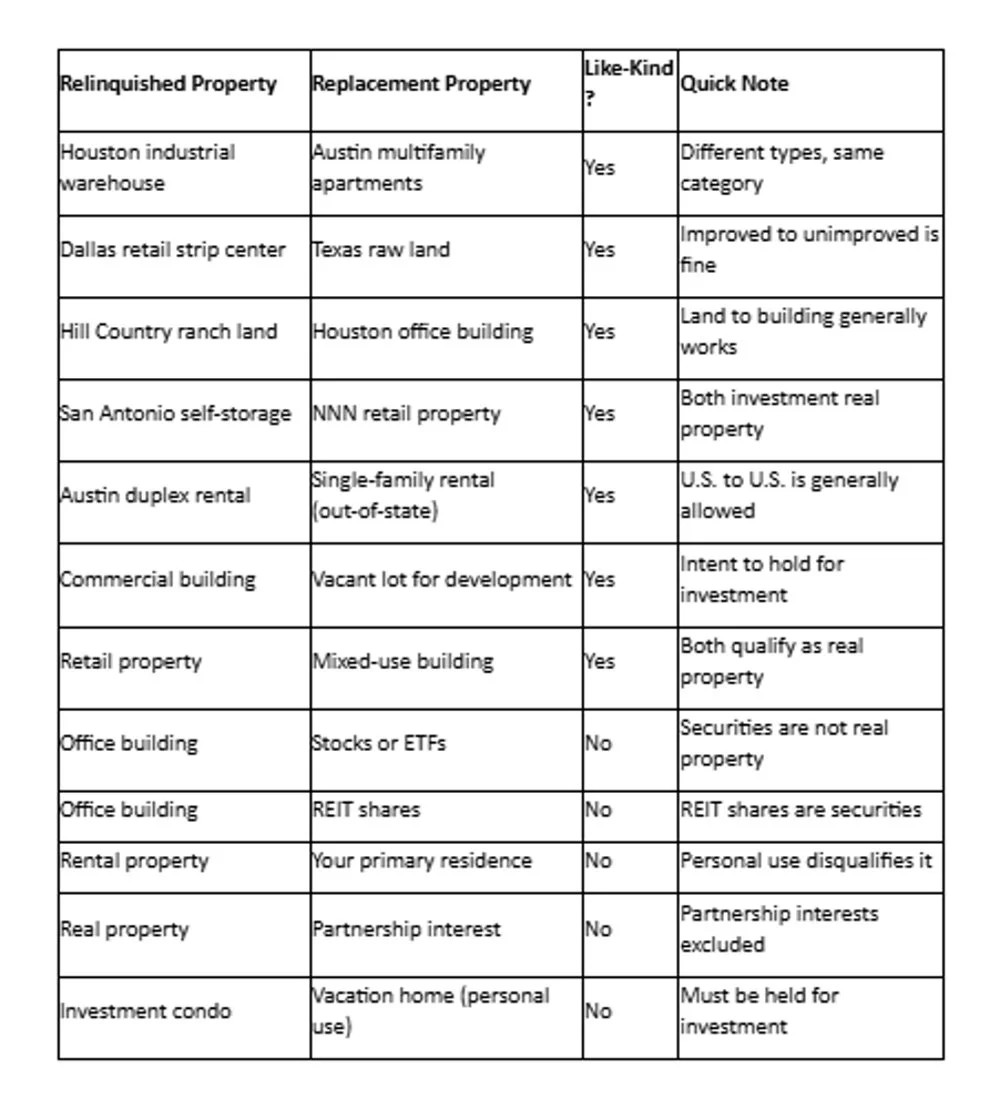

Like-Kind Matrix: Common Texas Property Swaps

Use this matrix to see at a glance which swaps generally qualify and which don't. Review it with your QI before identifying.

Want to estimate your potential tax savings? Try the 1031 Exchange Calculator to see what deferral could mean for your next deal.

Beyond Standard Exchanges: Technical Structures That Preserve Equity

While "like-kind" qualification is the foundation, the structure you choose can determine whether your equity stays fully deployed or leaks to unnecessary tax. At Securitas 1031, we specialize in the technical exchange types that solve specific investor challenges:

Deferred (Delayed) Exchange: The standard 45/180-day structure most investors use. You close on your relinquished property, then have 45 days to identify and 180 days to close on replacement property.

Reverse Exchange: When you need to acquire the replacement property before selling your relinquished property. This structure requires careful legal coordination and compliance—exactly where an attorney-led QI team adds protection.

Construction/Improvement Exchange: Planning to acquire land and improve it using exchange proceeds? The value of the improvements you wish to include in the exchange must be in place (labor and materials received) within the 180-day window. While the entire project need not be fully "complete" (e.g., Certificate of Occupancy), you generally only receive tax-deferral credit for the vertical value actually constructed by Day 180.[^4]

These aren't theoretical options—they're the exchanges where structure errors cost investors the most. For a deeper look at how these strategies fit your situation, see Build Wealth with 1031s.

Myth vs. Reality: Five Clarifications Investors Get Wrong

Myth 1: "Like-kind means the exact same property type."

Reality: For real property, like-kind is broad. An apartment building can be exchanged for raw land. A warehouse can become a retail center. The category is real property held for investment or business—not the specific building type.

What to do: Focus on use and intent, not appearance.

Myth 2: "Texas property must stay in Texas."

Reality: Section 1031 is federal law, not state law. You can generally exchange Texas real property for real property in another U.S. state. Houston to California? Usually fine. The restriction applies to foreign property, not interstate exchanges.[^3]

What to do: Confirm U.S.-to-U.S. situs with your QI if crossing state lines.

Myth 3: "Any real estate I own qualifies."

Reality: The property must be held for investment or productive use in a trade or business. Your primary residence doesn't qualify. A vacation home you use personally doesn't qualify. Use and intent are the requirements.

What to do: Document your investment intent from the start.

Myth 4: "REIT shares count as real estate."

Reality: REIT shares are securities, not real property. The IRS treats them like stocks. You cannot exchange an office building for REIT shares and defer your gain.

What to do: If you want geographic or sector diversification while maintaining direct ownership, consider acquiring multiple replacement properties across different markets or property types within the same exchange. This keeps you in control of the assets while spreading risk.

Myth 5: "I can hold the funds briefly between transactions."

Reality: If you touch the proceeds—even for a day—you may trigger constructive receipt, which can disqualify the entire exchange. The funds must flow through a Qualified Intermediary who holds them in a secure, compliant structure until closing on your replacement property.[^2]

What to do: Engage your QI before closing on the relinquished property. Structure matters, and an attorney-led intermediary ensures your funds remain protected and your exchange stays audit-ready.

Edge Cases to Flag Early

Some situations fall into gray areas where the answer isn't a simple yes or no. Don't guess on these—flag them for professional review before you identify.

Leaseholds and easements. Whether a leasehold qualifies as like-kind can depend on its remaining term. Short-term leaseholds may not meet the threshold. Easements have their own characterization rules. Get clarification early.

Mineral interests and water rights. Texas has significant oil, gas, and water assets. How these interests are characterized—as real property or something else—can vary based on state law and specific facts. If minerals or water rights are part of your deal, raise it with your CPA and QI before identification.

Improvement or construction exchanges. Planning to acquire land and build on it? Improvement exchanges (sometimes called build-to-suit or construction exchanges) have specific timing and documentation requirements. The improvements must be completed within the 180-day exchange period. This adds complexity that requires advance planning and precise legal structuring.

The theme here is simple: when in doubt, flag it early. The cost of a conversation is nothing compared to the cost of a disqualified exchange.

Is a 1031 Exchange Worth the Effort?

A common question: "Should I just pay the tax and keep things simple?"

For smaller transactions, that math might work. But there's a tipping point. When the capital gains tax exceeds roughly 15-20% of your net equity, the wealth erosion becomes significant. That's money you could have reinvested—compounding over time into larger deals and greater returns.

The Estate and Legacy Angle: Beyond immediate reinvestment, a 1031 exchange can be a wealth transfer tool. By deferring taxes and upgrading into properties with stronger cash flow or appreciation potential, you preserve more equity for heirs. And if you're holding property in direct co-ownership (Tenancy in Common) that you want to exit—perhaps with partners or family members—a 1031 exchange lets you redeploy your share into assets you control entirely, without triggering immediate tax. Note: If you own property through a partnership entity or multi-member LLC, specific "drop-and-swap" restructuring is required before you can exchange your individual share.

If you're unsure where you fall, a quick consultation can help you run the numbers. Sometimes the answer is "pay the tax." Often, it's "protect the equity."

Validate Before You Identify

You've got the checklist. You've got the matrix. Now the question is: does your specific situation fit cleanly, or are there details that need professional review?

The safest approach is to pressure-test your replacement property list with your QI and CPA before the 45-day identification window opens. That's not extra work—it's risk reduction. A 15-minute conversation can prevent a six-figure mistake.

At Securitas 1031, we work with Texas investors and business owners who want direct access to experienced professionals—not a national call center. Led by Charles H. Mansour, a real estate and tax attorney with a J.D. and LL.M. in Taxation and over 30 years of experience overseeing 18,000+ closings, our team brings legal precision to every exchange. Our Houston office at 440 Louisiana St, Suite 1100 is where real conversations happen. If you want to meet the specific team handling your exchange, we're here.

Schedule a Free In-Person Consultation to review your specific situation before you identify.

Or if you're ready to move forward: Call 713-275-8112 to initiate your 1031 exchange with Securitas 1031.

For brokers and CPAs seeking CE credit, our continuing education course covers the timing, rules, and key concepts behind 1031 exchanges. And for more foundational reading, explore our guide to Build Wealth with 1031s.

Frequently Asked Questions

Does like-kind mean the same property type?

No. For real property held for investment or business use, like-kind is a broad category. An apartment building can generally be exchanged for raw land, a warehouse, or a retail center. The test is about real property classification and use—not matching building types.

Can I exchange Texas property for out-of-state property?

Generally, yes. Section 1031 is federal law, and U.S. real property can typically be exchanged for other U.S. real property regardless of state. The restriction applies to foreign real property, not interstate transactions.

Does a primary residence qualify for a 1031 exchange?

No. Your primary residence is personal-use property, which is excluded from Section 1031. The property must be held for investment or productive use in a trade or business to qualify.

Can land be exchanged for a rental or commercial building?

Yes, in most cases. Raw land held for investment can generally be exchanged for improved property like a rental building or commercial structure, and vice versa. Both are real property held for investment or business use.

Do REIT shares or partnership interests qualify?

No. REIT shares are classified as securities, not real property. Partnership interests are also specifically excluded from Section 1031 treatment. You cannot exchange real property for these assets and defer your capital gains.

Disclaimer: This article provides general information about like-kind property rules in 1031 exchanges, including common factors like real property classification, investment/business use, and U.S. situs considerations, to help Texas investors and brokers evaluate next steps. It is not tax, legal, or financial advice. Consult your tax advisor and qualified intermediary for guidance on your specific transaction.

Our Editorial Process: We follow a careful editorial process to help you make confident decisions about complex 1031 exchange rules. Our content is drafted by professionals who work with real estate investors, reviewed for accuracy, and updated regularly when IRS guidance changes. We aim to explain technical rules in plain English—so you can spot risks early and protect your equity.

About the Securitas1031 Insights Team

The Securitas1031 Insights Team provides educational resources for commercial real estate investors navigating tax-deferred exchanges. Our content is developed in collaboration with legal and tax professionals to ensure accuracy and practical relevance. All information is for educational purposes and should not replace professional advice.

[^1]: IRS, "Like-Kind Exchanges - Real Estate Tax Tips," https://www.irs.gov/businesses/small-businesses-self-employed/like-kind-exchanges-real-estate-tax-tips

[^2]: IRS Publication 544, "Sales and Other Dispositions of Assets," Chapter 1: Like-Kind Exchanges, https://www.irs.gov/publications/p544

[^3]: Treasury Regulations §1.1031(a)-1, defining like-kind property requirements for real property exchanges, https://www.irs.gov/pub/irs-drop/td_9935.pdf

[^4]: IRS Revenue Procedure 2000-37, "Safe Harbor for Improvement Exchanges," https://www.irs.gov/pub/irs-drop/rp-00-37.pdf