1031 Exchange: Navigating Your Way to Wealth

We demystify the 1031 exchange—explaining how it works, highlighting its key benefits, and showing you how to use it to grow your real estate portfolio while keeping more of your capital working for you.

Whether you're a seasoned investor or new to the game, understanding the strategic advantages of a 1031 exchange can be a powerful tool for building long-term wealth.

6 Reasons Smart Investors Choose 1031 Exchanges

Build Wealth

Deferring capital gains taxes allows investors to reinvest more capital into higher-value properties, facilitating increased wealth accumulation.

Improve Cash Flow

Investors can exchange properties for those with higher rental income, enhancing their monthly cash flow.

Purchase Power

By deferring taxes, investors can utilize the full sales proceeds to acquire more valuable or additional real estate assets.

Diversify Real Estate Portfolio

A 1031 exchange enables diversification by allowing investors to trade properties in different markets or sectors, reducing risk.

Preservation of Equity

Deferring taxes helps preserve equity from property sales, allowing for reinvestment into new properties without losing capital.

Estate Planning

Properties passed to heirs may receive a step-up in basis, allowing them to avoid capital gains taxes, thus preserving wealth for future generations.

The Many Faces of 1031 Success

Our monthly spotlight of the wide range of people and entities who are using this powerful tax strategy to build wealth.

Managing the Closing Gap: Coordinating Sale and Purchase Timelines

Coordinate your broker, title company, lender, CPA, and QI before closing to prevent missing Day 45 and Day 180 deadlines that trigger immediate capital gains tax.

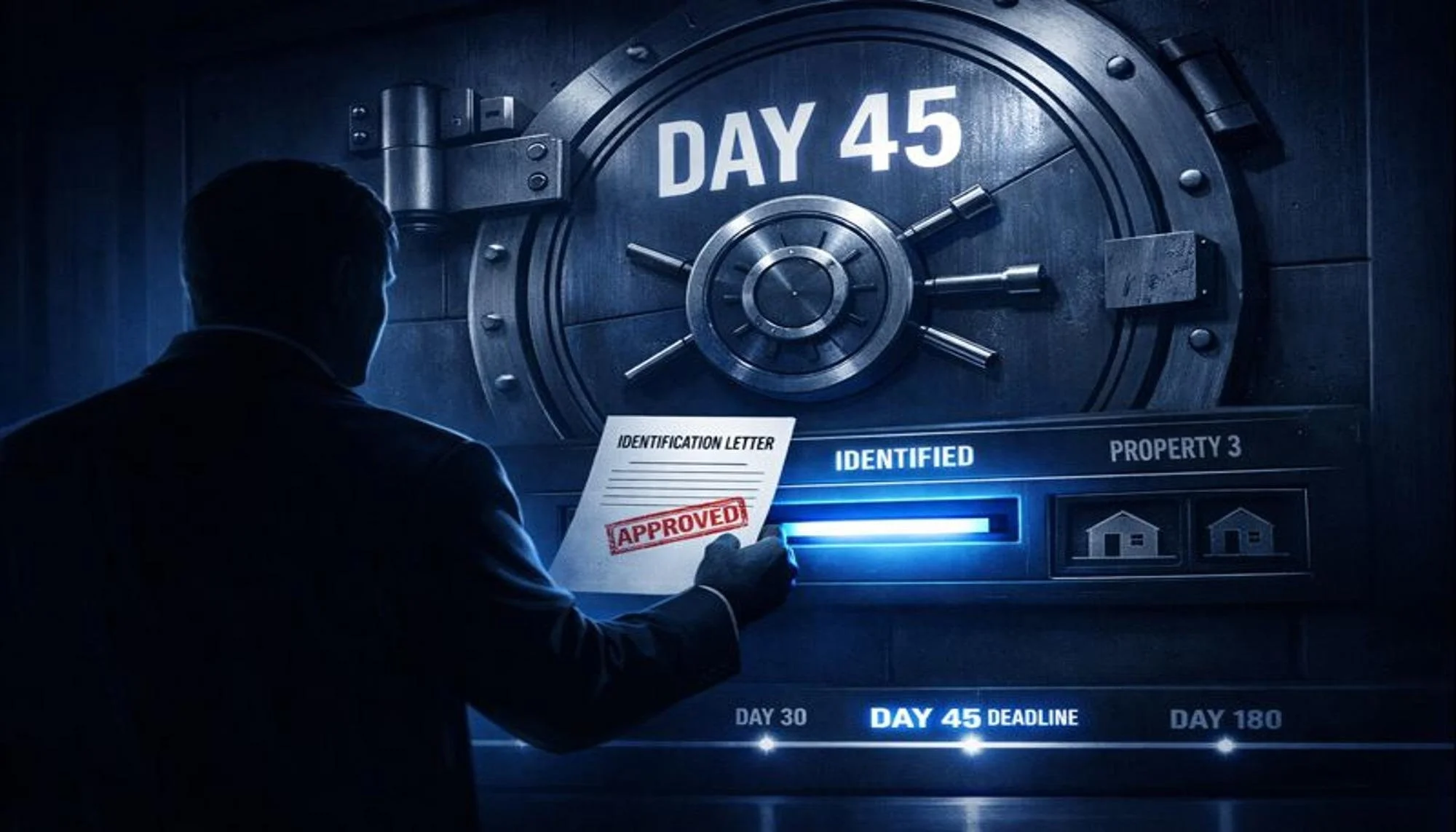

The 45-Day Identification Rule Explained: 3 Rules You Must Know

The 45-day identification rule requires written property designation within 45 days of transfer. Miss it by one day, and the entire tax deferral collapses.

The Broker's Liability Guide to 1031 Referrals

Brokers face negligence claims when 1031 exchanges fail. Vet QIs through five security questions, engage at LOI stage, and document process-only boundaries.

How to Choose a Qualified Intermediary: 5 Security Questions to Ask

Protect your 1031 exchange by asking five security questions about fidelity bonding, segregated accounts, and constructive receipt controls before signing with a QI.

The Investor’s Roadmap: Aligning Your Sale, Your Timeline, and Your Tax Strategy

Most 1031 Exchanges fail from team misalignment, not complexity. Synchronize your broker, CPA, and QI using a Day -30 roadmap to protect your equity through strict IRS deadlines.

What Happens if You Miss the 45-Day Deadline? (And How to Prevent It)

Missing the 45-day deadline fails your 1031 exchange, triggering 30-40% taxation. Prevent this by engaging a QI before listing and hitting Day 30 checkpoints.

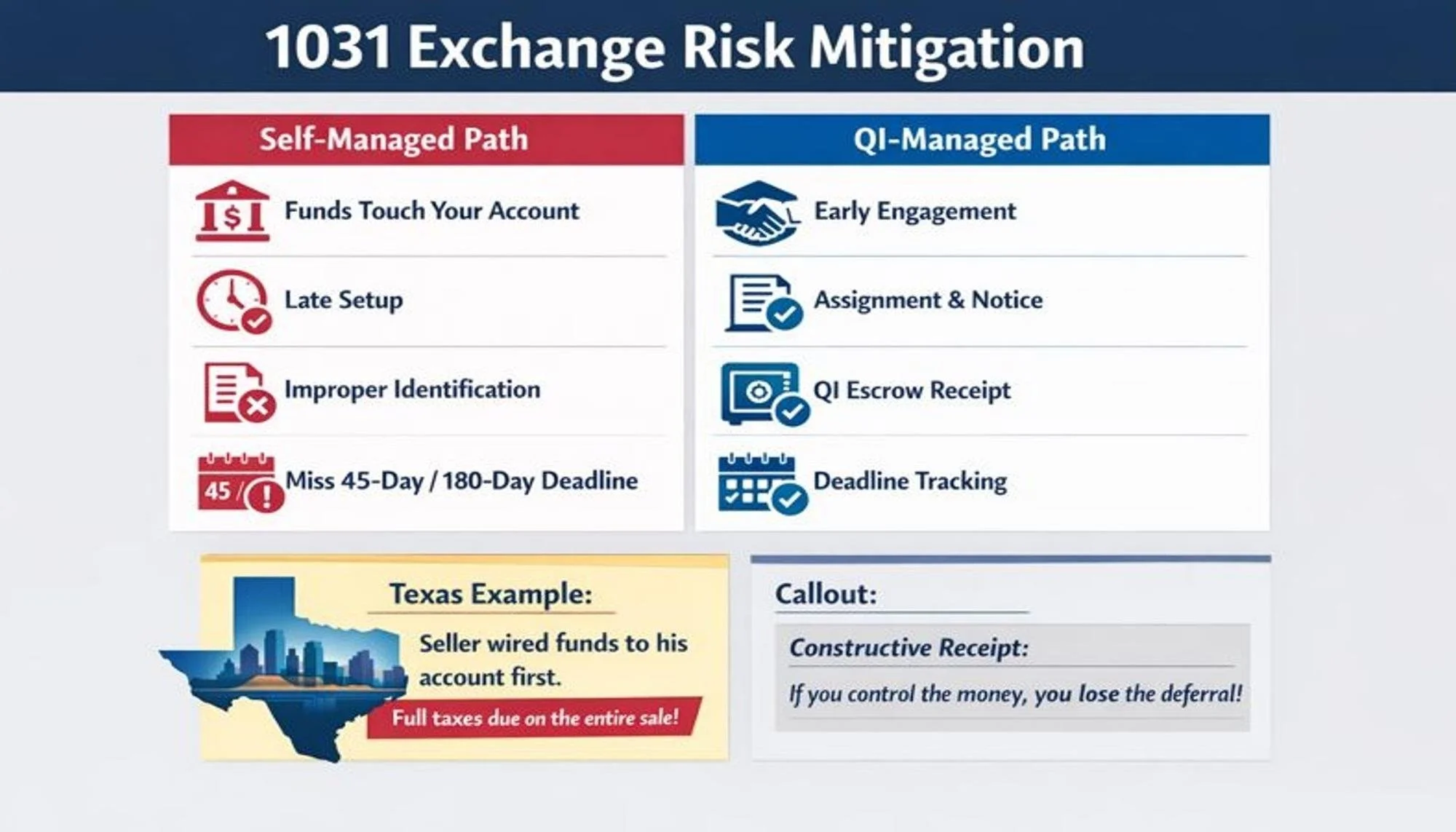

The 3 Most Common 1031 Exchange Mistakes That Trigger a Tax Bill

Constructive receipt, title mismatches, and missed 45-day deadlines cause most preventable 1031 exchange failures, turning tax deferrals into immediate bills.

Beat the Clock: A Strategic Timeline for a Flawless 1031 Exchange

Missing 1031's 45-day or 180-day deadline means full capital gains tax. Prevent this by setting alerts at Days 30, 40, and 44 and identifying backup properties.

Navigating Non-Safe Harbor Reserve Exchanges in Texas

Reserve language like 'at seller's direction' can disqualify your Texas 1031 exchange by creating constructive receipt, even with a QI. Use this 11-point checklist.

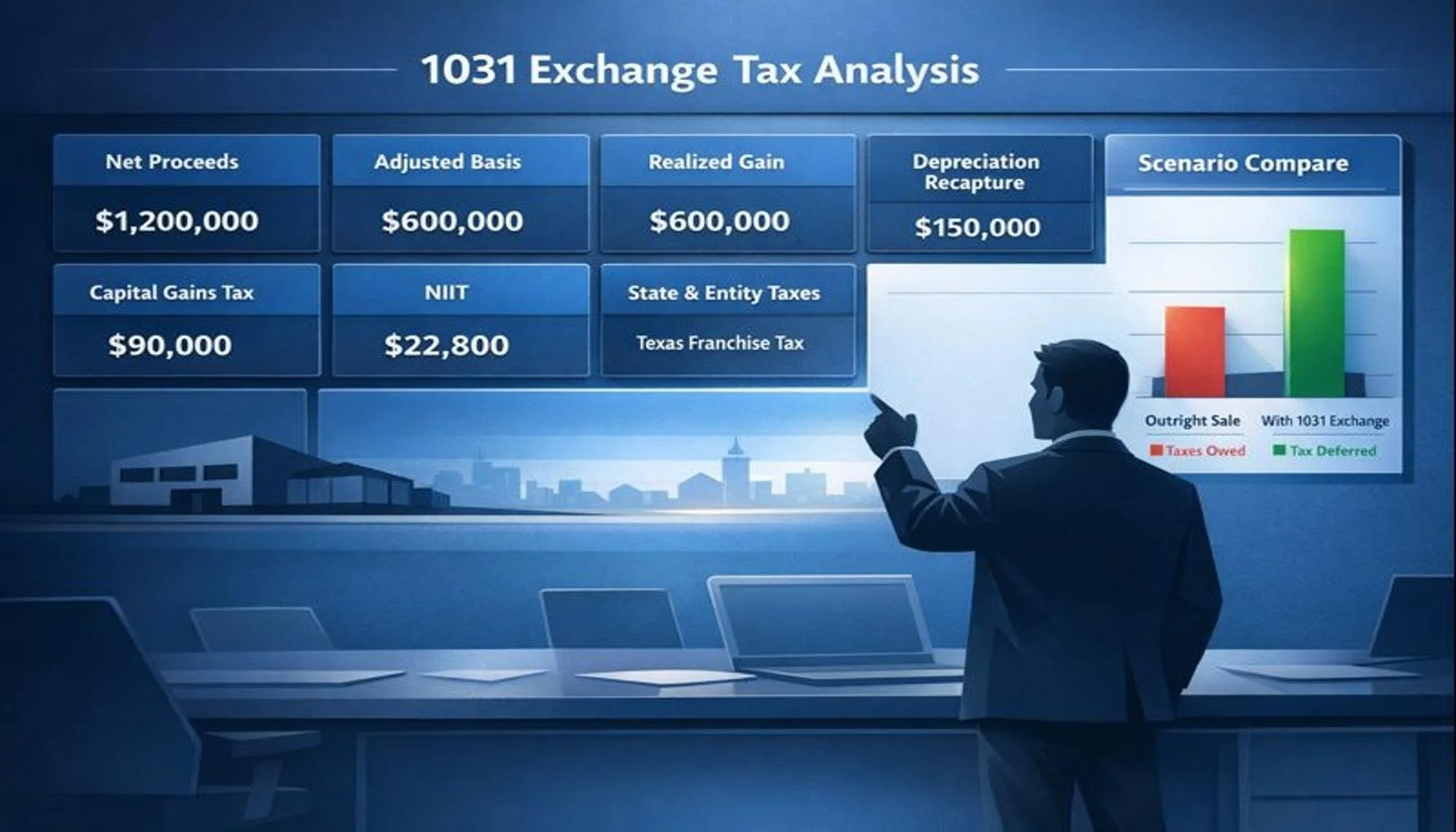

Calculating Your Potential Capital Gains Tax Savings (Step-by-Step)

Calculate your capital gains tax before selling commercial property using an 8-step method that reveals how 1031 exchanges can preserve $150,000+ in equity.

Why the 'DIY' Approach to 1031 Exchanges Puts Your Equity at Risk

Property owners cannot safely self-manage 1031 exchanges because touching sale proceeds triggers constructive receipt, risking up to 40% in taxes on your gain.

What Qualifies as Like-Kind Property? A Simple Checklist for Texas Investors

Real property held for investment qualifies as like-kind regardless of type. Validate replacements using five requirements before your 45-day identification deadline.

From Tax Liability to Wealth Legacy: The Definitive 1031 Exchange Guide for Commercial Investors

Structure a 1031 exchange before closing to defer 20-30% tax burden on gains through strict 45-day identification and 180-day acquisition requirements.