Managing the Closing Gap: Coordinating Sale and Purchase Timelines

📌 Key Takeaways

Successful 1031 exchanges depend on coordinating five parties—broker, title company, lender, CPA, and qualified intermediary—before the relinquished property closes to prevent missed federal deadlines that trigger immediate taxation.

The 180-Day Trap for Late-Year Closers: Investors selling relinquished properties in December face exchange completion deadlines as early as April 15 unless they file tax extensions, potentially losing 75 days of the standard 180-day window.

Identification Requires Strict Compliance: The 3-Property Rule (up to three properties of any value) or 200% Rule (unlimited properties not exceeding 200% of relinquished value) governs Day 45 identification—violating these quantitative limits invalidates the entire exchange.

Construction Value Must Be in Place: Improvement exchanges only defer taxes on construction actually completed and incorporated into the property by Day 180; pre-paying contractors for post-deadline work creates taxable boot.

Reverse Exchanges Use Parking Structures: Exchange Accommodation Titleholders temporarily "park" title to either the replacement property (Exchange Last) or relinquished property (Exchange First) when standard delayed timing won't work.

Early QI Engagement Prevents Constructive Receipt: Waiting until closing day to involve the qualified intermediary risks improper fund flow, creating immediate tax liability even when all other steps are correct.

Coordination beats speed—federal deadlines are absolute, but advance alignment makes them manageable.

Commercial real estate investors managing tight closing windows will gain operational clarity here, preparing them for the coordination email template and timing scenarios that follow.

~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~

Day 44. 4:47 PM.

The lender needs one more document. Your broker is chasing a signature. Title is waiting on wiring instructions from someone—you're not sure who. And the clock? The clock doesn't care that everyone's doing their best.

You're in the narrow window between "contract signed" and "deal closed," where a 1031 exchange can quietly fall apart. Not because of bad intent. Because five people are working off five different calendars, and nobody confirmed who owns what.

This is the closing gap—the coordination chaos between your relinquished property sale and your replacement property purchase. When it's managed well, you barely notice it. When it's not, you miss a federal deadline and trigger a tax bill that was entirely avoidable.

With a clear coordination plan, you can align your broker, title company, lender, CPA, and qualified intermediary so the sale closing and purchase closing stay in sync—even when the dates don't line up perfectly. You'll know exactly who does what, when they do it, and how to catch problems before they become failures.

What the "Closing Gap" Means in a 1031 Exchange (and Why It's Where Deals Fail)

The closing gap is the time between when your relinquished property closes and when your replacement property closes. In a perfect world, these happen simultaneously. In the real world, they rarely do.

That gap creates risk because federal tax law imposes two strict deadlines that start the moment your relinquished property closes. Miss either deadline, and the entire exchange fails—turning your deferred tax liability into an immediate one.

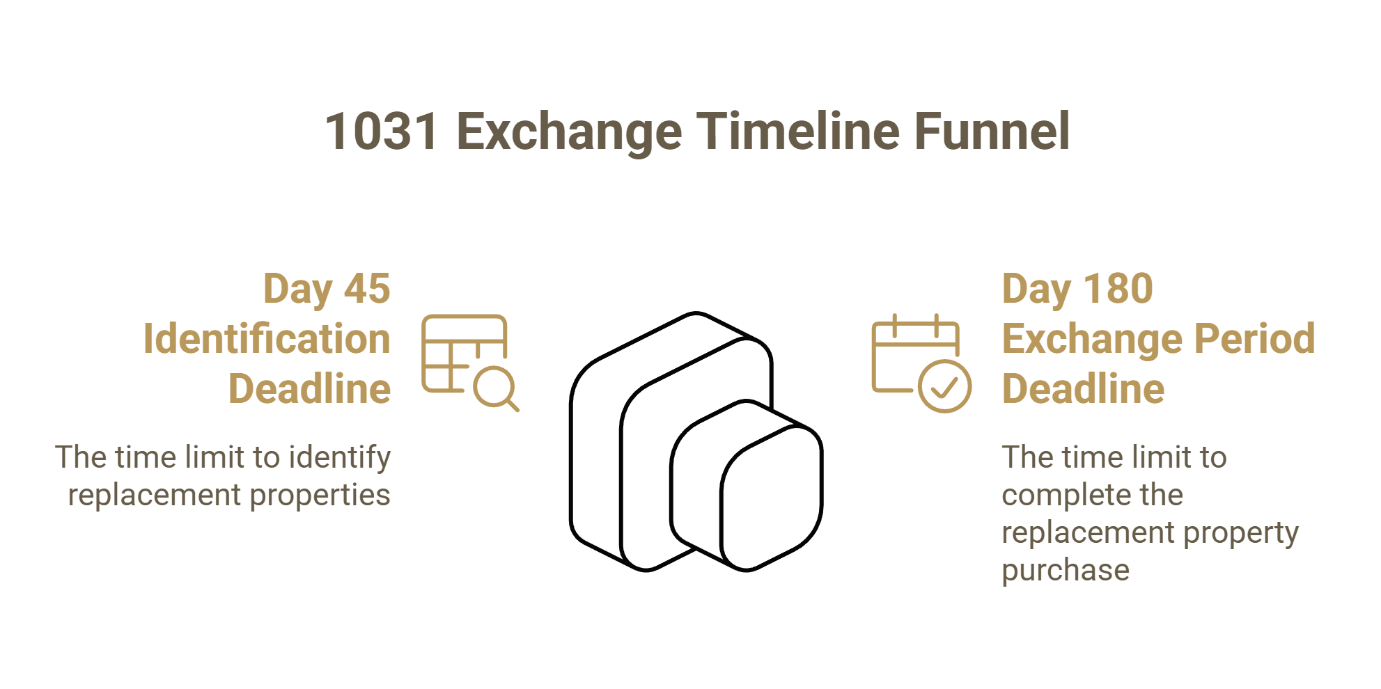

The Two Clocks That Matter: Day 45 and Day 180

Under 26 CFR §1.1031(k)-1, the deferred exchange rules establish two non-negotiable timelines:

Day 45 (Identification Deadline): You have 45 calendar days from the date your relinquished property closes to formally identify potential replacement properties in writing to your qualified intermediary. No extensions. No exceptions for weekends or holidays.

Day 180 (Exchange Period Deadline): You have the earlier of 180 calendar days from the closing of your relinquished property or the due date of your federal income tax return (including extensions) to complete the purchase of your replacement property. This is your outer limit. Note: If your relinquished property closes late in the year (e.g., December), your exchange period may be shortened to April 15 unless you file for a tax extension. If the deadline arrives and the replacement hasn't closed, the exchange fails.

These are federal statutory deadlines. Texas closing practices, local customs, and good intentions don't change them.

Where Timing Mistakes Create Tax Risk: Deadlines, Documentation, and Constructive Receipt

Three specific failure points create the majority of closing gap problems:

Missed identification deadline: If you don't submit a compliant written identification to your QI by 11:59 PM on Day 45, the exchange is over. The IRS doesn't accept verbal agreements or "we were close."

Constructive receipt of funds: If sale proceeds from your relinquished property flow to you—even briefly—before they reach the QI, you've "received" the money. That disqualifies the exchange. This is why you can't hold the funds "for a day" while you figure out the next step.

Coordination breakdown: When your broker, title company, lender, CPA, and QI aren't aligned on dates and responsibilities, critical documents get delayed. A missing signature on Day 43 can mean a missed deadline on Day 45.

The closing gap is where these risks concentrate. It's the operational space where theory meets execution—and where small coordination failures create large tax consequences.

Three Timing Scenarios and the Right 1031 Structure for Each

Not every 1031 exchange follows the same path. The structure you need depends on which property closes first—and whether you have time to search for a replacement or need to act immediately.

Sale Closes First: Delayed Exchange (the Most Common Path)

This is the standard structure. You sell your relinquished property, the proceeds go to your QI, and then you have 45 days to identify and 180 days to close on a replacement.

When it works well: You have a clear exit strategy for your current property and a realistic pipeline of replacement options. The market has sufficient inventory, and you're confident you can find, negotiate, and close on a suitable replacement within six months.

General principle: In delayed exchanges, speed matters—but control and clarity matter more. A rushed process that introduces a funds-handling mistake or a documentation miss can be more damaging than a conservative timeline that keeps the exchange structure intact.

Coordination requirement: Your QI must be engaged before the relinquished closing. The sale contract must include assignment language allowing the QI to step into your position at closing. All parties must confirm that sale proceeds will be wired directly to the QI—not to you, not to your attorney, not "held briefly" by anyone else.

Replacement Closes First: Reverse Exchange (When You Need to Buy Before You Sell)

In a reverse exchange, you acquire the replacement property before you sell the relinquished property. This requires a more complex structure governed by IRS Revenue Procedure 2000-37, which provides a safe harbor framework.

When this structure is necessary: You've found the right replacement property, but it won't stay on the market long enough for you to complete a standard delayed exchange. Or market conditions make it likely your relinquished property will take longer to sell than your replacement will take to close.

Coordination requirement: An Exchange Accommodation Titleholder (EAT) temporarily holds title—referred to as "parking" the title—to either the replacement property ("Exchange Last") or the relinquished property ("Exchange First") while you complete the transaction. This adds legal complexity and requires tight coordination with your QI, who will often serve as or arrange the EAT.

Because reverse exchanges carry higher structural risk and cost, they're typically reserved for situations where a delayed exchange isn't feasible. Your QI should evaluate whether your specific scenario justifies the added complexity.

Same-Day or Tight Window Closings: Coordination Checklist for Simultaneous-Style Execution

Occasionally, the relinquished sale and replacement purchase can close on the same day or within a very tight window. This isn't technically a "simultaneous exchange" in the strict regulatory sense, but it functions similarly and requires intense coordination.

Required coordination steps:

Confirm both title companies are aware of the 1031 exchange and have the QI's contact information and wiring instructions.

Ensure the relinquished property closing happens first (even if only by hours), so the replacement purchase doesn't inadvertently close before exchange funds are available.

Have your QI on standby to confirm receipt of relinquished sale proceeds and authorize release of funds for the replacement purchase.

Verify that all assignment documents are executed and recorded in the correct sequence.

When executed correctly, same-day closings can eliminate most of the closing gap risk. When coordination fails, they create compounded problems across two simultaneous transactions.

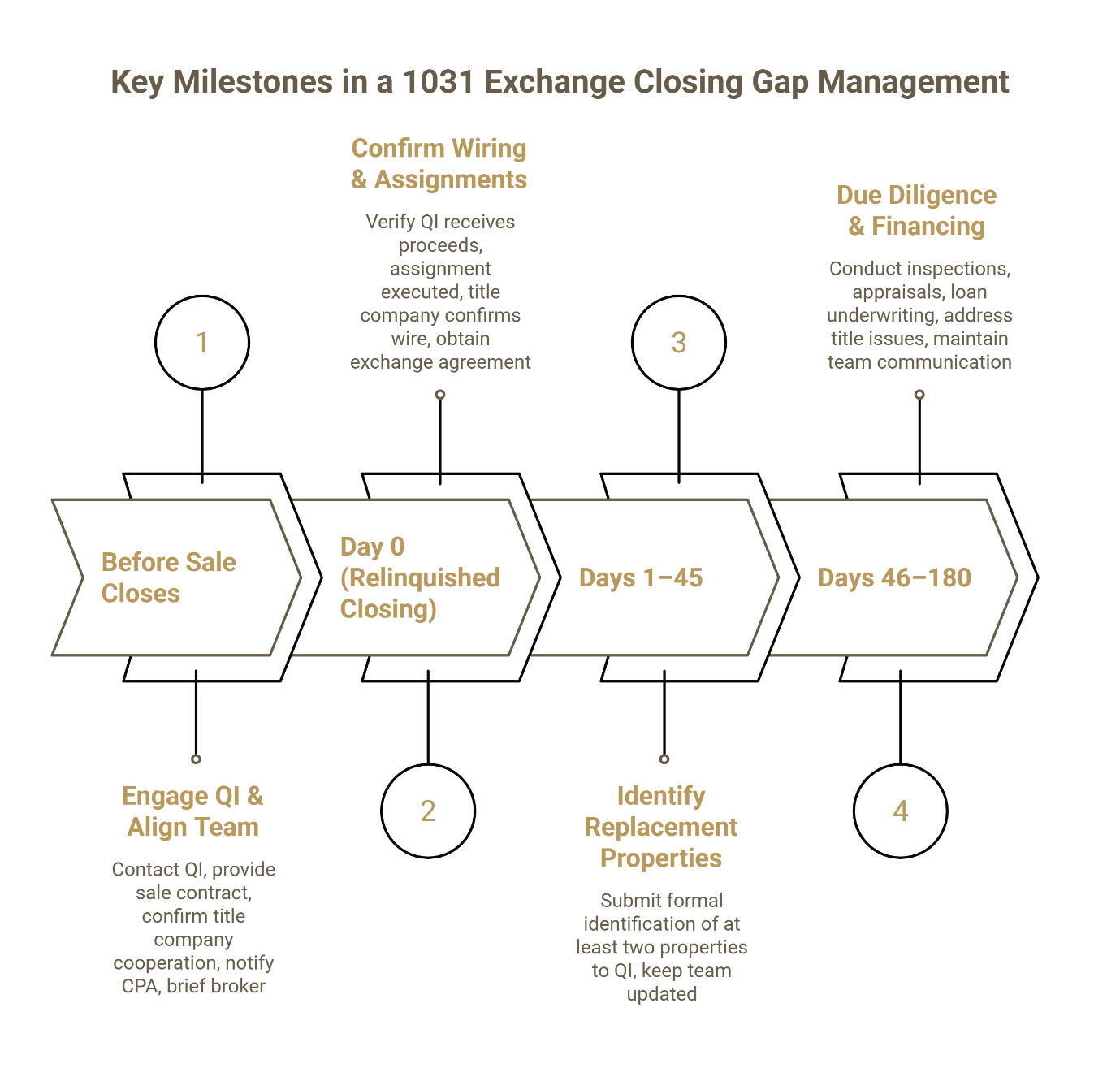

The Coordination Playbook: What to Do Before Closing, on Day 0, and Through Day 45

The most reliable way to prevent closing gap failures is to establish clear responsibilities and communication protocols before the relinquished property closes. Once Day 0 arrives, you're operating under a deadline. Preparation prevents panic.

Before the Sale Closes: Engage a Qualified Intermediary Early and Align the Team

The single most common 1031 exchange mistake is waiting until the day of closing to bring in the QI. By that point, the sale contract is already signed, the title work is complete, and making last-minute changes creates risk.

What "early" means: Ideally, engage your QI before you sign the purchase and sale agreement for the relinquished property. At minimum, engage them at least 10-14 days before the scheduled closing.

Required actions before closing:

Provide your QI with a copy of the signed sale contract so they can prepare the exchange agreement and assignment documents.

Confirm with your title company or closing attorney that they will accept the assignment and route proceeds through the QI.

Notify your CPA that a 1031 exchange is in progress so they can prepare for the Form 8824 reporting requirement.

Brief your broker on the 45-day identification rules so they understand the urgency of identifying replacement properties quickly.

Securitas1031's approach emphasizes security and precision—treat the QI as a process owner for the exchange steps, not a last-minute document vendor. This early alignment prevents the most common source of closing gap failures: nobody knew what they were supposed to do until it was too late to do it correctly.

Day 0 (Relinquished Closing): Confirm Wiring, Assignments, and Cooperation Clauses

Day 0 is the date your relinquished property closes. This is the day the federal clock starts. Everything that happens on Day 0 must be documented correctly.

Critical Day 0 confirmations:

Verify that the closing statement shows the QI as the party receiving the sale proceeds, not you personally.

Confirm that the assignment of your rights under the purchase agreement has been executed and that the buyer has acknowledged the assignment through a cooperation clause.

Obtain written confirmation from the title company or closing attorney that exchange proceeds have been wired to the QI's segregated exchange account—not a general operating account.

Request a copy of the executed exchange agreement and assignment documents for your records.

On Day 0, your focus is narrow: ensure the money goes to the right place and the paperwork is in order. If something looks incorrect, stop the closing and fix it. Correcting a mistake on Day 0 is straightforward. Correcting it on Day 30 is complicated. Correcting it on Day 46 is impossible.

Days 1–45: Identify With Backups and Keep All Parties in Sync

The moment Day 0 closes, you're on the clock. You have 45 calendar days to submit a compliant written identification of potential replacement properties to your QI.

Identification best practices:

Identify at least two properties, even if you're confident about your first choice, while adhering to the "3-Property Rule" (identifying up to three properties of any value) or the "200% Rule" (identifying any number of properties providing their aggregate value does not exceed 200% of the relinquished property's value). If your primary target falls through, you'll have backup options already on the list that fit within these strict IRS identification limits.

Submit identification as a formal deliverable, not a casual email thread. Email to your QI is acceptable and creates a timestamp, but treat it with the formality it deserves.

Include the full legal address of each property. Vague descriptions like "a property in Austin" aren't sufficient.

Keep your broker, lender, and CPA informed of your identification so they can begin preliminary work on financing and due diligence.

One investor we worked with submitted a single-property identification on Day 42. That property's seller backed out on Day 50. With no backup properties identified, the exchange failed. The 45-day deadline is absolute.

Proactive communication during Days 1-45: Send a brief status update to your team every 7-10 days. Confirm that the broker is actively sourcing properties, the lender has begun pre-qualification, and the QI has received and acknowledged your identification. This prevents the "silent drift" where everyone assumes someone else is handling the next step.

Days 46–180: Keep Momentum So the Replacement Closing Doesn't Become the Failure Point

Most people focus their anxiety on the 45-day identification deadline. That's understandable—it arrives quickly and feels urgent. But the truth is, many exchanges that fail do so between Day 46 and Day 180, when momentum slows and coordination breaks down.

Due Diligence and Financing: Prevent the Lender Timeline From Blowing Up Your Exchange

After you've identified your replacement property, you enter a phase that often involves property inspections, environmental assessments, appraisals, and loan underwriting. Each of these steps has its own timeline—and those timelines don't automatically sync with your Day 180 deadline.

Common lender-related delays:

The appraisal takes three weeks instead of one because the appraiser's calendar is full.

The underwriter requests additional documentation that requires clarification from your CPA.

Title issues on the replacement property require the seller to resolve liens or encumbrances before closing can proceed.

How to prevent lender delays from becoming exchange failures:

Start the financing process immediately after you identify the replacement property. Don't wait until Day 60 or Day 90 to submit a loan application. Time is the only asset you can't recover in a 1031 exchange.

Provide your lender with a clear, one-page summary of the exchange timeline that includes your Day 180 deadline. Explicitly ask whether their standard underwriting timeline fits within that window. If it doesn't, escalate the conversation or consider alternative financing.

Maintain weekly contact with your loan officer. A brief email asking "what's the next step and when does it happen?" keeps your file moving and surfaces problems early.

Staying Coordinated Through the Final Stretch

Run weekly checkpoint calls or email updates with your broker, lender, title/escrow, CPA, and QI focused on three questions: What's the target closing date? What conditions remain open? What could slip? The point isn't more meetings—the point is preventing silent schedule drift that pushes you past Day 180.

Replacement Closing Coordination: Release of Exchange Funds and Settlement Statement Review

When your replacement property is ready to close, the final coordination step is ensuring the exchange funds are released correctly and that the settlement statement reflects the exchange structure.

Pre-closing checklist for the replacement purchase:

Notify your QI at least 48-72 hours before the scheduled closing date so they can prepare funds for release.

Confirm that the closing agent for the replacement property has the QI's wiring instructions and understands that exchange funds will be coming from the QI, not from you directly.

Review the draft settlement statement before closing. Verify that the source of funds is listed as the QI and that your name appears as the buyer (or the entity name if you're using an LLC).

Ensure any additional funds you're contributing beyond the exchange proceeds (for "trading up") are clearly documented as separate from the exchange funds.

After the replacement property closes, request written confirmation from your QI that the exchange is complete. This typically includes a final accounting showing the exchange funds disbursed and any remaining funds returned to you (which will be taxable as "boot").

The replacement closing is the finish line, but it's not automatic. Coordination failures at this stage—incorrect wiring instructions, missing signatures, title defects discovered at the last minute—can delay the closing past Day 180. That's why the 48-72 hour advance notice to your QI is critical. It creates a buffer for resolving unexpected issues.

Template: The Broker + Escrow Coordination Email Script

The most effective way to keep everyone aligned is to send a single coordination email to all parties at the beginning of the exchange. This email establishes the timeline, assigns responsibilities, and creates a written record of what was communicated.

Who to Send It To (Broker, Title/Escrow, Lender, CPA, QI)

Send this email to every person or entity involved in the transaction:

Your buyer's broker and your listing broker (for the relinquished property)

Your buyer's broker and the seller's broker (for the replacement property)

The title company or closing attorney handling the relinquished closing

The title company or closing attorney handling the replacement closing

Your lender (if financing the replacement purchase)

Your CPA or tax advisor

Your qualified intermediary

Use "CC all" rather than individual emails. This ensures everyone sees the same information at the same time and can reply-all if they spot a conflict or have a question.

The Exact Details to Include So Nothing Gets Lost in the Shuffle

Here's a ready-to-use coordination email. Replace the bracketed items with your specific information, and send it as soon as you've engaged your QI and have preliminary closing dates.

Subject: 1031 Exchange Timeline Coordination – Relinquished Closing [Date] / Day 45 = [Date] / Day 180 = [Date]

Hello team,

We are coordinating a 1031 exchange and want all parties aligned on the key dates and responsibilities.

Key dates (federal deadlines):

Relinquished property closing (Day 0): [Insert Date]

Identification deadline (Day 45): [Insert Date]

Exchange completion deadline (Day 180): [Insert Date]

Parties + responsibilities:

Broker: Provide status updates on replacement pipeline and contract milestones. Confirm when properties are under contract and when inspections/due diligence periods close.

Title/Escrow: Confirm assignment and cooperation language is included in the sale contract. Confirm wiring procedures with the QI. Provide a draft settlement statement 48 hours before closing for review.

Lender: Confirm underwriting timeline and conditions needed to close the replacement property before Day 180. Flag any potential delays immediately.

CPA/Tax advisor: Confirm title and vesting consistency between relinquished and replacement properties. Advise on any reporting requirements or documentation needed for Form 8824.

Qualified Intermediary (QI): Provide exchange agreement and assignment documents. Confirm receipt and acceptance of written identification. Coordinate release of exchange funds for replacement closing.

Today's needed confirmations:

Written confirmation that the relinquished sale contract and replacement purchase contract both include 1031 cooperation language.

Wiring instructions confirm that exchange proceeds will route directly through the QI with no investor receipt.

Replacement contract timeline: inspection period, financing contingency, appraisal, and target closing date.

Please reply-all confirming you received this email and noting any risk points on your timeline.

Thank you,

[Your Name]

[Your Contact Information]

This email takes five minutes to write and prevents hours of confusion later. It establishes the shared understanding that everyone needs to operate as a coordinated team—not as independent contractors who happen to be working on the same deal.

When to Escalate: Signs You Should Consider a Reverse or Improvement Exchange

Not every closing gap can be managed with a standard delayed exchange. Sometimes the timing mismatch is so severe—or the replacement property requires so much work—that you need a more specialized structure.

You Must Close the Replacement Before Selling

If you've found the right replacement property but it won't stay on the market long enough for you to complete a delayed exchange, a reverse 1031 exchange may be the only viable option.

When this structure makes sense:

The replacement property is in a competitive market and has multiple offers. If you don't close within 30 days, you'll lose it.

Your relinquished property is taking longer to sell than anticipated, but you've already identified and negotiated the replacement.

You're executing a strategic acquisition where timing is dictated by the seller's needs, not yours.

Key considerations:

Reverse exchanges are more expensive and administratively complex than delayed exchanges. They require an Exchange Accommodation Titleholder to temporarily hold title, and they often involve short-term financing. These costs are justified when the replacement property's strategic value outweighs the added expense—but they're not appropriate for every situation.

Before committing to a reverse exchange, consult with your QI to ensure the structure is feasible given your financing, title, and timeline constraints.

You Need Time to Build or Renovate Before the Replacement Is "Exchange-Ready"

In a construction or improvement exchange, you use a portion of the exchange proceeds to fund improvements on the replacement property during the 180-day exchange period. The property must be identified by Day 45, and you will only receive tax-deferral credit for the value of improvements actually constructed and in place by Day 180. Pre-paying for labor or materials to be installed after Day 180 does not count toward your exchange value.

When this structure is appropriate:

You're acquiring a property that requires significant renovation or build-out to meet your investment objectives.

The cost of improvements can be funded from the exchange proceeds, and you have a contractor who can complete the work within the 180-day window.

You want to "trade up" in value not just by buying a more expensive property, but by improving a property to increase its market value.

Critical timing requirement:

The improvements must be completed before Day 180. If the work isn't done by the deadline, you'll receive the unspent exchange funds back as taxable "boot." That means tight coordination with your contractor, your QI, and your title company to ensure draw schedules align with the federal deadline.

Construction and improvement exchanges are powerful tools for investors who want to build equity through renovation rather than just acquisition. But they require even tighter timeline management than a standard delayed exchange.

Frequently Asked Questions

Can I Go Under Contract on the Replacement Before My Sale Closes?

Yes. You can search for properties, make offers, and sign purchase contracts for potential replacement properties at any time—even before you close on the relinquished sale.

What you cannot do is close on the replacement property before you close on the relinquished property (unless you're using a reverse exchange structure). As long as you're only under contract, not yet closed, you're fine.

This is one reason why starting your replacement property search early is so valuable. You can have a signed contract and a clear closing timeline before your Day 45 identification deadline even starts.

What Happens If My Replacement Deal Falls Apart After Day 45?

If you identified multiple properties on your Day 45 written identification, you can pivot to one of your backup properties. This is why identifying two or three properties is standard practice—it gives you options if your first choice doesn't work out.

If you only identified one property and that deal collapses, you cannot add new properties to your identification list after Day 45. The identification deadline is absolute. At that point, your only option is to attempt to salvage the original deal or accept that the exchange will fail.

This is exactly what happens if you miss the 45-day deadline, functionally. You lose your ability to complete the exchange, and the deferred tax liability becomes due.

Does Texas Closing/Escrow Practice Change Any Federal 1031 Deadlines?

No. The 45-day and 180-day deadlines are federal statutory requirements under IRC Section 1031. They apply uniformly across all states.

Texas does have some unique closing practices—such as the frequent use of title companies rather than attorneys for closings, and the common practice of using earnest money contracts with specific Texas Real Estate Commission forms—but none of these affect the federal exchange timeline.

Your Texas title company or closing agent must coordinate with your QI to ensure assignment documents are executed and exchange proceeds are routed correctly. But the federal clock is the same whether you're closing in Houston, Austin, or anywhere else in the United States.

Your Path Forward

You now have the coordination framework that prevents the most common closing gap failures: a clear understanding of the federal deadlines, a playbook for aligning your team, and a ready-to-use coordination email that keeps everyone on the same page.

The closing gap is where execution replaces theory. It's where the difference between "I'll handle it" and "I've confirmed it's handled" determines whether your exchange succeeds or fails.

If you're preparing for a 1031 exchange or are already in the closing gap coordination phase, the next step is simple. Use the coordination email script to align your team, confirm that your QI is engaged and has all necessary documents, and establish weekly check-ins to track progress against your Day 45 and Day 180 deadlines.

Want to estimate what's at stake before you lock your timeline? Use our 1031 Exchange Calculator to see how much equity you'd lose to taxes without a successful exchange.

Ready to start your 1031 exchange with a team that understands Houston closing coordination? Schedule an in-person consultation or call +1-713-461-1717 to speak with a qualified intermediary at Securitas1031. Our office is located at 3730 Kirby Dr, Suite 1200, Houston, Texas 77098.

Disclaimer: This article is for general educational purposes only and is not tax or legal advice. 1031 exchange rules are technical and fact-specific. Always consult your CPA and/or attorney for guidance on your specific transaction.

Our Editorial Process

Our expert team uses AI tools to gather and synthesize answers and then verify all of that content against IRS publications and tax code data. We do our best to keep our content accurate and up to date. But we recommend you always consult a qualified professional.

By: The Securitas1031 Insights Team

The Securitas1031 Insights Team is a group of professionals with deep experience in 1031 exchanges, real estate transactions, and capital gains tax strategies. Our goal is to publish clear, accurate guidance that helps investors protect their equity and avoid costly mistakes. When we cover complex topics, we reference IRS publications and industry best practices—and we always recommend discussing your specific situation with a qualified tax advisor.