How to Create a Back-Up Plan for Your Replacement Property

📌 Key Takeaways

After Day 45, you typically cannot add new replacement properties to your identification list, making a compliant backup plan mandatory before the deadline expires.

The 45-Day Deadline Is Absolute: Your identification list becomes locked at Day 45, eliminating the ability to pivot to new properties if your primary deal collapses.

Tax Returns Shorten Your Window: The exchange period ends on the earlier of 180 days or your tax return deadline, creating an "April 15 trap" for year-end closings without extensions.

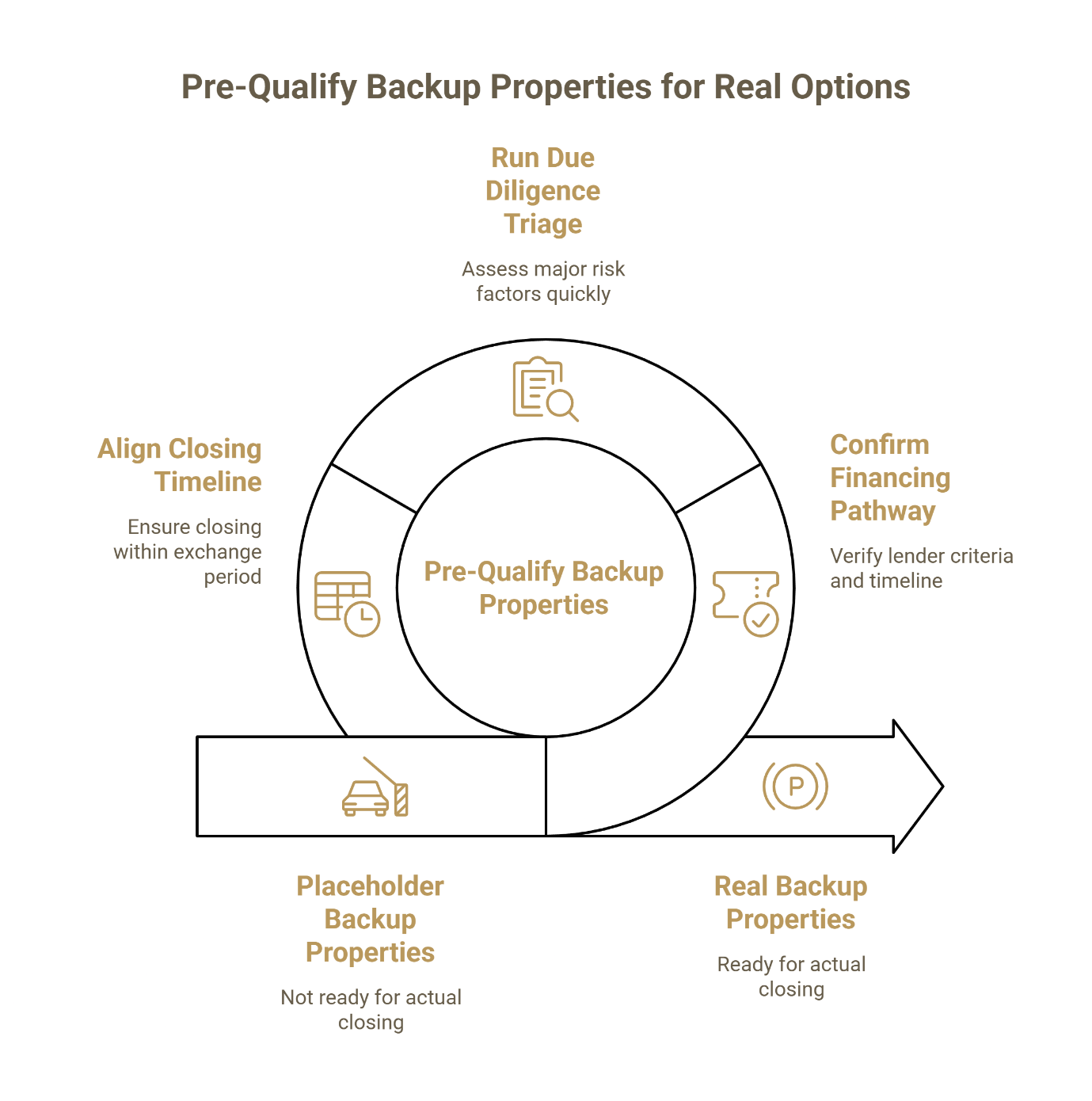

Pre-Qualify Every Backup Property: Real backups require confirmed financing pathways, preliminary due diligence, and realistic closing timelines—not aspirational placeholders that can't actually close within 180 days.

Use the 3-Property Rule: Identify up to three properties of any value to create compliant optionality without triggering complex 200% Rule calculations or impossible 95% Rule acquisition thresholds.

Run Disciplined Checkpoints: Set hard decision dates at Day 1-10, 15, 30, 40, and 44 with your broker, CPA, and Qualified Intermediary to prevent coordination breakdowns.

Realistic backups identified early protect equity from becoming an avoidable tax bill.

Individual commercial real estate investors and their advisors will gain actionable timeline protection strategies here, preparing them for the detailed compliance framework that follows.

~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~

Day 62. The due diligence report lands on your desk. Environmental issue flagged. The deal is dead.

You glance at the calendar. The relinquished property closed 62 days ago. The 45-day identification window closed 17 days ago. You never identified a Plan B.

The exchange fails. The tax bill arrives.

A "backup plan" in a 1031 exchange isn't a vague idea—it's a compliant identification strategy. Because the IRS gives you just 45 days after your sale closes to identify replacement property, you need more than one viable option on your identification notice. If your primary deal falls apart after Day 45, you typically can't add a brand-new property to the list. Your safety net is to identify Plan A plus realistic backups that fit within the 3-Property Rule, the 200% Rule, or the 95% Rule—and to confirm your identification is properly delivered and acknowledged. In a tight Texas market, this is how you prevent your equity from being consumed by a tax bill.

Why a Backup Plan Is Mandatory in a 1031 Exchange

Deals fall apart for reasons outside your control. Financing doesn't close. Environmental reports surface contamination. Title issues emerge three weeks into escrow. A seller gets cold feet. In Houston's industrial market or Austin's competitive multifamily sector, these aren't rare events—they're part of the normal transaction cycle.

The problem: after Day 45, you generally cannot add new properties to your identification list. The 45-day identification deadline creates a fixed list of replacement options. If your primary deal dies on Day 60 and you never identified backups, you're left with nothing. No compliant replacement means no exchange. No exchange means the IRS treats your sale as a taxable event.

A backup plan isn't extra work. It's equity protection architecture. You aren't hedging due to a lack of confidence in Plan A. You're protecting yourself against the single-point-of-failure risk that kills exchanges in tight markets.

And if you're a broker advising a client, the back-up plan is also reputation protection. The client doesn't remember the nuance. They remember whether the exchange stayed compliant.

The Non-Negotiables: 45-Day Identification Requirements That Make (or Break) Your Plan B

The IRS doesn't grant extensions for being busy or optimistic about your primary deal. The identification requirements under Treasury Regulation §1.1031(k)-1 are strict, and understanding them is the foundation of any viable backup strategy.

The 45-day identification period is triggered the day the relinquished property is transferred, ending at midnight on the 45th day thereafter. While practical counting often treats "Day 1" as the day after closing, the legal period technically opens upon transfer. You have exactly 45 calendar days to submit your identification—no business day exceptions.

Your identification must be in writing, signed by you, and delivered to a proper party as specified in the regulations. That's typically your Qualified Intermediary, but it can also be the seller of the replacement property or other permitted recipients. Verbal agreements don't count. Email drafts you never sent don't count. The identification must be delivered and acknowledged before midnight on Day 45.

You must comply with one of three identification rules:

The 3-Property Rule is the most common. You can identify up to three properties of any value. If you list a Houston industrial warehouse, an Austin multifamily complex, and a retail strip center in San Antonio, you're compliant—regardless of their combined market value.

The 200% Rule allows you to identify more than three properties, but their combined fair market value cannot exceed 200% of the value of your relinquished property. If you sold a property for $1 million, you can identify as many replacement options as you want, provided their total value doesn't exceed $2 million.

The 95% Rule is the fallback. You can identify an unlimited number of properties at any total value, but you must actually acquire at least 95% of the total identified value by Day 180. This rule is rarely used because it's operationally difficult to execute.

Backup properties reduce the risk of a failed exchange if your primary replacement contract falls through. But only if they're on the list before Day 45 ends.

Step 1: Build a Plan A, Plan B, Plan C Identification List (That Still Fits the Rules)

Your backup properties must be realistic alternatives—not aspirational wish-list assets you'd never actually close on.

Start with your primary target. That's the property you're actively pursuing—the one under contract or in serious negotiation. Then add backups that you could realistically acquire if Plan A collapses.

Keep your backups within your financing capacity and closing timeline. If your lender pre-approved you for a $2.5 million acquisition and Plan A is a $2.3 million Austin multifamily property, your backups should be in a similar price range. Don't identify a $4 million trophy asset as your backup unless you have a clear path to finance it within 180 days.

Geographic and asset-type diversification can help. If Plan A is a Houston industrial warehouse in a tight submarket, consider identifying a backup in a different Houston submarket or a similar industrial property in Austin. The goal is to create optionality without creating impossible execution scenarios.

Here's what a compliant identification list might look like for a Texas investor using the 3-Property Rule:

Plan A: 45,000 SF industrial warehouse, Northwest Houston, under contract at $2.1 million

Plan B: 38,000 SF industrial flex space, East Austin, listed at $1.9 million, reviewed financials

Plan C: 52-unit multifamily property, North San Antonio, listed at $2.3 million, financing pre-qualified

Each property is viable. Each fits within your equity and debt capacity. Each could close within 180 days if activated.

Don't list properties you haven't researched. "123 Main Street, Houston" isn't a backup plan—it's a placeholder that provides zero protection if Plan A fails. Backups are not wish-list properties. A placeholder is worse than nothing because it creates false confidence.

Step 2: Pre-Qualify Backup Properties So They're Real Options—Not Placeholders

A property on your identification list is only a true backup if you could actually close on it. That means pre-qualifying the financing, running preliminary due diligence, and confirming the timeline works.

Confirm your financing pathway. Contact your lender early—ideally between Day 1 and Day 10 of your exchange period, not on Day 35. Verify that your backup properties fit their lending criteria. If Plan B is a different asset class than Plan A, make sure your lender will finance it. Get a term sheet or a letter of interest. Know the timeline. If your lender needs 60 days to close, you need to account for that when evaluating whether a backup is realistic. Have proof of funds ready for earnest money and closing costs, and understand the path to rate locks, appraisal ordering, and third-party reports.

Run a fast due diligence triage. You don't need a full Phase I environmental report on every backup, but you should understand the major risk factors. Review the rent roll if it's multifamily—check for major rollover risk or large delinquencies. Check for known environmental flags from prior uses or Phase I triggers. Confirm that title is clear or that any issues are resolvable—look for easements, access problems, or encroachments. Assess property condition and any deferred capital expenditures that could slow underwriting. A backup property with a cloud on title that takes 90 days to resolve isn't a real backup.

Align your closing timeline with the 180-day exchange period. If your relinquished property closes on January 15, your replacement must close by July 14 (or July 13 in a leap year). Crucially, the exchange period ends on the earlier of 180 days or the due date of your tax return (including extensions). If you close late in the year—say, December—you must file a tax extension to utilize the full 180 days; otherwise, your deadline is April 15. This is the "April 15 trap" that catches unprepared investors who think they automatically have six months to complete their exchange. If a backup property has a seller who won't close for 120 days, and you're already on Day 50 when Plan A dies, the math doesn't work. Your backup needs to be ready to close within the remaining window.

The difference between a real backup and a placeholder is whether you've pressure-tested it before you need it.

Step 3: Add Contract-Level Protections That Keep the Exchange Moving

Once you've identified your backups and confirmed they're viable, the next step is to structure your purchase agreements to support the exchange timeline—not fight against it.

Use 1031 cooperation clauses. These are standard provisions that require the seller to cooperate with your exchange structure. The clause typically states that the seller acknowledges you're completing a tax-deferred exchange and agrees to execute any necessary documentation to facilitate it. This isn't optional language. It's a signal to the seller and their counsel that timing matters.

Avoid contract terms that make closing inside 180 days unrealistic. If a seller insists on a 90-day due diligence period with unlimited extensions, that's a red flag. Your total exchange period is 180 days. A contract that burns 120 days before you even get to closing leaves no margin for error.

Keep earnest money and inspection periods practical. You need enough time to complete due diligence, but not so much time that the deal drifts into the danger zone. A 30-day inspection period with a 60-day closing is standard for commercial real estate. A 60-day inspection period with a 90-day closing is a problem if you're on Day 45 of your exchange when you activate the backup. Build offers that are fast, clear, and coordinated—especially if you're in Houston or Austin markets where competition forces speed.

The goal is to create contracts that respect your 180-day constraint without appearing desperate. Experienced brokers understand exchange timelines. If your backup property's listing broker doesn't, that's a risk factor worth considering.

Step 4: Run a Deadline-Driven Cadence with Your Broker, CPA, and Qualified Intermediary

Most exchanges don't fail because of bad intent. They fail because of coordination breakdowns and missed signals. A disciplined timeline cadence reduces failure risk more than continued casual searching does. A clean exchange is a team sport.

Assign clear responsibilities. Your broker manages property search, negotiations, and closing coordination. Your CPA advises on tax strategy, basis calculations, and compliance. Your Qualified Intermediary holds the funds, prepares the exchange documents, and ensures IRS compliance. Everyone needs to know their role and the key dates.

Set checkpoint dates at Day 1-10, Day 15, Day 30, Day 40, and Day 44. These aren't arbitrary. Day 1-10 is when you initiate lender conversations and get the financing pathway confirmed. Day 15 is early enough to course-correct if your primary target isn't progressing. Day 30 is the halfway point—if you don't have a signed contract by now, you need backups lined up. Day 40 is the final push to get identification submitted. Day 44 is the emergency deadline to confirm delivery and acknowledgment.

Use a shared tracker or calendar. A simple spreadsheet or shared Google Calendar with the key dates, responsible parties, and status updates eliminates confusion. When your broker, CPA, and QI are all looking at the same timeline, miscommunication drops dramatically. Define who drafts the identification notice, who verifies property descriptions, who sends it, and who confirms receipt and archives proof.

The calendar is not flexible. Day 45 is Day 45. No one grants extensions because your broker was on vacation or your CPA was busy with tax season. The cadence forces decisions when they matter.

What If Plan A Dies After Day 45? Your Options (and What You Can't Do)

This is the scenario your backup plan was designed for. Plan A collapses on Day 62. Due diligence reveals a problem. Financing falls through. The seller backs out.

You can only purchase properties you identified on your original list. If Plan B or Plan C was on that list, you pivot immediately. You activate the backup, accelerate due diligence, and push toward closing. You have until Day 180 to close on at least one of your identified properties.

If none of your identified properties close by Day 180, the exchange fails. The IRS treats your original sale as a taxable event, and you owe capital gains tax on the full amount. This is why realistic backups matter. A backup property you can't actually close on provides zero protection.

Can you modify your identification after Day 45? Generally, no. Treasury Regulation §1.1031(k)-1 is clear: once the 45-day identification period ends, the list is locked. There are extremely limited exceptions—such as IRS-declared disaster areas where the agency issues formal relief—but these are rare and require specific circumstances. Don't plan on an exception. Plan on getting it right the first time.

If you're in this situation and unsure of your options, consult your tax advisor or attorney immediately. Every exchange is unique, and professional guidance is essential when navigating a failed primary deal.

Quick Checklist: A Backup Plan You Can Implement This Week

Here's your action plan for building a compliant backup strategy:

Identify 2–3 viable backup properties using the 3-Property Rule (or 200% Rule if needed). Make sure each backup is a property you've researched and could realistically close on within 180 days.

Pre-qualify your financing and run preliminary due diligence on each backup. Confirm your lender will finance the backup. Review the rent roll, environmental factors, and title. Know the major risk factors before you need to activate the property.

Deliver your written identification to your Qualified Intermediary before midnight on Day 45. Sign it. Confirm receipt. Get written acknowledgment. This is not a step you can skip or delay.

Maintain a disciplined cadence with your broker, CPA, and QI. Set checkpoint dates at Day 1-10, 15, 30, 40, and 44. Use a shared tracker. Assign responsibilities. Force decisions when they matter.

The difference between a failed exchange and a successful one often comes down to whether you identified realistic backups before Day 45—and whether you pressure-tested them before you needed them.

Frequently Asked Questions

Can I change my replacement properties after 45 days?

Generally, no. Once the 45-day identification period ends under Treasury Regulation §1.1031(k)-1, your list is locked. You can only purchase properties you identified on that original list. There are extremely rare exceptions for IRS-declared disaster areas, but you should not plan on qualifying for relief. The key is to get your identification right the first time.

How many backup properties should I identify?

It depends on your risk tolerance and the market. If you're using the 3-Property Rule, you can identify up to three properties of any value. Many Texas investors identify one primary target and one or two realistic backups. The goal is to have enough optionality to pivot if Plan A fails, without creating an unmanageable number of options to track.

What if my backup property isn't under contract by Day 45?

That's fine. You don't need a signed contract on your backup properties by Day 45. You only need to identify them in writing and deliver that identification to your Qualified Intermediary. However, the backup should be a property you've researched and could realistically acquire within the 180-day exchange period if you need to activate it.

What happens if none of my identified properties close by Day 180?

The exchange fails, and the IRS treats your original sale as a fully taxable event. You'll owe capital gains tax on the entire amount. This is why pre-qualifying your backups and maintaining a strict timeline cadence is so important. The 180-day deadline is absolute.

Who must receive my identification notice?

Your written identification must be delivered to your Qualified Intermediary, the seller of the replacement property, or another permitted recipient as defined by IRS regulations. Most investors deliver it to their QI, as they're already managing the exchange documents and funds. Always confirm receipt and get written acknowledgment before the midnight deadline on Day 45.

Resources

Beat the Clock: A Strategic Timeline for a Flawless 1031 Exchange

What Happens if You Miss the 45-Day Deadline? (And How to Prevent It)

The 3 Most Common 1031 Exchange Mistakes That Trigger a Tax Bill

Want to sanity-check your numbers and timeline before you commit? Use our 1031 Exchange Calculator to estimate your potential tax deferral and map your key dates. The calculator provides a general estimate—consult a tax professional for a detailed analysis specific to your situation.

Need a local Qualified Intermediary to keep your exchange audit-proof? Schedule an in-person consultation with Securitas1031 in Houston. Our team has been providing secure, efficient, and compliant 1031 exchange services since 2009, with over 18,000 closings and $3 billion in transactions across Texas and beyond.

Disclaimer: This article is for informational purposes only and does not constitute legal or tax advice. Every 1031 exchange is unique, and you should consult your tax advisor or attorney before making decisions.

Our Editorial Process

Our content is reviewed internally for accuracy and clarity. When needed, we consult subject-matter experts to ensure alignment with IRS guidelines and industry best practices.

By: The Securitas1031 Insights Team

The Securitas1031 Insights Team is our dedicated engine for publishing clear, practical education for commercial real estate investors navigating 1031 exchanges. We focus on risk reduction, timeline clarity, and investor confidence.