Beat the Clock: A Strategic Timeline for a Flawless 1031 Exchange

📌 Key Takeaways

A 1031 exchange timeline functions as a risk-management system where missing either the 45-day identification or 180-day completion deadline triggers full capital gains tax liability with no appeals.

Setup Before Closing Starts the Clock Right: Engaging your Qualified Intermediary when a sale becomes probable—not certain—provides weeks instead of hours to build your replacement property pipeline.

Backup Properties Are Non-Negotiable Insurance: Identifying three properties under the 3-property rule protects against deal collapse, lender delays, or title issues that could otherwise kill your entire exchange.

Calendar Alerts at Days 30, 40, and 44 Prevent Chaos: Structured checkpoints force progressive action on identification drafting, property descriptions, and delivery logistics before midnight on Day 45.

Reinvest Total Net Value, Not Just Cash: The exchange requires replacing the entire value of your sold property—equity plus debt—to avoid taxable mortgage boot that catches unprepared exchangers.

The Mailbox Rule Protects Timely Mailing: Identification sent via US Mail on or before Day 45 (postmark date) satisfies IRS delivery requirements even if received later.

Disciplined process control eliminates last-minute scrambles and preserves tax deferral.

Commercial property owners and their brokers will gain immediately actionable timeline management strategies here, preparing them for the day-by-day implementation guide that follows.

The clock on your desk reads 4:47 PM. Day 44 of your identification period. Your first-choice property just fell out of contract, and you have roughly thirty-one hours to identify a replacement before midnight tomorrow kills your entire exchange.

This is not a theoretical scenario. It happens to commercial property owners in Houston, Austin, and San Diego more often than most brokers care to admit. The difference between a successful 1031 exchange and an unexpected six-figure tax bill often comes down to one thing: whether you treated your timeline as an administrative detail or as the risk-management system it actually is.

A 1031 exchange allows real estate property owners to defer capital gains taxes by reinvesting the total net value (equity plus debt) from a sold property into a like-kind replacement property. The IRS provides two non-negotiable deadlines: 45 days to identify your replacement property and 180 days to complete the exchange. Miss either deadline, and the exchange fails. No appeals. No statutory extensions (barring federally declared disasters). Just taxes due.

Whether you're executing a standard deferred exchange, acquiring property before you sell in a reverse exchange, or using exchange funds to improve replacement property in a construction exchange, these timeline rules remain constant. The good news? With proper planning and a clear roadmap, these deadlines become manageable milestones rather than looming threats. This guide walks through the entire process—day by day—so you can execute your exchange with confidence and precision.

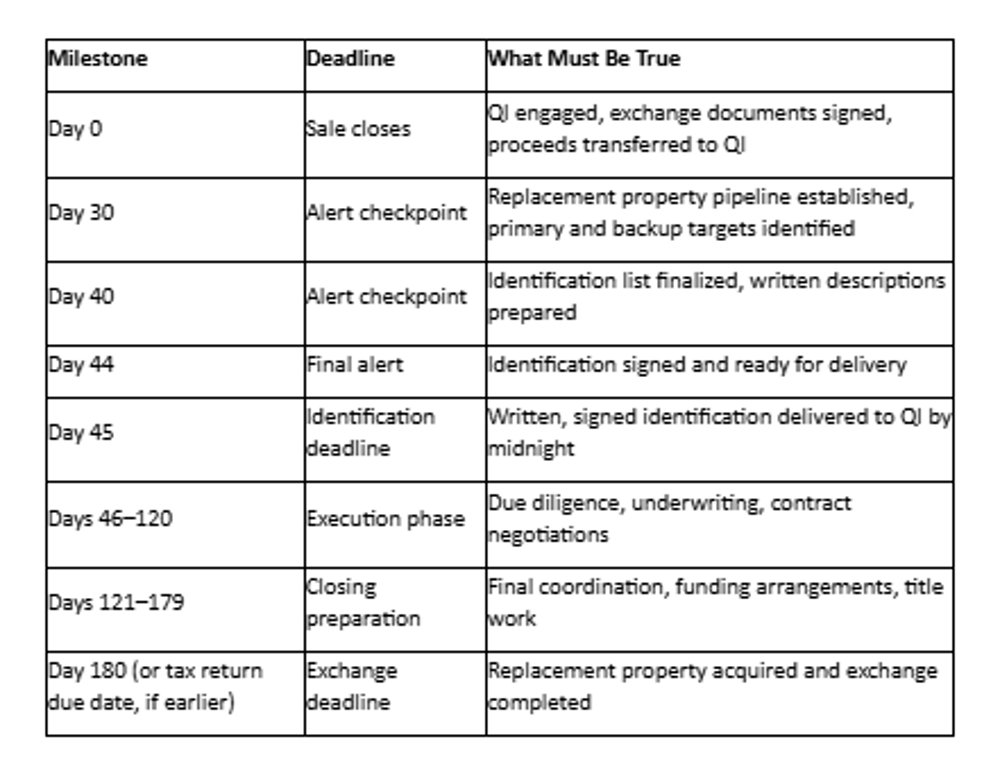

The 1031 Exchange Timeline at a Glance

Before diving into the details, here is the complete timeline every exchanger needs to know. Print this table and keep it visible throughout your exchange.

One critical detail that catches many exchangers off guard: the 180-day deadline can be shortened. If your exchange period overlaps with your tax return due date (typically April 15 for individuals), you must complete the exchange before that date—unless you file for a tax filing extension for the year in which the relinquished property was sold.[^1] For example, if you close on the sale of your relinquished property on December 20, you would have fewer than 120 days to complete the exchange unless you file Form 4868 to extend your tax return deadline.

Day 0 Is Not Closing Day—It Is Setup Day

Here is the most expensive mistake property owners make: waiting until closing day to engage a Qualified Intermediary.

By the time escrow closes, your 45-day clock is already running. If you spent those final weeks before closing focused solely on the sale—negotiating terms, managing inspections, coordinating with your broker—you have compressed your identification window before it even begins.

Think of it this way. A Houston property owner selling an industrial asset receives a signed Letter of Intent from a buyer. That LOI should trigger immediate action: contact a Qualified Intermediary in Houston and open your exchange file before the purchase agreement is finalized. This gives you weeks, not hours, to build your replacement property pipeline.

The consequences of poor timing extend beyond stress. When exchangers rush their identification, they make errors—vague property descriptions, missed delivery requirements, or identification lists that leave no backup options. These errors are often fatal to the exchange.

Day 0 should feel boring. Boring is good. Boring means the process was built before the clock started.

The rule is simple: engage your QI the moment a sale becomes probable, not the moment it becomes certain. This holds true whether you're planning a standard deferred exchange, preparing for a reverse exchange where you'll acquire before you sell, or structuring a construction exchange to improve your replacement property.

Schedule a Free In-Person Consultation

Ready to discuss your timeline? The team at Securitas1031—led by Charles H. Mansour, an attorney with over 30 years of experience and 18,000+ successful closings—can walk you through the process and help you map critical dates before your sale closes. Securitas 1031 serves as your secure intermediary, ensuring compliant handling of exchange proceeds while you maintain control over your property selection and investment strategy.

Securitas1031, LLC

440 Louisiana St, Suite 1100, Houston, Tx 77002

Phone: 713-275-8112

Pre-Closing Checklist: What to Do Before the Sale Closes

The weeks before closing are your strategic planning window. Use this checklist to ensure nothing falls through the cracks:

Confirm Property Eligibility and Intent

Both your relinquished property (the one you are selling) and your replacement property must be held for investment or business use.[^2] Personal residences and vacation homes used primarily for personal enjoyment do not qualify. Document your investment intent clearly in your records. As the property owner, you must demonstrate that both properties serve business or investment purposes—not personal use.

Identify and Engage Your Qualified Intermediary

Select a QI with experience handling exchanges in your property type and market. At Securitas 1031, our team of attorneys and real estate professionals brings deep technical expertise to standard deferred exchanges, reverse exchanges (where you acquire before selling), and construction exchanges (where you improve the replacement property). Execute the exchange agreement before your sale closes. Ensure your QI is prepared to receive proceeds directly from escrow—you cannot touch the funds at any point.

Align Your Professional Team

Schedule a coordination call with your broker, CPA, and QI. Confirm everyone understands the 45-day and 180-day deadlines. Establish a communication protocol for time-sensitive decisions. Your CPA and attorney should understand your role as the decision-maker on all property selections and exchange strategy.

Build Your Replacement Property Pipeline

Begin your property search immediately—do not wait for the sale to close. Identify at least one primary target and two backup properties. Gather legal descriptions or street addresses for each potential property. Remember: you as the taxpayer are selecting and acquiring these properties directly—your QI facilitates the compliant transfer of funds, but the investment decisions remain yours.

Set Calendar Alerts Now

Create alerts that force action before the deadline:

Day 30 alert: "Review identification list status"

Day 40 alert: "Finalize identification list"

Day 44 alert: "Identification must be delivered tomorrow"

Do not rely on mental math or memory. The deadlines are absolute.

The 45-Day Identification Period: The "Shot Clock" Phase

Days 1 through 45 are the most critical—and the most unforgiving—phase of your exchange.

During this window, you must formally identify the replacement property (or properties) you intend to acquire. This is not a casual process. The IRS requires specific procedures, and failure to follow them precisely will invalidate your identification.[^1]

What "Identify" Actually Means

Your identification must meet three requirements:

Written form: The identification must appear in a written document.

Signed by you: The document must bear your signature (or the signature of your authorized representative) as the taxpayer executing the exchange.

Sent or Delivered properly: The identification must be hand-delivered, mailed, faxed, or otherwise sent to a person involved in the exchange—typically your Qualified Intermediary—by midnight on Day 45.[^1] Note that if mailed, the identification is considered delivered at the time of mailing (postmark date), provided it meets IRS specific mailing requirements.

Verbal identifications do not count. Telling your broker or attorney which property you want is not sufficient. The identification must be in writing, signed, and delivered to the correct party.

The property description must be clear and unambiguous. For real estate, this means including either the legal description, the street address, or a distinguishable name.[^2] A vague description like "a retail property in the Galleria area" will not satisfy IRS requirements.

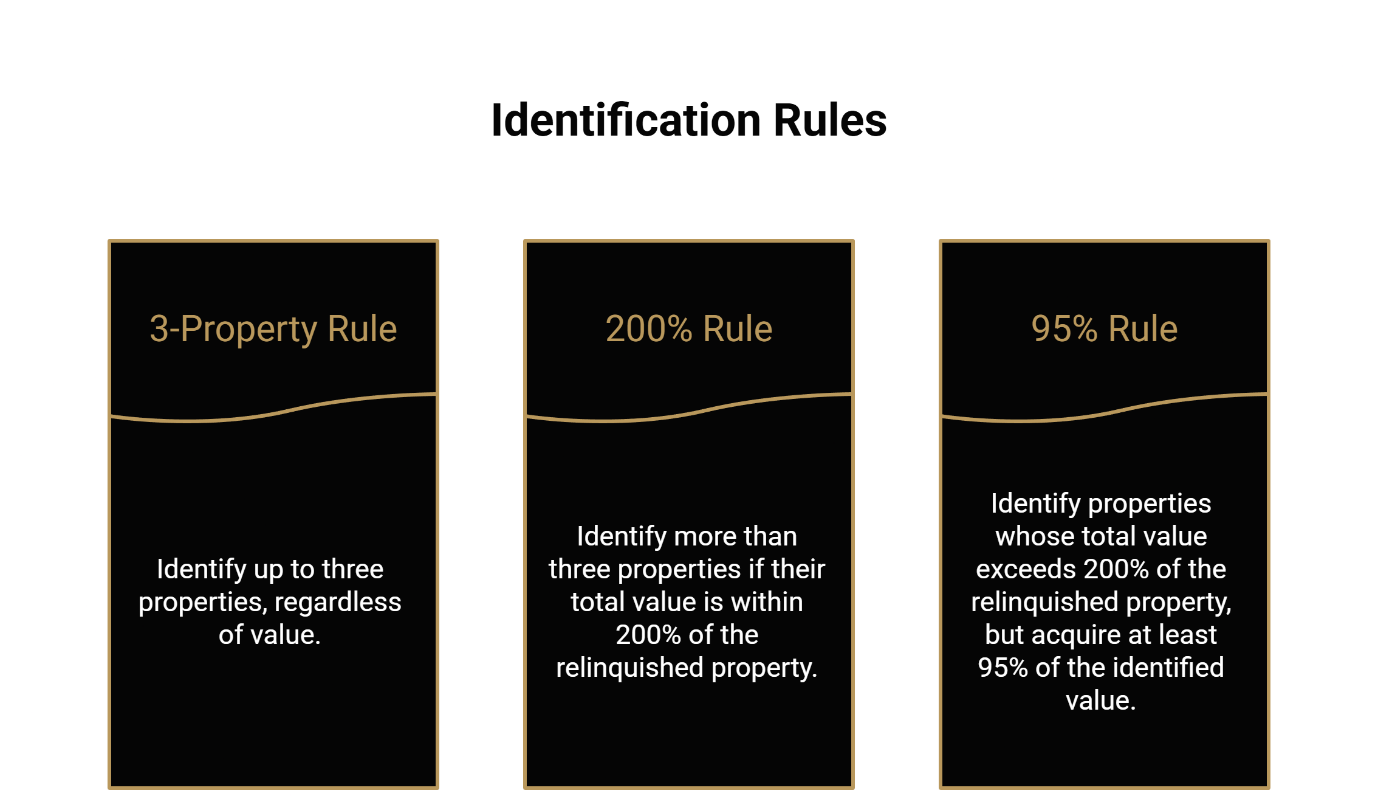

The Three Identification Rules

The IRS provides three frameworks for identifying replacement properties. You must comply with at least one of these rules:

The 3-Property Rule

You may identify up to three properties, regardless of their total value. This is the simplest and most commonly used approach. If you identify three or fewer properties, their combined value does not matter—you could identify three properties worth $50 million each if you wanted.[^3]

The 200% Rule

If you want to identify more than three properties, the total fair market value of all identified properties cannot exceed 200% of the value of your relinquished property.[^3]

For example, if you sold a property for $1 million, you could identify four, five, or even ten replacement properties—as long as their combined value does not exceed $2 million.

The 95% Rule

This is the exception to the 200% rule. If you identify properties whose total value exceeds 200% of your relinquished property, your identification is still valid—but only if you acquire at least 95% of the total value of all identified properties.[^3]

In practice, the 95% rule is difficult to satisfy. Most exchangers stick to the 3-property rule or the 200% rule to avoid complications.

Why Backup Properties Are Essential

Markets shift. Deals fall apart. Sellers change their minds.

If you identify only one property and that deal collapses on Day 60, you have no options. Your exchange fails. You owe capital gains taxes on the original sale.

This is why experienced property owners always identify backup properties. Under the 3-property rule, you can identify three properties with the intention of acquiring just one. If your first choice falls through, you pivot to your second or third choice without missing a beat.

Backups protect against common failure points: a lender shifting terms late in underwriting, a seller introducing delays or retrading, or a title, survey, or environmental issue surfacing late. In volatile markets—and Houston commercial real estate has seen its share of volatility—this flexibility is not optional. It is your safety net.

This backup strategy applies equally whether you're executing a deferred exchange, a reverse exchange (where timing pressure is even more acute because you must coordinate acquisition before sale), or a construction exchange where improvement timelines can shift unexpectedly.

The Calendar Alert System

Do not wait until Day 44 to finalize your identification. Build in buffer time with these alert checkpoints:

Day 30: Review your replacement property pipeline. Are your targets still available? Have any new opportunities emerged? Confirm top targets and backups are still viable. Request missing diligence documents. Verify who prepares the written identification. This is your last chance to make major adjustments to your strategy.

Day 40: Finalize your identification list. Gather all required property descriptions (legal descriptions or street addresses). Prepare the written identification document. Schedule signature logistics.

Day 44: Your identification should be signed and ready for delivery. Double-check that you have the correct delivery method for your QI (email, fax, overnight mail—confirm their requirements). Conduct a final verification: delivery method, receipt confirmation, and a "no loose ends" check.

It is 4:45 PM on Day 44. Two targets are viable, one is shaky, and the backup list is incomplete. In that moment, speed creates risk. The only reliable defense is that the drafting, descriptions, and delivery plan were built earlier—before the day became emotionally loud.

Day 45 (by midnight): Deliver your signed identification to your Qualified Intermediary. Do not assume delivery—confirm receipt.

What Invalidates an Identification?

These errors can disqualify your exchange:

Oral identification (not in writing)

Late delivery (after midnight on Day 45)

Vague or ambiguous property descriptions

Delivery to the wrong party (such as your attorney or broker instead of your QI)

Failure to sign the identification document

Any of these errors can disqualify your exchange. When in doubt, confirm the requirements with your QI before Day 45.

Days 46–120: Execute, Underwrite, and De-Risk the Closing Gap

Once the identification period ends, you enter the execution phase. You have identified your target properties. Now you must close on at least one of them within the remaining exchange period.

The primary challenge during this phase is the "closing gap"—the coordination required between your sale (which has already closed) and your purchase (which must close before Day 180).

Managing the Closing Gap

Unlike a traditional purchase where you control both sides of the timing, a 1031 exchange introduces a hard deadline that the seller of your replacement property may not fully appreciate. Your job during Days 46–120 is to compress risk by accelerating due diligence and maintaining clear communication with all parties.

This period often contains underwriting cycles and lender conditions, title and survey coordination, and contract amendments with timing changes. The risk is not one "big mistake." It is small misalignments that accumulate until the timeline becomes fragile.

Conduct due diligence early. Do not wait until Day 90 to order inspections, environmental reports, or title searches. Begin this work immediately after Day 45 so you have time to address any issues that surface. For construction exchanges, use this window to finalize improvement plans and contractor agreements—construction timelines must fit within your 180-day exchange period.

Communicate your timeline. Inform the seller of your replacement property—and their broker—that you are operating under a 1031 exchange deadline. Most sellers will accommodate reasonable timeline requests, but they need to know the stakes.

Build contingency time. If your target closing date is Day 150, work backward and build in a 15–20 day buffer for unexpected delays. Appraisals take longer than expected. Lenders require additional documentation. Title issues surface. Plan for the real world, not the ideal scenario.

Broker/Client Alignment Checklist

Before Day 60, ensure the following items are confirmed in writing:

Target closing date for replacement property acquisition

Financing contingencies and lender timeline

Inspection and due diligence deadlines

Required signatures and authorization procedures (ensure you as the property owner have final authority on all decisions)

Communication protocol for time-sensitive decisions

Confirm Day 45 and Day 180 dates are on everyone's calendar (and confirm if the tax return due date could create an earlier deadline)

Set a weekly cadence for status updates

Define who can approve pivots to backup properties

Identify contingencies that could extend closing and build alternate timing paths

Ensure signers are available to prevent "last-minute unavailability" failures

The goal is to eliminate ambiguity. Everyone involved—you as the exchanger, the seller, brokers, lenders, and your QI—should know exactly what needs to happen and when.

Days 121–180: Close the Replacement Property Without Surprises

The final stretch of your exchange requires vigilance and coordination.

Remember: the exchange period ends at midnight on the earlier of Day 180 or your tax return due date (including extensions).[^1] This "earlier of" rule catches exchangers who start transactions late in the year. If you closed your sale on November 15 and your tax return is due April 15, you have only about 150 days—not 180—unless you file for an extension.

The Reverse Timeline Method

Work backward from your deadline to ensure you have sufficient time. A reliable execution technique is to build the closing plan in reverse:

Day 180 (or tax return due date): Exchange must be complete. Replacement property must be acquired.

Day 170: All closing documents should be finalized and funds ready for disbursement.

Day 165: Last practical window for final lender conditions and document review.

Day 160: Final title review and lender approval confirmed.

Day 150: All contingencies removed and closing date locked. Commit to final property choice if multiple closings are possible.

Day 140: Appraisal and final inspections complete.

Day 135: Confirm title and survey status and remove avoidable uncertainties.

If your timeline does not allow for this sequence, you are cutting it too close. Consider accelerating your closing or, if necessary, identify backup properties earlier in the process. The goal is a "perfectly boring" close—no improvisation, no frantic escalations.

For property owners planning estate transitions or seeking to free themselves from unwanted joint ownerships, this final phase is where thoughtful property selection pays off. Your replacement property becomes the foundation for wealth preservation and legacy planning—make sure the acquisition is executed with the same care you applied to your identification strategy.

Filing Extension Strategy

For exchanges that begin late in the calendar year, filing a tax extension is often the prudent choice. By extending your tax return due date by six months, you preserve your full 180-day exchange period.[^2]

This is a straightforward administrative step, but it must be done proactively. Consult with your CPA to ensure the extension is filed properly and on time.

What Happens If You Miss Day 45 or Day 180?

The consequences are straightforward: the exchange fails, and you owe capital gains taxes on the original sale.

There is no appeals process. There is no hardship exception. The IRS does not grant extensions for 1031 exchange deadlines except in cases of federally declared disasters affecting taxpayers in specific geographic areas. [^1] [^4] If your replacement deal falls apart on Day 46 and you have no backup properties identified, the exchange is over.

This is why the earlier sections of this guide emphasize preparation, backup properties, and calendar alerts. The prevention strategy is simple:

Engage your QI early

Identify multiple properties (use your backup slots)

Set calendar alerts at Day 30, 40, and 44

Build buffer time into your closing schedule

Communicate your deadlines clearly to all parties

The goal is not to "beat the clock" through heroic last-minute efforts. The goal is to make the clock irrelevant by building a system that keeps you ahead of every deadline.

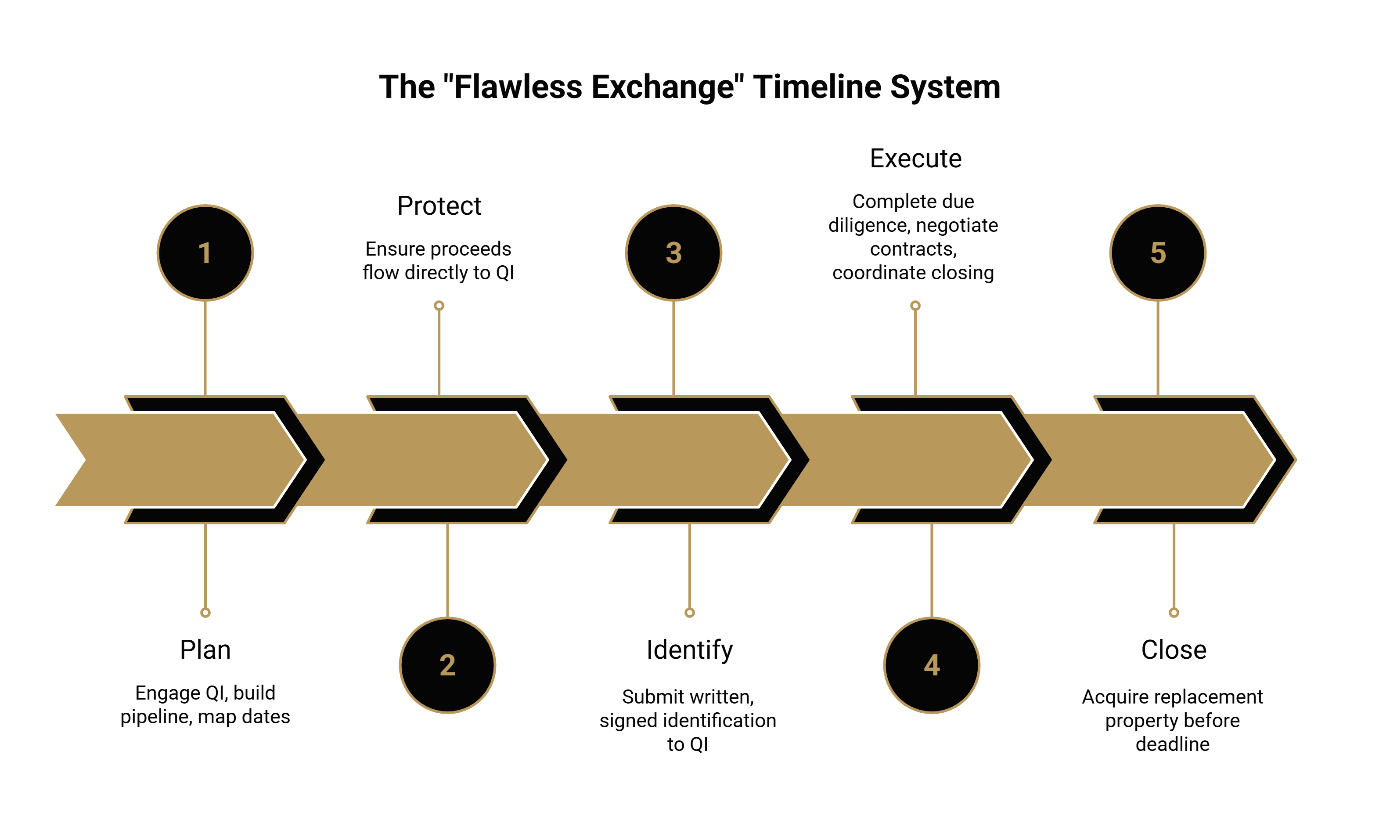

The "Flawless Exchange" Timeline System

A successful 1031 exchange follows a five-step system:

Plan — Engage your QI and build your replacement property pipeline before your sale closes. Map all critical dates. Whether you're executing a deferred exchange, reverse exchange, or construction exchange, the planning phase sets the foundation for success.

Protect — Ensure proceeds flow directly to your QI. Never take possession of exchange funds. Securitas 1031's secure handling of exchange proceeds—backed by attorney oversight and 30+ years of transaction experience—protects your exchange from disqualifying receipt issues.

Identify — Submit a written, signed identification to your QI by Day 45. Include backup properties. You as the property owner maintain full control over which properties you identify—your QI ensures the process meets IRS compliance standards.

Execute — Complete due diligence, negotiate contracts, and coordinate closing timelines during Days 46–180. For construction exchanges, this phase includes finalizing improvement plans and contractor coordination within the exchange timeline.

Close — Acquire your replacement property before Day 180 (or your tax return due date, if earlier). This is where you take ownership of the property that will serve your wealth-building and legacy planning goals.

The goal of this system is a perfectly boring, audit-proof transaction. No last-minute scrambles. No missed deadlines. No surprises. Just a disciplined process that preserves your capital gains deferral and positions you for continued wealth building.

Ready to Start Your 1031 Exchange?

The Securitas1031 team—led by Charles H. Mansour, an attorney with a BS, JD, and LL.M. in Taxation—has helped commercial property owners throughout Houston, Austin, and San Diego execute compliant exchanges with disciplined process control. With over 18,000 closings and $3 billion in transactions, our team provides the security and expertise that high-net-worth individuals demand. Whether you're planning your first exchange or your tenth, the right time to start planning is now.

Call Today to Initiate Your 1031 Exchange with Securitas 1031

Securitas1031, LLC

440 Louisiana St, Suite 1100, Houston, Tx 77002

Phone: 713-275-8112

Frequently Asked Questions

When does the 45-day clock start?

The 45-day identification period begins on the date you transfer the relinquished property—typically the closing date of your sale.[^1] Both the 45-day and 180-day periods run concurrently from this date; they are not sequential.

How do I properly identify replacement property?

Your identification must be in writing, signed by you as the exchanger, and delivered to your Qualified Intermediary (or another person involved in the exchange who is not your agent) by midnight on Day 45. The property must be described clearly using its legal description, street address, or distinguishable name.[^2]

What are the 3-property, 200%, and 95% rules?

These are three alternative frameworks for identifying replacement properties. The 3-property rule lets you identify up to three properties of any value. The 200% rule lets you identify more than three properties if their total value does not exceed 200% of your relinquished property's value. The 95% rule applies if you exceed the 200% limit—you must then acquire at least 95% of the total identified value.[^3]

Can I change my identification list after Day 45?

Generally, no. Once the 45-day identification period expires, you cannot add, remove, or modify properties on your list. This is why identifying backup properties within the initial 45 days is so important.

Does the exchange period ever end before 180 days?

Yes. The exchange period ends at the earlier of Day 180 or your tax return due date (including extensions).[^1] If you close your sale late in the year, your exchange period may be shortened unless you file for a tax extension.

What if my replacement deal falls apart after Day 45?

If you identified backup properties during the 45-day period, you can acquire one of those instead. If you identified only one property and that deal fails, your exchange fails and you owe capital gains taxes on the original sale.

Are there extensions for missing Day 45?

Generally, no. The IRS does not grant extensions for 1031 exchange deadlines except in cases of federally declared disasters.[^1][^4] Weekend and holiday deadlines are not extended to the next business day.

Why do I need a Qualified Intermediary?

The IRS requires that you not take possession of exchange proceeds at any point during the transaction. A Qualified Intermediary holds the funds from your sale and disburses them to acquire the replacement property, ensuring you maintain compliance with IRS regulations.[^2] Handling the proceeds yourself—even briefly—can disqualify the entire exchange. At Securitas 1031, our attorney-led team ensures secure, compliant handling of your exchange proceeds while you maintain full control over property selection decisions.

Where can I learn more about 1031 exchanges?

Securitas1031 offers free continuing education courses covering the timing, rules, and key concepts behind 1031 exchanges. These sessions—taught by our experienced team—are designed for brokers seeking TREC CE credit and property owners looking to deepen their understanding of exchange strategies.

How can I estimate my potential tax savings?

Use the 1031 Exchange Calculator to estimate how much you could save by deferring capital gains taxes through a 1031 exchange.

Disclaimer: This article is for informational purposes only and does not constitute tax or legal advice. Every transaction is unique. Consult your CPA, tax advisor, and/or legal counsel regarding your specific situation.

Our Editorial Process: We develop our educational content by (1) reviewing current IRS guidance and industry standards, (2) translating the rules into practical checklists and timelines for commercial real estate transactions, and (3) conducting an internal review for clarity, compliance, and plain-language accuracy before publication.

About the Author: Charles H. Mansour, BS, JD, LL.M. (Taxation) is the Founder & CEO of Securitas1031, LLC, focused on helping commercial property owners execute compliant 1031 exchanges with disciplined process control and secure handling of exchange proceeds.

[^1]: IRS Fact Sheet FS-2008-18, "Like-Kind Exchanges Under IRC Section 1031," provides guidance on the 45-day identification period and 180-day exchange period requirements.

[^2]: IRS Instructions for Form 8824 outline the written identification requirements, property description standards, and tax return due date considerations for like-kind exchanges.

[^3]: Treasury Regulation §1.1031(k)-1(c)(4) establishes the three identification rules: the 3-property rule, the 200% rule, and the 95% rule for identifying replacement properties in deferred exchanges.

[^4]: IRS Revenue Procedure 2018-58 provides postponement relief in certain federally declared disaster situations.