Navigating Non-Safe Harbor Reserve Exchanges in Texas

📌 Key Takeaways

Reserve and holdback language in Texas commercial real estate closings can inadvertently disqualify a 1031 exchange by granting the taxpayer prohibited access rights to exchange proceeds.

Control Language Disqualifies Exchanges: Phrases like "at seller's direction" or "seller may request release" create constructive receipt risk that pierces safe harbor protection.

Non-Safe Harbor Happens Inadvertently: These transactions typically still use a qualified intermediary but fail Treas. Reg. § 1.1031(k)-1(g) requirements when reserve documents grant taxpayer access.

Rights Trump Location: Where funds sit matters less than whether the taxpayer can receive, pledge, borrow, or benefit from them during the exchange period.

Restructure Before Closing: Revising escrow instructions to eliminate seller direction rights and assign holdbacks to the QI preserves the strongest compliance position.

Use the 11-Point Checklist: Pressure-testing reserve documents with your QI and counsel before signing prevents costly post-closing complications.

Early document review prevents exchange disqualification and potential recognition of substantial capital gains tax.

Texas commercial real estate investors planning 1031 exchanges with repair holdbacks, tenant improvement reserves, or indemnity escrows will gain compliance clarity here, preparing them for the detailed reserve analysis and restructuring strategies that follow.

A commercial property closes. The settlement statement looks fine—until a repair holdback appears in the title company's escrow instructions. Funds will be retained "until repairs are complete," with language that allows release "at seller's direction" or with "seller approval."

That is the moment many otherwise well-planned 1031 exchanges get exposed. Not because a reserve exists, but because reserve and holdback language can accidentally give the taxpayer a right to control or benefit from exchange proceeds. When that happens, constructive receipt risk moves from theoretical to real.

This guide explains what non-safe harbor reserve exchanges are, why they create problems, and provides a practical checklist to pressure-test reserve language before closing.

What Is a Non-Safe Harbor Reserve Exchange?

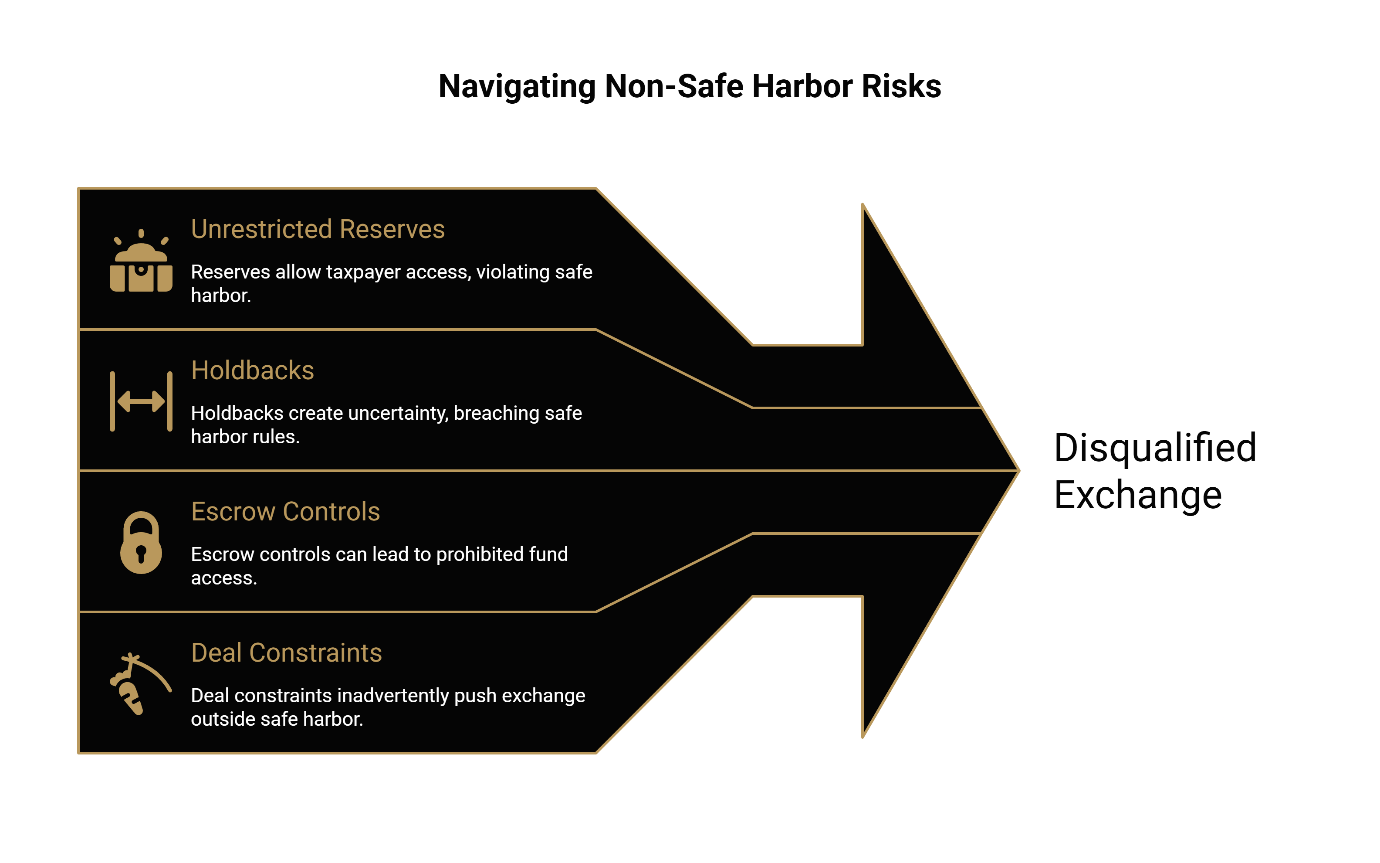

A non-safe harbor reserve exchange is a 1031 exchange structure that—often inadvertently—fails to strictly satisfy the requirements of the statutory safe harbors (specifically Treas. Reg. § 1.1031(k)-1(g)), effectively removing the automatic protection against constructive receipt. While these transactions typically still utilize a qualified intermediary, the presence of unrestricted reserves or holdbacks pierces the regulatory shield.

The term itself signals elevated risk and typically arises because reserves, holdbacks, or escrow controls create uncertainty about whether the taxpayer has prohibited access to the funds.

When an exchange falls outside safe harbor protections, the taxpayer bears a heavier burden to demonstrate compliance. The IRS may more readily argue that the taxpayer had actual or constructive receipt of funds, which would disqualify the exchange and trigger immediate recognition of capital gains.

Investors typically encounter this situation not by choice but by circumstance. Deal constraints like title company holdbacks, repair escrows, lender requirements, or complex multi-party closings can inadvertently push an otherwise compliant exchange outside the safe harbor framework.

Non-safe harbor does not automatically mean disqualification. However, it does mean the transaction lacks the regulatory shield that safe harbor provides, and every document, timeline, and control mechanism faces heightened scrutiny.

Why Safe Harbor Matters in a 1031 Exchange

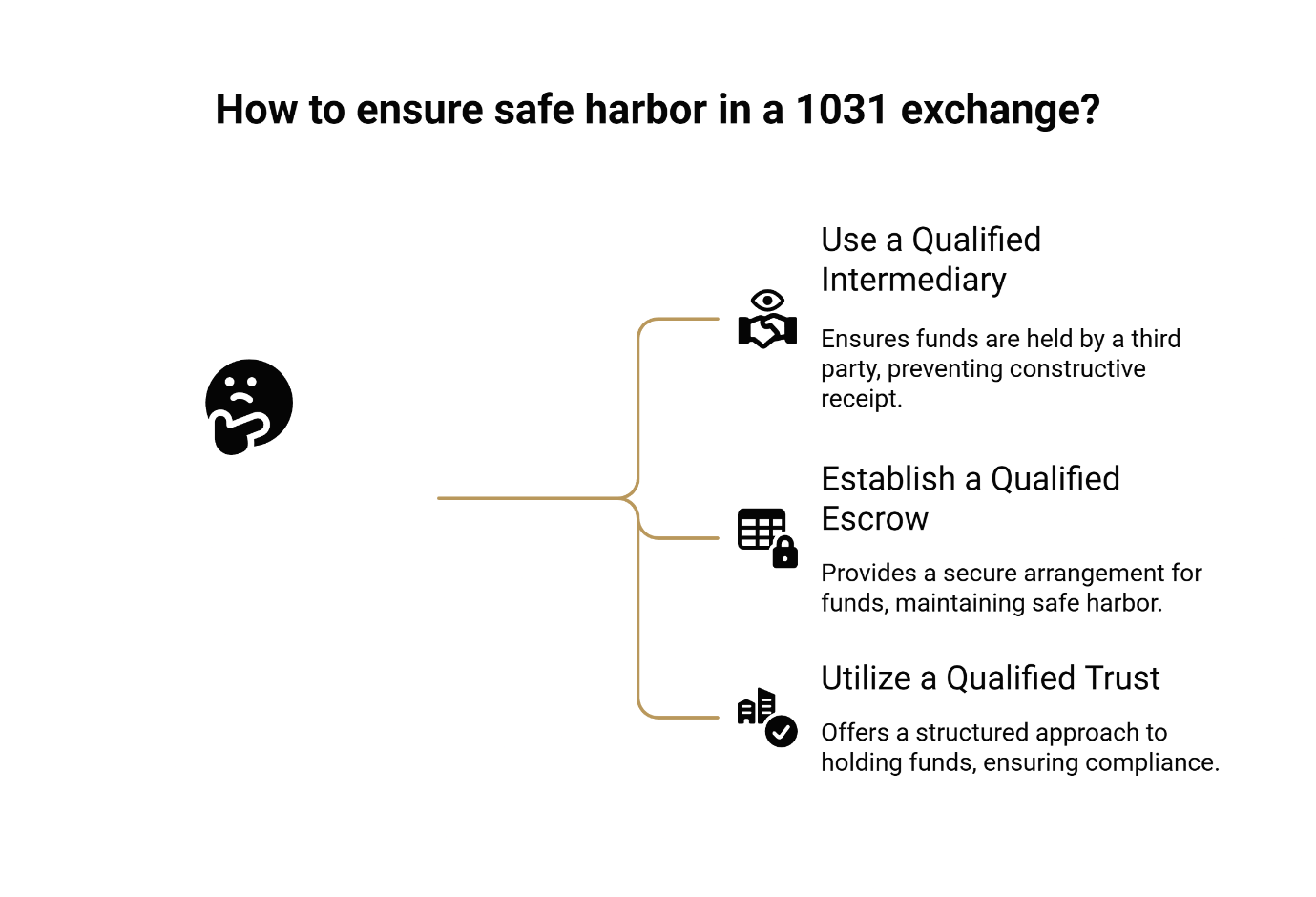

The Treasury regulations establish specific safe harbors that, when followed, provide assurance that the taxpayer will not be treated as having actual or constructive receipt of exchange funds. These safe harbors include using a qualified intermediary to hold proceeds, establishing a qualified escrow arrangement, or utilizing a qualified trust.

The practical rule is straightforward:

Your rights to the money matter more than where the money sits.

Even when funds are physically held by a third party, if the taxpayer retains the ability to receive, pledge, borrow, or otherwise obtain the benefits of those funds during the exchange period, constructive receipt may apply. The regulations include specific limitations—sometimes referenced as "g(6) limitations"—that restrict the taxpayer's access to exchange proceeds except in narrow circumstances. For the primary regulatory text, see 26 CFR §1.1031(k)-1 at the Legal Information Institute.

The timing constraints matter just as much as the control restrictions. Taxpayers have 45 days to identify replacement property and 180 days to complete the exchange. These deadlines shape every decision about reserves and escrow releases. For comprehensive guidance, see the IRS resource on like-kind exchanges.

This is why escrow language matters so much. A repair holdback held by a title company appears safe on the surface. But if the underlying documents give the seller authority to direct release, approve disbursements, or accelerate access under certain conditions, the taxpayer may have retained precisely the kind of rights that undermine safe harbor protection.

Before moving forward with any complex exchange structure, consider running preliminary numbers through a 1031 exchange calculator to understand the potential tax deferral at stake.

How Reserve and Holdback Language Creates Constructive Receipt Risk

Texas title companies commonly use reserves and holdbacks for legitimate transactional purposes. Each can also create 1031 problems if drafted without exchange compliance in mind. Common reserve and holdback categories include:

Repair escrows and repair holdbacks

Tenant improvement (TI) reserves

Indemnity escrows and claim reserves

Rent reserves and lease-up adjustments

Post-closing purchase price adjustments

The danger lies in specific phrases that grant the seller control or access rights. Watch for language like:

"At seller's direction"

"Seller may request release"

"Seller approval required for disbursement"

"Upon seller's written authorization"

"Seller shall have the right to direct"

Even without intent to access the funds, the mere existence of these documentary rights can be enough to establish constructive receipt. The IRS looks at what the taxpayer could do under the documents, not necessarily what they actually did.

Texas title companies often use standardized holdback addenda that work perfectly well for non-1031 transactions but contain problematic language for exchange purposes. The time to identify and revise this language is before closing—not after the documents are signed and recorded.

Consider a scenario where a Houston investor sells an industrial property with a $75,000 repair holdback for roof work. The standard title company addendum states that funds will be released "upon joint written direction of buyer and seller" or "at seller's request with buyer's consent." That phrase—"at seller's request"—creates a right of access that may compromise the exchange.

Restructuring typically involves revising the escrow instructions to eliminate seller direction rights entirely, assigning the holdback to the qualified intermediary, and ensuring release occurs only upon satisfaction of objective conditions without seller involvement.

When Investors End Up Outside Safe Harbor

Several trigger scenarios push transactions outside safe harbor protection:

Proceeds controlled by a disqualified party. If exchange funds are held by someone who is the taxpayer's agent for other purposes—such as an attorney who regularly represents the taxpayer, an accountant, or an employee—the qualified intermediary safe harbor may not apply.

Escrow not structured as qualified. An escrow arrangement must meet specific regulatory requirements to qualify as a safe harbor. Standard title company escrows for holdbacks often do not meet these requirements unless specifically modified.

Taxpayer rights not properly restricted. Even with a qualified intermediary in place, if separate reserve or holdback arrangements grant the taxpayer access rights, those arrangements may taint the overall exchange.

Closing timing misalignment. When the release of reserve funds does not align with the 45-day identification period or 180-day exchange period, complications arise regarding how those funds are treated.

When any of these triggers appear, the first step is to pause. Get the qualified intermediary and legal counsel aligned on the specific issue. Determine whether escrow instructions can be rewritten to cure the problem. Confirm that all assignments, notices, and restrictions are properly documented. Only then should the transaction proceed.

Decision Tree: Choosing the Safest Path Forward

When reserve or holdback arrangements threaten safe harbor protection, investors generally face three paths:

Path A: Restructure into Safe Harbor (Preferred)

The cleanest solution is usually to restructure the transaction so that it falls within safe harbor protections. This might involve assigning the holdback to the qualified intermediary, revising escrow instructions to eliminate taxpayer access rights, or restructuring the timing of releases to align with exchange deadlines. This path requires coordination among the qualified intermediary, title company, attorneys, and sometimes the buyer—but it preserves the strongest compliance position.

Path B: Proceed Outside Safe Harbor with Strict Controls (High Caution)

In some circumstances, restructuring is not feasible. The deal structure, buyer requirements, or lender constraints may make safe harbor impossible. Proceeding outside safe harbor is not automatically fatal, but it requires rigorous documentation, clear written analysis of the compliance position, and controls that demonstrate the taxpayer never actually received or had access to the funds. This path should only be taken with experienced counsel and a qualified intermediary who understands the specific risks. Even then, the exchange carries elevated audit risk.

Path C: Abandon 1031 or Consider Alternative Planning

Sometimes the math does not work. If the holdback amount is small relative to total proceeds, or if restructuring costs exceed the tax benefit, abandoning the 1031 treatment for that portion—or the entire transaction—may be the rational choice. Alternative planning strategies like installment sales or other deferral mechanisms may deserve consideration. This path requires honest assessment of whether the complexity and risk justify the potential benefit.

Texas Checklist: Pressure-Test Your Reserve Before Closing

Before signing any closing documents involving reserves, holdbacks, or escrow arrangements in a 1031 exchange, work through this checklist with your qualified intermediary and counsel:

Who holds the funds? Confirm whether the reserve is held by the title company, a separate escrow agent, or the qualified intermediary. Funds held by the QI generally receive stronger protection.

Who can direct release? Review every provision addressing disbursement authority. If the seller can request, direct, or authorize release, that language must be removed or revised.

What events trigger release? Identify each condition that causes funds to be disbursed. Objective conditions (completion of repairs verified by third-party inspection) are safer than subjective ones (seller satisfaction).

Can the taxpayer request or approve release? Any language granting the seller approval rights, consent rights, or request rights creates risk. These provisions should be eliminated.

Can the taxpayer pledge, borrow, or benefit from the funds? The regulations prohibit receiving the benefits of exchange funds during the exchange period. Confirm the documents contain no such rights.

Do escrow instructions restrict access through the entire exchange period? Restrictions must remain in place until the exchange is complete—either through acquisition of replacement property or expiration of the 180-day period.

Are assignments and notices properly executed? If the holdback is assigned to the qualified intermediary, confirm the assignment is documented and all parties (title company, buyer) have received proper notice.

Is there a clear documentation and audit trail? Every instruction, revision, and communication should be in writing and retained. If the IRS questions the exchange years later, contemporaneous documentation is essential.

Does timing align with 45/180 deadlines? Confirm that release of reserve funds does not create complications with identification or exchange period deadlines.

Have you obtained counsel and QI review before signing? This is the most important step. Before any closing documents are executed, pause and get professional review of the reserve/holdback structure.

Escalation rule: If the reserve language cannot be made control-safe, pause and obtain qualified intermediary and legal review before signing.

Bring this checklist to your title company and ask them to address each item before closing.

Two Texas Examples

Example 1: Houston Industrial Sale with Repair Holdback

A Houston investor sells a 40,000-square-foot industrial warehouse for $2.8 million, with plans to acquire a multifamily property in Austin. The buyer's inspection reveals roof issues, and the parties agree to a $60,000 repair holdback pending completion of repairs.

The title company's standard holdback addendum provides that funds will be released "upon seller's written request and submission of paid invoices, subject to buyer's reasonable approval."

The risk: The phrase "upon seller's written request" grants the seller a right to initiate release. This creates potential access that could compromise the exchange.

Safer design objective: The parties revise the escrow instructions to provide that funds will be released "upon title company's receipt of (a) a third-party inspection report confirming completion of specified repairs to buyer's specifications, and (b) joint written authorization from buyer's counsel and the qualified intermediary." The seller's right to request release is eliminated. The holdback is also assigned to the qualified intermediary, with the title company holding as sub-escrow agent under the QI's instructions.

Example 2: Austin Acquisition with Tenant Improvement Reserve

A different investor sells a San Antonio retail center and acquires an Austin office building. The acquisition contract requires a $120,000 tenant improvement reserve to fund build-out obligations for a new tenant.

The original escrow instructions state that the reserve will be disbursed "at seller's direction upon submission of contractor invoices and lien waivers."

The risk: Post-closing, this investor is now the buyer of the replacement property—not the seller. But the question remains: who controls these funds? If structured as proceeds from the original sale that the investor can direct, access issues arise. If the reserve is characterized as a separate obligation of the replacement property, it may not be exchange proceeds at all.

Safer design objective: The parties restructure the transaction so that the tenant improvement reserve is funded directly by the seller of the Austin property (the party from whom our investor is buying) rather than from exchange proceeds. Alternatively, if the reserve must come from exchange proceeds, the funds are held by the qualified intermediary with release conditioned on objective construction milestones verified by an independent party, with no investor direction rights.

FAQs About Non-Safe Harbor Reserve Exchanges in Texas

Is a non-safe harbor reserve exchange ever a good idea?

Rarely. In most cases, the goal should be restructuring the transaction to fit within safe harbor protections. Proceeding outside safe harbor is sometimes unavoidable due to deal constraints, but it should be treated as a last resort requiring experienced counsel and rigorous documentation.

Can a title company holdback be part of a 1031 exchange?

Yes, but only if structured properly. The holdback must not grant the taxpayer rights to receive, direct, pledge, or borrow against the funds. Ideally, the holdback should be assigned to the qualified intermediary or held under escrow instructions that eliminate taxpayer access.

What is the "g(6)" limitation and why do practitioners mention it?

This refers to provisions in Treasury regulations that limit a taxpayer's rights to receive exchange funds during the exchange period. The regulations permit receipt only in specific circumstances. When escrow or reserve language grants broader access, it may violate these limitations and create constructive receipt.

Does Texas having no state income tax change the 1031 analysis?

Texas has no state income tax, which eliminates one layer of tax deferral benefit. However, federal capital gains tax and depreciation recapture still apply, making 1031 exchanges valuable for Texas investors. The compliance requirements remain identical regardless of state tax treatment.

When should a qualified intermediary or attorney get involved?

Before closing documents are drafted or signed. Once documents are executed, restructuring becomes far more difficult. Early involvement allows time to identify problems and revise language before the transaction closes.

What happens if the IRS disqualifies the exchange?

Disqualification means the taxpayer recognizes gain in the year of sale as if no exchange occurred. Depending on the transaction, this could mean substantial federal capital gains tax plus depreciation recapture, along with potential interest and penalties if the IRS determines the position was not adequately supported.

Next Step: Get a Compliance-First Review Before You Close

Reserve and holdback arrangements are common in Texas commercial real estate transactions. When a 1031 exchange is involved, these arrangements deserve careful scrutiny—not at the closing table, but well in advance.

The team at Securitas 1031 works with Texas investors to identify reserve and holdback risks before they become problems. Bring your draft escrow language, your timeline, and your questions to a free in-person consultation.

Schedule a free in-person consultation. Call 713-275-8112 or visit 440 Louisiana St Suite 1100, Houston, TX 77002.

For a quick estimate of potential tax deferral, run your numbers in our 1031 exchange calculator.

For additional learning and training resources, explore our continuing education offerings.

About the Securitas1031 Insights Team

The Securitas1031 Insights Team provides educational resources for commercial real estate investors navigating tax-deferred exchanges. Our content is developed in collaboration with legal and tax professionals to ensure accuracy and practical relevance. All information is for educational purposes and should not replace professional advice.

Our Editorial Process

Our expert team uses AI tools to help organize and structure initial drafts. Every piece is then extensively rewritten, fact-checked, and enriched with first-hand insights and experience from our human Insights Team to ensure accuracy and clarity.

Call 713-275-8112 or visit 440 Louisiana St Suite 1100, Houston, TX 77002 to discuss your exchange.