The 3 Most Common 1031 Exchange Mistakes That Trigger a Tax Bill

📌 Key Takeaways

Process errors—not market conditions—cause most preventable 1031 exchange failures, and three technical missteps account for the majority of unexpected tax bills.

Touching Proceeds Kills the Exchange: If sale funds ever reach your account, even briefly, the IRS may disqualify your entire tax deferral.

Taxpayer Names Must Match Exactly: John Doe selling but JD Properties LLC buying triggers immediate capital gains liability.

Miss Day 45, Lose Everything: The identification deadline has zero exceptions—Day 46 means full taxes due regardless of replacement property.

Engage Your QI Before Closing: Qualified intermediaries must control funds from the moment escrow closes to maintain safe harbor protection.

Entity Changes Require Early Planning: Forming an LLC after the sale or changing ownership percentages between properties creates different taxpayers and breaks the exchange.

Structure protects equity; casual handling creates tax events.

Individual property owners planning investment sales in Texas will gain critical compliance safeguards here, preparing them for the detailed mistake-prevention strategies that follow.

The tax bill arrives. Not because the market turned. Not because the deal fell through. Because a checkbox got missed—or the wrong name appeared on a document.

Picture this: You've just closed on a small retail strip in Houston that you've owned and managed for eight years. The buyer's funds hit escrow. You're already eyeing an industrial pad site near The Woodlands for the exchange—a property you'll own directly and control completely. Then your CPA calls. The proceeds went to the wrong account for 48 hours. Your 1031 exchange? Potentially disqualified. The capital gains you planned to defer? Now typically due during the next tax filing season.

This wasn't supposed to happen.

If that scenario makes your stomach drop, you're not alone. A 1031 exchange is not paperwork. It is an equity-protection structure—and structure breaks when money, title, or timing is handled casually. Many preventable 1031 exchange failures don't come from bad investments or market timing. They come from process errors—technical missteps that turn a tax-deferral strategy into an unexpected tax event. The three mistakes below account for a significant portion of these failures among individual property owners.

Understanding these pitfalls now—before you list or close—determines whether you build generational wealth or merely generate a tax bill. For a deeper look at how 1031 exchanges fit into a broader wealth-building and legacy planning strategy, explore how to build wealth with 1031s.

Mistake #1: Constructive Receipt (Touching the Proceeds)

Here's the rule in plain terms: If you as the property owner have access to, control over, or benefit from your sale proceeds—even briefly—the IRS may consider you to have "constructively received" the money. That can disqualify your exchange.[^1]

Touching your exchange funds for even a second can turn a tax deferral into a taxable event.

How this happens in practice:

The title company wires proceeds to your personal or business account "temporarily" before the qualified intermediary (QI) is engaged

You sign closing documents that give you authority to direct the funds

Escrow holds the funds in your name while you "figure out the next property"

Each of these scenarios can break the safe harbor that protects your exchange.

🚨 Red Flag: If the funds ever touch your account, the exchange may be over.

Consequence: Constructive receipt can convert your tax-deferred exchange into a fully taxable sale.

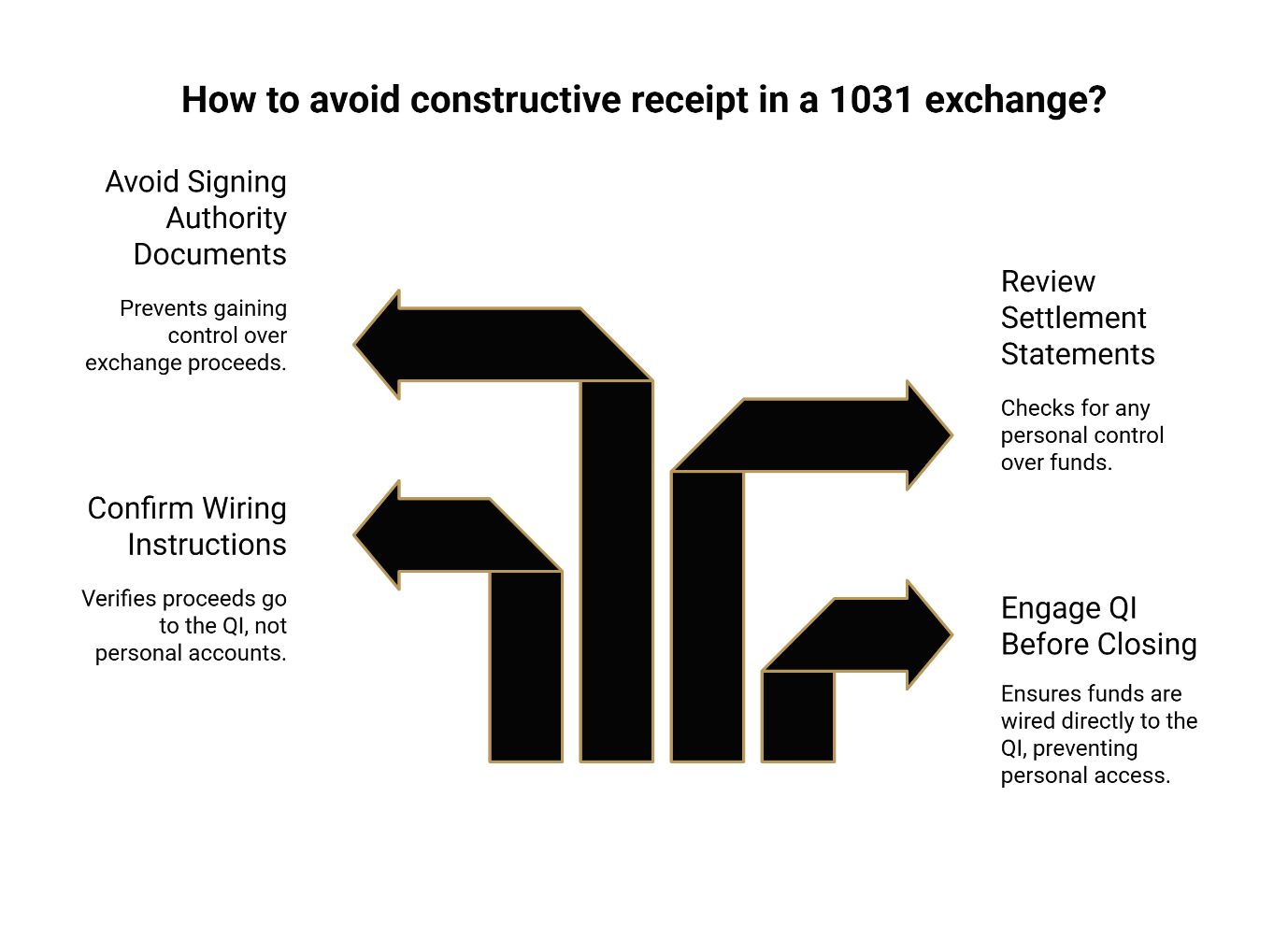

Prevention:

Engage your QI before closing—not after

Confirm wiring instructions route proceeds directly to the QI

Review settlement statements to ensure you never have control of funds

Never sign documents giving you authority over exchange proceeds

The fix is straightforward: Your QI must be in place before escrow closes, and the proceeds must flow directly to them. Not to you. Not "for a day or two." Not through your attorney's trust account. Directly to the QI.

This is where working with an experienced, attorney-led qualified intermediary becomes critical. The team at Securitas 1031—led by founder Charles H. Mansour, who has overseen more than 18,000 closings and $3 billion in transactions over 30+ years—structures each exchange to maintain the safe harbor protections that keep your equity working for you.

Wondering how much you might defer? Run the numbers with the 1031 Exchange Calculator before your closing.

Mistake #2: Title/Taxpayer Mismatch (The Partnership/LLC Trap)

This is where most property owners—and even some advisors—get tripped up.

The IRS requires that the same taxpayer who sells the relinquished property must be the same taxpayer who acquires the replacement property.[^2] Sounds simple. In practice, it's a minefield—especially when partnerships, LLCs, or estate planning entities are involved.

Here's the concept in plain language: If John Doe sells a property, John Doe must buy the replacement. If JD Properties LLC sells, then JD Properties LLC must buy. A mismatch between these names can trigger immediate tax liability.

Common mismatch scenarios that cause problems:

Individual sells, LLC buys (or vice versa): You sold in your personal name, but your attorney recommended an LLC "for liability protection" on the new property. Different taxpayers. Potential problem.

Partnership sells, partners want to buy separately: Three partners own a property together. They sell, but each partner wants to buy their own replacement property. Unless structured correctly, this breaks the same-taxpayer requirement.

Entity created after sale: You close on the sale, then form an LLC for the replacement purchase. The LLC didn't exist when you sold. Different taxpayer.

Ownership percentages change: A husband and wife own property 50/50. They sell, but the replacement is titled 70/30. The IRS may view this as a partial exchange failure.

🚨 Red Flag: John Doe sold it, but JD Properties LLC is buying—this mismatch can trigger taxes.

Consequence: Title mismatches can partially or fully disqualify your exchange, resulting in immediate capital gains tax.

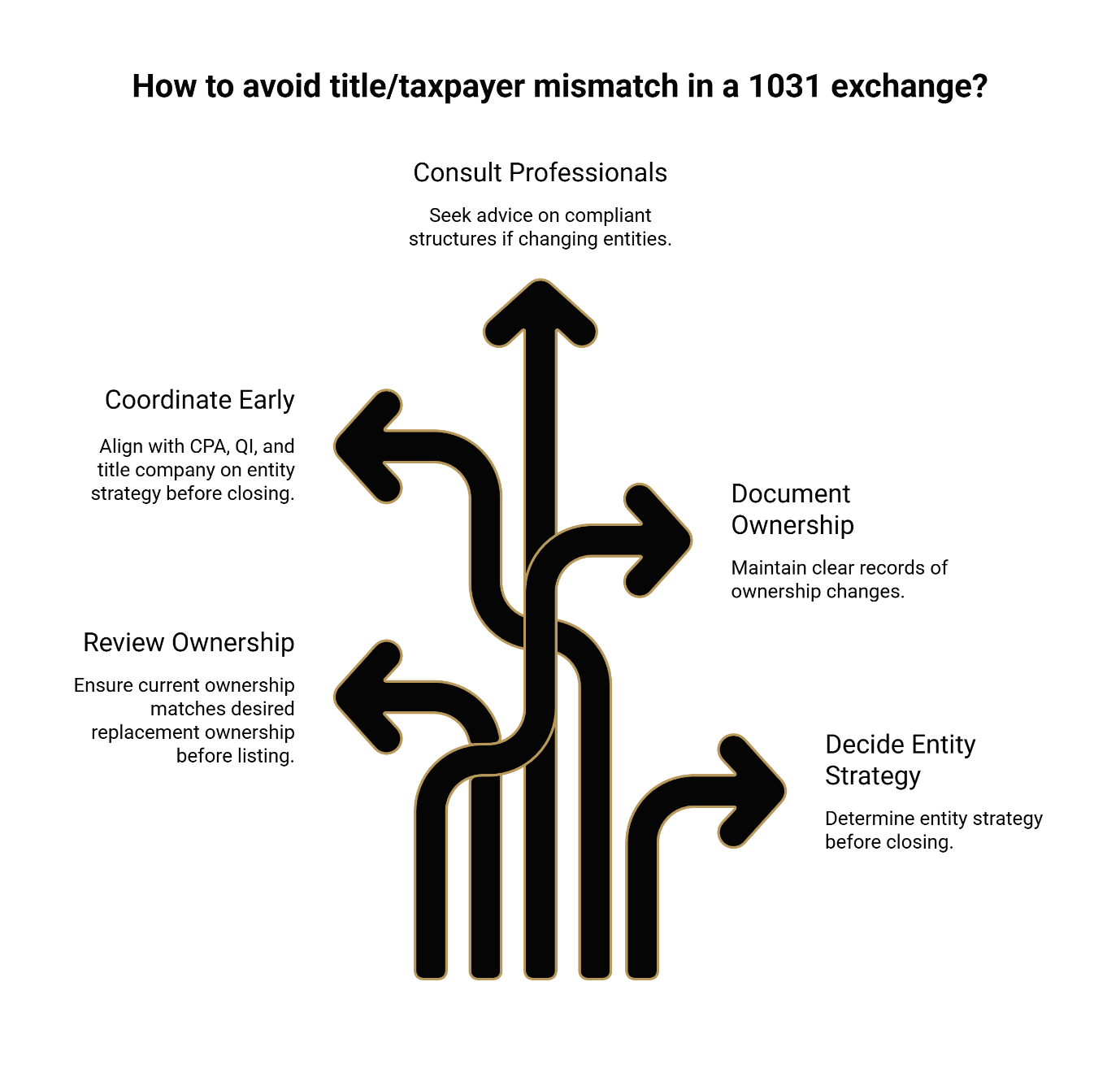

Prevention:

Think of this as a coordination challenge between you, your CPA and attorney, your QI, and your title company. Everyone needs to be aligned on who the taxpayer is—before closing pressure sets in.

Review ownership and title before listing the property

Coordinate early with your CPA, QI, and title company on entity strategy

If you want to change entities, consult professionals about compliant structures (like single-member LLCs treated as disregarded entities)

Document the chain of ownership clearly

Decide your entity strategy before closing—not after

This mistake deserves extra attention because it often gets discovered too late. A broker brings a deal to closing, the property owner mentions wanting to "put the new one in an LLC," and suddenly a preventable problem becomes an expensive one.

The prevention? Have the title/ownership conversation early. Loop in your CPA and QI before you sign a listing agreement—not the week before closing. Meet the Securitas 1031 team to discuss your specific ownership structure with attorneys who understand both tax law and real estate compliance.

Mistake #3: Missing the 45-Day or 180-Day Deadline

The timeline is statutory. No extensions. No exceptions for being busy, distracted, or waiting for the perfect deal.[^3]

The two deadlines:

45-Day Identification Period: The clock starts the day after your sale closes. You have exactly 45 calendar days to formally identify potential replacement properties in writing to your QI.

180-Day Exchange Period: You must close on a replacement property within 180 calendar days of your original sale (or by your tax return due date, including extensions—whichever comes first).

Miss Day 45 by even one day? Your exchange generally fails. Close on Day 181? Same result.

Why this goes wrong:

"I'll identify something next week" turns into Day 44

The property you identified falls out of contract, and you have no backup

A holiday weekend or title delay pushes closing past Day 180

The exchanger forgets that the clock started at their closing, not when they found a replacement

🚨 Red Flag: Day 44 and signatures aren't in—your exchange is in the danger zone.

Consequence: Missing either deadline typically results in a failed exchange and taxes due on the entire gain.

Prevention:

Create a "Day 1 Calendar" the moment your sale closes

Identify backup properties (you can identify up to three under the standard rule)

Coordinate with your broker and QI on identification deadlines before closing

Set calendar alerts for Day 30, Day 40, and Day 44

Have your identification documents drafted and ready to sign early

Quick "Red Flag" Checklist

Use this checklist before and during your exchange. Brokers and CPAs: feel free to share this with clients.

⚠️ Constructive Receipt Warning Signs:

[ ] Proceeds are being wired anywhere other than directly to the QI

[ ] You have signing authority over exchange funds

[ ] QI is not engaged before closing

[ ] Settlement statement shows you as recipient of funds

⚠️ Title/Taxpayer Mismatch Warning Signs:

[ ] Name on sale deed differs from name on purchase deed

[ ] Entity changes planned between sale and purchase

[ ] Partnership members buying separately without proper structure

[ ] New LLC formed after the relinquished property closes

⚠️ Deadline Warning Signs:

[ ] No formal identification submitted by Day 44

[ ] Only one property identified with no backups

[ ] Closing timeline extends beyond Day 175 with unresolved contingencies

[ ] Tax return due date falls before Day 180 (and no extension filed)

When to Involve a Qualified Intermediary (QI)

The short answer: before you sign closing instructions.

A qualified intermediary isn't just paperwork. Your QI serves as the secure holder of your sale proceeds, maintaining the structure that satisfies IRS safe harbor requirements, documenting your exchange, and helping ensure you don't inadvertently disqualify yourself.[^4]

At Securitas 1031, we've built our reputation on providing secure, efficient, and compliant 1031 exchange services. Our team—seasoned attorneys and real estate professionals with deep expertise in tax law—handles exchanges for individual property owners across a wide range of scenarios:

Deferred (Delayed) Exchanges: The standard 45/180-day timeline structure

Reverse Exchanges: When you need to acquire your replacement property before selling

Construction/Improvement Exchanges: Using exchange funds to build or improve replacement property

Estate and Legacy Planning: Structuring exchanges that preserve wealth for your heirs or help you exit unwanted co-ownership arrangements

What to prepare before your first conversation:

Property details (address, approximate value, ownership structure)

Names and contact information for your CPA, attorney, and broker

Expected closing date

Any planned entity changes or ownership adjustments

The earlier you engage, the more time you have to identify and prevent potential problems—especially title mismatches. Named after Securitas, the Roman goddess of security and stability, our firm is built on the principle that your exchange funds deserve the highest level of protection and your transaction deserves the attention of experienced legal professionals.

Frequently Asked Questions

Can my attorney or escrow officer hold the funds instead of a qualified intermediary?

Generally, no. Attorneys, escrow officers, and other "disqualified persons" with a pre-existing relationship to you typically cannot serve as your QI. The IRS safe harbor rules require an independent third party.[^5]

What if I miss Day 45 but still buy a replacement property within 180 days?

The identification deadline is strict. Missing Day 45 typically disqualifies the exchange, even if you close on a replacement property within the 180-day window. There are very limited exceptions (like federally declared disasters), but they rarely apply.

Does the name on title really have to match exactly?

The taxpayer must be the same. Minor variations (like middle initials) are generally not problematic, but substantive differences—like an individual versus an LLC—can disqualify or partially disqualify the exchange. When in doubt, consult your CPA and QI.

What if I want to form an LLC for the replacement property?

This is possible, but timing and structure matter. A single-member LLC that's disregarded for tax purposes may work, but a new multi-member LLC is a different taxpayer. Discuss this before closing with your tax advisor and QI.

How early should I contact a QI if I'm listing my property?

As early as possible—ideally when you decide to sell. This gives you time to address any title or entity issues before they become closing-day crises.

Next Step: Protect Your Proceeds Before You Close

"The most painful tax bills are the ones that were 100% preventable with a simple structural check."

If you're planning to sell investment property that you own and manage in Houston, Austin, San Antonio, or anywhere in Texas, the time to engage a qualified intermediary is now—not after closing, not when the buyer's funds are in transit.

Securitas 1031 specializes in helping individual property owners and business owners execute compliant exchanges with security-first fund handling and local coordination. Our team of attorneys and real estate professionals brings the depth of experience and legal expertise that high-stakes transactions demand.

Schedule a Free In-Person Consultation or call (713) 275-8112 to discuss your specific situation before you close.

For CPAs, attorneys, and tax professionals: Partner with a qualified intermediary you can trust. Our team understands complex ownership structures and can serve as an extension of your practice.

Texas brokers: Ask about our continuing education course on 1031 exchange fundamentals.

Disclaimer: This article is for informational purposes only and does not constitute legal or tax advice. 1031 exchange outcomes depend on specific facts, deadlines, and documentation. Consult your attorney and tax advisor regarding your situation.

About the Securitas1031 Insights Team

The Securitas1031 Insights Team provides educational resources for commercial real estate investors navigating tax-deferred exchanges. Our content is developed in collaboration with legal and tax professionals to ensure accuracy and practical relevance. All information is for educational purposes and should not replace professional advice.

Our Editorial Process

Our expert team uses AI tools to help organize and structure initial drafts. Every piece is then extensively rewritten, fact-checked, and enriched with first-hand insights and experience from our human Insights Team to ensure accuracy and clarity.

[^1]: IRS, "About Form 8824 (Like-Kind Exchanges)," https://www.irs.gov/forms-pubs/about-form-8824

[^2]: IRS, "Instructions for Form 8824," https://www.irs.gov/instructions/i8824

[^3]: IRS, "FAQ: Like-kind exchanges," https://www.irs.gov/faqs/sale-or-trade-of-business-depreciation-rentals/sales-trades-exchanges

[^4]: eCFR, "26 CFR § 1.1031(k)-1(g)(4) (Safe harbor for qualified intermediaries)," https://ecfr.io/Title-26/Section-1.1031(k)-1

[^5]: Federation of Exchange Accommodators, "About," https://1031buildsamerica.org/about/