Calculating Your Potential Capital Gains Tax Savings (Step-by-Step)

📌 Key Takeaways

Calculating your potential capital gains tax before listing determines whether you preserve or forfeit six figures in equity for your next acquisition.

Tax Math Changes Everything: A $1.2 million sale nets $577,366 after taxes versus $728,000 with proper 1031 deferral—$150,634 in preserved equity.

Depreciation Recapture Surprises Most Sellers: Unrecaptured Section 1250 Gain taxes prior depreciation at 25%, significantly higher than standard capital gains rates.

Texas Entity-Held Property Has Hidden Costs: While Texas has no personal income tax, LLCs may face Franchise Tax on sale proceeds unless qualifying as passive entities.

Constructive Receipt Kills Exchanges Instantly: Taxpayers who touch proceeds—even briefly—jeopardize full deferral; funds must flow directly through qualified intermediaries.

Estate Planning Multiplies Deferral Power: Deferred taxes transfer to replacement property basis, then heirs receive step-up at death, potentially eliminating liability entirely.

Security over speed: accurate estimates prevent panicked day-44 decisions.

Texas commercial property owners planning exits or generational wealth transfers will gain calculation clarity here, preparing them for the detailed step-by-step methodology that follows.

The number hits you mid-sentence.

Your broker is walking through the draft settlement statement, and there it is—"Estimated Federal Taxes." Six figures. Maybe more. The equity you spent years building, about to evaporate before you even start looking for your next property.

Most commercial property owners in Texas don't realize how much of their gain will disappear to taxes until they're staring at closing documents. By then, options narrow. Decisions get rushed. And rushed decisions in real estate tend to be expensive ones.

Here's the reality: knowing your potential tax liability before you list changes everything. It shapes your replacement property budget. It clarifies your financing conversations. It determines whether you can uptrade, hold steady, or need to adjust expectations entirely.

Think of your equity like carrying a bucket of water across a desert. Without a lid—without a proper 1031 exchange structure—the sun evaporates a significant portion before you reach the next oasis. The math in this guide helps you see exactly how much water you're protecting.

A 1031 exchange isn't paperwork. It's wealth-preservation architecture. And the fastest way to make a bad decision is to guess at the tax bill.

This guide gives you a clear method to estimate your capital gains exposure on a commercial property sale—and see how much equity a properly structured exchange could preserve for your next acquisition. The steps are intentionally straightforward—your CPA will refine the final numbers, but you need an estimate now to plan the deal. For a faster calculation, the 1031 Exchange Calculator on our site can run these numbers in minutes.

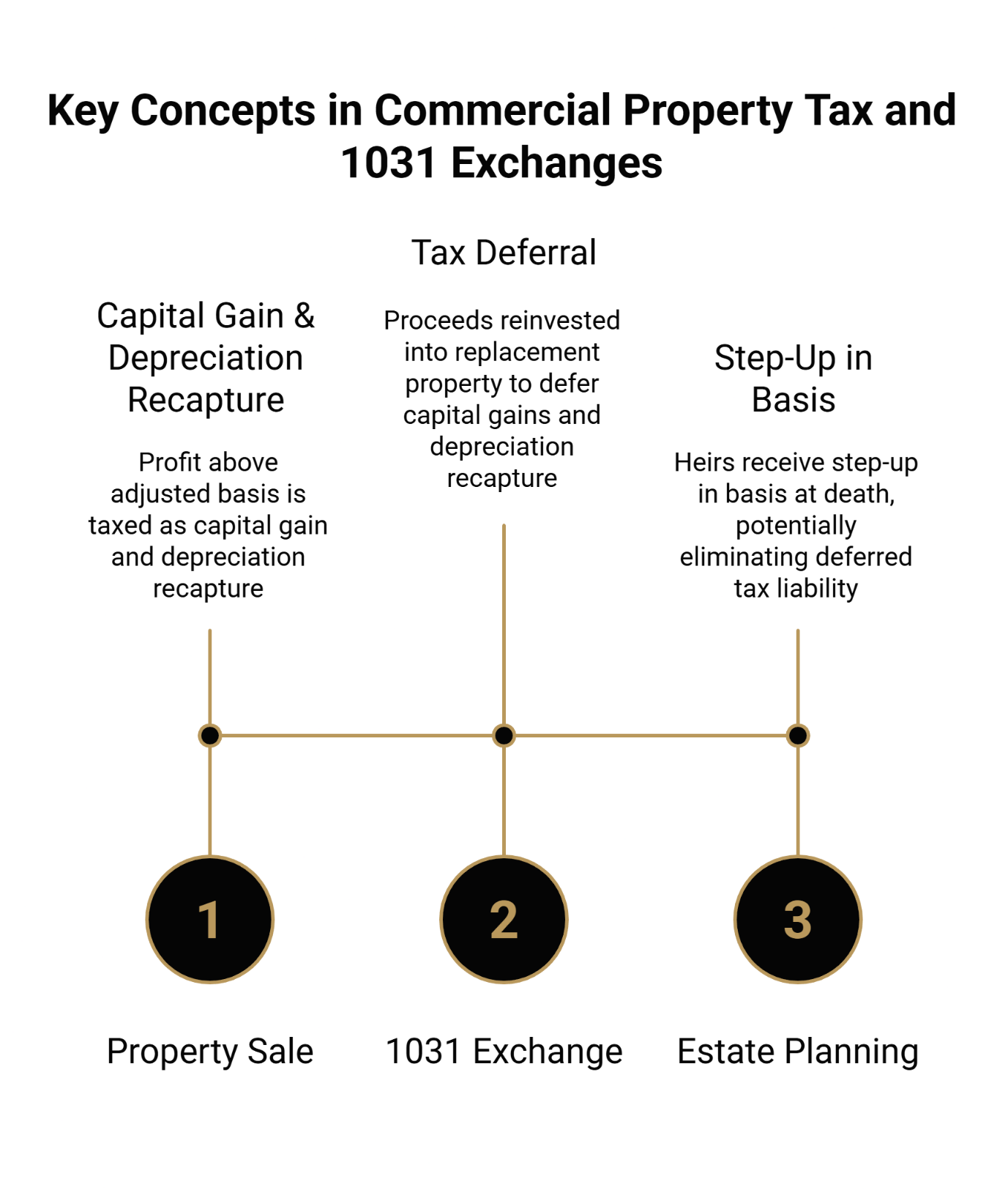

Quick Definitions: Understanding the Tax Components

Before running any numbers, three concepts need to be clear.

Capital Gain vs. Depreciation Recapture

When you sell a commercial property for more than your adjusted basis, the IRS treats that profit in two parts.

Capital gain is the portion of your profit above what you originally paid (adjusted for improvements and depreciation). For properties held longer than a year, this qualifies for long-term capital gains treatment.

Depreciation recapture works differently. Over the years you owned the property, you likely claimed depreciation deductions that reduced your taxable income. The IRS effectively wants that back. For most real property, this is taxed as Unrecaptured Section 1250 Gain, which is capped at a maximum rate of 25%—significantly higher than the standard 15% or 20% long-term capital gains rates.[^1]

Most sellers focus only on the capital gain. The recapture portion often surprises them.

What a 1031 Exchange Changes

A 1031 exchange allows exchangers to defer—not eliminate—both capital gains and depreciation recapture taxes by reinvesting proceeds into qualifying replacement property.[^2] The key word is defer. The tax liability doesn't disappear; it transfers to the new property's basis. But deferral means that equity stays working for you now, compounding in your next investment rather than going to the IRS this year.

For Texas property owners, this matters especially. While Texas has no personal state income tax, commercial property held in legal entities (such as LLCs) may be subject to the Texas Franchise Tax upon sale, unless the entity qualifies as a passive entity.[^3] Even without personal state income tax, federal liability alone can consume 20-30% of your gain or more.

Why Deferral Matters for Estate Planning and Wealth Transfer

Tax deferral through a 1031 exchange isn't just about preserving capital for your next deal—it's about building transferable wealth for your heirs.

When you defer taxes and reinvest into larger or more productive assets, you're compounding equity that can pass to the next generation. At death, your heirs receive a step-up in basis, potentially eliminating the deferred tax liability entirely. This makes the 1031 exchange one of the most powerful estate planning tools available to property owners.

For families holding commercial real estate across generations, this strategy transforms what could have been a tax event into a wealth-building mechanism. It also provides an exit strategy for owners who want to free themselves from burdensome joint ownerships or transition out of active management—without triggering immediate tax consequences that would erode the estate.

The calculation work below helps you quantify not just the immediate tax savings, but the equity you're preserving for long-term wealth accumulation and legacy planning.

Before You Start: The 6 Numbers You Need

Gather these before running any calculations. Most come from your closing statement, depreciation schedules, or a quick conversation with your CPA.

Estimated sale price — What you expect to receive (or have contracted)

Selling costs — Broker commissions, transfer taxes, legal fees, title insurance

Debt payoff — Remaining mortgage balance at closing

Original purchase price plus capital improvements — What you paid, plus any significant improvements capitalized (not expensed)

Accumulated depreciation — Total depreciation claimed over your ownership period (from tax returns or depreciation schedule)

Your applicable tax rates — Federal long-term capital gains rate, depreciation recapture rate, and whether NIIT applies (confirm with your CPA)

A note on rates: Tax rates depend on your income level, filing status, and other factors. The figures used in examples below are illustrative. Your CPA should confirm the rates that apply to your specific situation.

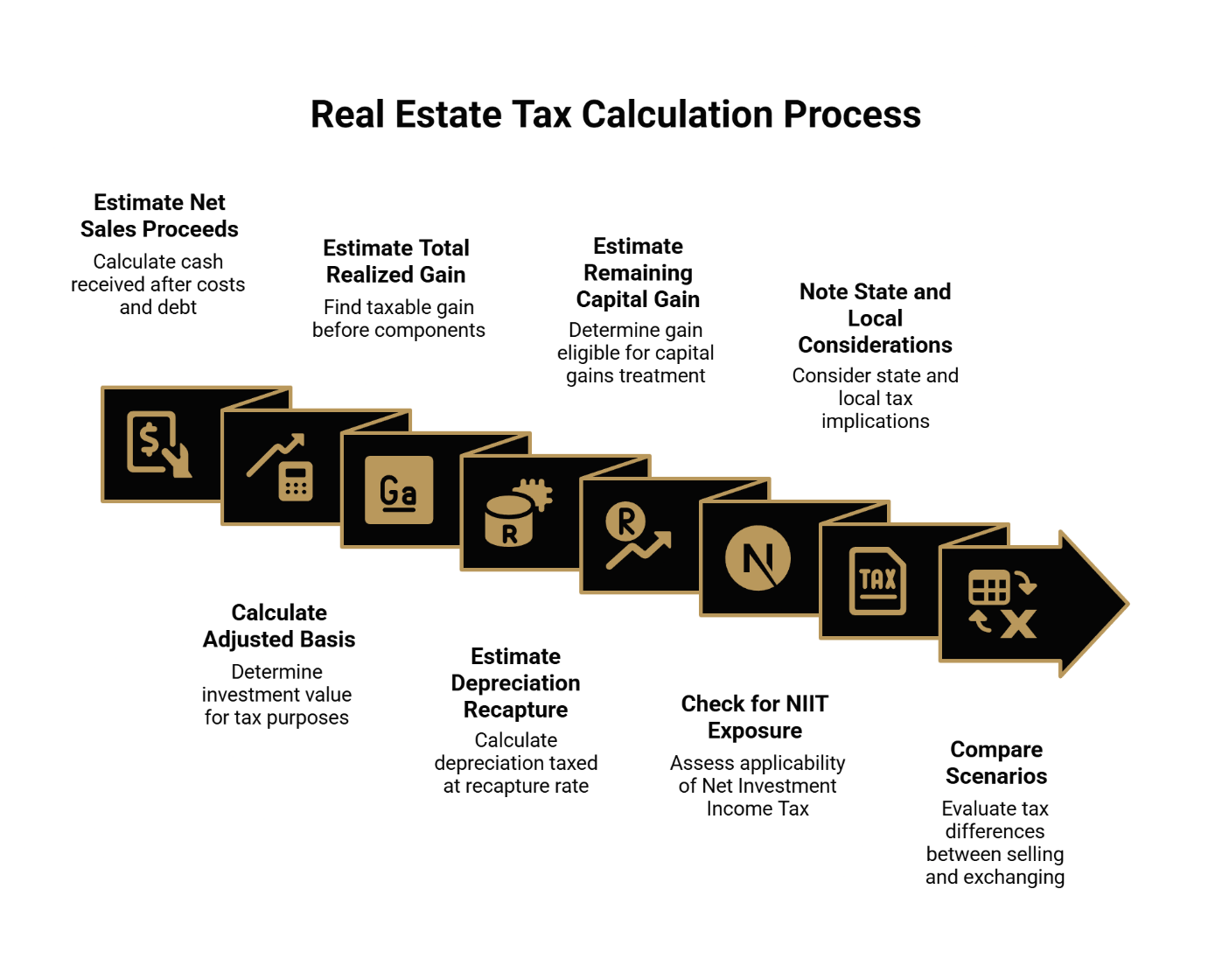

Step-by-Step: Estimate Your Taxable Gain and Potential Tax Bill

Step 1: Estimate Net Sales Proceeds

Start with your expected sale price. Subtract selling costs (commissions, closing costs, transfer fees). Then subtract any debt payoff.

Net Sales Proceeds = Sale Price − Selling Costs − Debt Payoff

This tells you how much cash you'd actually walk away with—before taxes.

Where to find it: Your broker's estimated net sheet or preliminary settlement statement.

Step 2: Calculate Your Adjusted Basis

Your adjusted basis reflects your original investment, modified by improvements and depreciation.

Adjusted Basis = Original Purchase Price + Capital Improvements − Accumulated Depreciation

This number represents what the IRS considers your "investment" in the property for tax purposes.

Where to find it: Closing statement from your purchase, records of capital improvements, and depreciation schedules from your tax returns.

Step 3: Estimate Your Total Realized Gain

Total Realized Gain = Sale Price − Selling Costs − Adjusted Basis

This is the exchanger's taxable gain before splitting it into its components.

Step 4: Estimate the Depreciation Recapture Portion

The recapture portion equals your accumulated depreciation (up to the amount of your total gain). This gets taxed at the recapture rate.

Depreciation Recapture = Accumulated Depreciation (limited to total gain)

Example: If you claimed $150,000 in depreciation and your total gain is $200,000, the recapture portion is $150,000.

Step 5: Estimate the Remaining Capital Gain Portion

Capital Gain Portion = Total Realized Gain − Depreciation Recapture

This remainder qualifies for long-term capital gains treatment if the taxpayer held the property more than one year.

Step 6: Check for NIIT Exposure

The Net Investment Income Tax adds 3.8% to investment income for taxpayers above certain income thresholds.[^4] If your modified adjusted gross income exceeds those thresholds, factor NIIT into your estimate.

Where to find it: Discuss with your CPA based on your projected annual income.

Step 7: Note State and Local Considerations

While Texas has no personal state income tax, commercial property held in legal entities (such as LLCs) may be subject to the Texas Franchise Tax upon sale, unless the entity qualifies as a passive entity.[^3] This is a meaningful advantage for individual Texas property owners—but federal taxes still apply in full.

If you own property in other states or are considering replacement property elsewhere, state tax implications may differ.

Calculation Flow Summary

Here's how the steps connect to produce your final tax estimate:

Step 1 → Calculate cash you'll receive (Sale Price − Costs − Debt = Net Proceeds)

Step 2 → Determine your tax basis (Purchase + Improvements − Depreciation = Adjusted Basis)

Step 3 → Find your taxable gain (Sale Price − Costs − Adjusted Basis = Realized Gain)

Step 4 → Isolate depreciation recapture (Limited to total gain)

Step 5 → Calculate capital gain portion (Realized Gain − Recapture = Capital Gain)

Step 6 → Add NIIT if applicable (Based on income thresholds)

Step 7 → Apply state considerations (Texas: no personal state income tax, but entity-level franchise tax may apply; federal remains)

This sequence ensures you account for every component that affects your final tax liability.

Step 8: Compare Your Two Scenarios

Now calculate the difference:

Scenario A: Estimated taxes if you sell outright (capital gains tax + depreciation recapture tax + NIIT if applicable)

Scenario B: Estimated taxes deferred with a full 1031 exchange (assuming the exchanger reinvests all proceeds into qualifying replacement property with no boot)

The gap between A and B represents equity that stays in your pocket—available for the next down payment, available to uptrade into a larger asset, available to improve your debt service coverage on the replacement property.

Worked Example: Houston Industrial Property

After overseeing more than 18,000 closings and $3 billion in real estate transactions, the team at Securitas 1031 has seen how small calculation errors early in the process create costly surprises at closing. This simplified scenario demonstrates the method Texas property owners use to estimate their exposure before listing.

Property: Small industrial warehouse

Held: 12 years

Sale Price: $1,200,000

Selling Costs: $72,000 (6%)

Remaining Mortgage: $400,000

Original Purchase Price: $650,000

Capital Improvements: $75,000

Accumulated Depreciation: $190,000

Calculation:

Adjusted Basis: $650,000 + $75,000 − $190,000 = $535,000

Total Realized Gain: $1,200,000 − $72,000 − $535,000 = $593,000

Depreciation Recapture Portion: $190,000

Capital Gain Portion: $593,000 − $190,000 = $403,000

Estimated Taxes (Illustrative Rates):

Unrecaptured Section 1250 Gain (max 25%): $190,000 × 0.25 = $47,500

Long-term capital gains at 20%: $403,000 × 0.20 = $80,600

NIIT at 3.8% (if applicable): $593,000 × 0.038 = $22,534

Total Estimated Federal Tax (Outright Sale): Approximately $150,634

With a Full 1031 Exchange: Taxes deferred. That $150,634 stays invested in your next property.

On a $1.2 million sale, that is the difference between walking away with roughly $577,366 (your net proceeds minus the tax bill) versus keeping the full $728,000 working for you in the replacement property—compounding for the next generation if this is part of a long-term estate plan.

"The numbers don't lie. A proper estimate before listing isn't optional—it's the foundation of every smart exchange decision."

Tax Savings Worksheet

Want to run these numbers for your own property? Use this planning worksheet before your listing meeting or LOI negotiation. Fill in your numbers, then validate the results with your CPA and qualified intermediary.

A) Sale and Payoff

Sale price: $__________

Selling costs: $__________

Debt payoff: $__________

Net sales proceeds (sale − costs − payoff): $__________

B) Basis

Original purchase price: $__________

Capital improvements: $__________

Accumulated depreciation: $__________

Adjusted basis ((purchase + improvements) − depreciation): $__________

C) Gain Estimate

Realized gain ((sale − costs) − adjusted basis): $__________

Depreciation recapture (min(depreciation, gain)): $__________

Remaining capital gain (gain − recapture): $__________

NIIT check (possible): Yes / No / Ask CPA

Use this worksheet to pressure-test your numbers, then refine your estimate with the 1031 Exchange Calculator or schedule a consultation with the team at Securitas 1031.

Use the Calculator—And What to Do With the Result

The 1031 Exchange Calculator on our site lets you input your property details and see estimated tax savings in minutes.

How to use it:

Enter your property type, state, estimated sale price, original purchase price, cost of improvements, and depreciation taken. The calculator returns your estimated capital gain and potential tax deferred.

What to do with the result:

Set your replacement property budget. Knowing your preserved equity clarifies how much you can put toward the next acquisition.

Refine your financing conversations. Lenders want to see your equity position. A clear estimate strengthens your loan application.

Evaluate uptrade opportunities. Can you move from a $1.2 million property to a $1.8 million property? The deferred tax may make the difference.

Consider estate planning implications. If this exchange is part of a long-term wealth transfer strategy, the preserved equity compounds over time and may pass to heirs with favorable tax treatment.

Brief your CPA early. Share the estimate so they can validate assumptions and flag any complications before you're under contract.

The calculator provides estimates. Final tax outcomes depend on your complete financial picture—which is why the next step is a conversation with a qualified intermediary and your tax advisor.

Common Mistakes That Blow Up Your Estimate—And Sometimes Your Exchange

Over three decades of commercial real estate law and tax practice, Charles H. Mansour has guided clients through thousands of exchanges—and seen how preventable errors turn viable deals into tax nightmares. These six mistakes appear repeatedly, and each one is avoidable with proper planning.

Mistake 1: Confusing Cash Proceeds With Taxable Gain

Your net proceeds (cash in hand after costs and debt) are not the same as your taxable gain. Gain is calculated against adjusted basis, not against what you owe. Many sellers underestimate their tax exposure because they're looking at the wrong number.

Mistake 2: Forgetting Depreciation Recapture

Depreciation deductions felt good when you took them. The recapture portion of your gain—taxed at higher rates—often catches sellers off guard. Always factor it in.

Mistake 3: Basis Errors After Years of Improvements

If you've owned the property for a decade or more, tracking capital improvements matters. Improvements increase your basis and reduce your gain. Missing documentation can mean paying more tax than necessary—or, worse, creating audit risk.

Mistake 4: Taking "Boot" Without Realizing the Tax Impact

Boot is any non-like-kind property the exchanger receives in the transaction—including cash. If you pull $50,000 out of the deal for personal use, that $50,000 becomes immediately taxable. Even a small amount of boot can trigger unexpected liability.

Mistake 5: Constructive Receipt (Touching the Funds)

This is the one that turns intended exchanges into fully taxable sales. If the taxpayer has access to the proceeds—even briefly—the IRS can treat the entire transaction as a sale.[^5] A qualified intermediary exists specifically to prevent this. The funds must go directly to the QI at closing, not through your hands.

"Constructive receipt isn't a technicality. It's a deal-breaker. One misstep, and the deferral disappears."

The correct flow: buyer's funds go to the qualified intermediary, who holds them in a segregated account, then releases them to acquire the replacement property on the exchanger's behalf. The incorrect flow—buyer to seller to intermediary, or any variation where the seller can access funds—creates constructive receipt and destroys the exchange.

Mistake 6: Waiting Too Long to Engage a Qualified Intermediary

The exchange documents must be in place before closing. Engaging a QI on closing day—or after—is too late. The safest approach: bring in your intermediary as soon as you're serious about selling, ideally before you sign a purchase agreement.[^6]

Selecting a qualified intermediary is not administrative work—it's a security decision. The team at Securitas 1031 was built around this principle. Named for the Roman goddess of security and stability, Securitas 1031 brings attorneys, tax professionals, and real estate specialists to every exchange. With more than 30 years of combined experience and $3 billion in closed transactions, the firm's approach prioritizes compliance, structure, and the kind of careful execution that protects client equity from unnecessary risk.

When you're moving six or seven figures through a 180-day timeline, security matters as much as speed.

Frequently Asked Questions

What is the difference between capital gains tax and depreciation recapture?

Capital gains tax applies to the profit above your adjusted basis. Depreciation recapture specifically targets the depreciation deductions you claimed over the years, taxing that portion at a different (often higher) rate.

Does a 1031 exchange eliminate my taxes or defer them?

Defer, not eliminate. The tax liability transfers to your replacement property's basis. You'll eventually owe taxes when you sell without exchanging—but deferral lets your full equity compound in the meantime. For estate planning purposes, heirs may receive a step-up in basis at your death, potentially eliminating the deferred tax entirely.

How do I find my adjusted basis if I've owned the property for years?

Start with your original purchase price. Add documented capital improvements. Subtract accumulated depreciation from your tax returns. Your CPA or the depreciation schedule attached to prior returns should have these figures.

Do selling costs reduce my taxable gain?

Yes. Legitimate selling costs—commissions, transfer taxes, legal fees—reduce your amount realized, which lowers your taxable gain.

Does Texas charge state capital gains tax on real estate?

While Texas has no personal state income tax, commercial property held in legal entities (such as LLCs) may be subject to the Texas Franchise Tax upon sale, unless the entity qualifies as a passive entity. However, federal capital gains tax, depreciation recapture, and NIIT (if applicable) still apply.

When do the 45-day and 180-day clocks start?

Both clocks start on the day the exchanger closes on the sale of the relinquished property. You have 45 days to identify potential replacement properties and 180 days total to close on one or more of them.

What happens if I take cash out of the deal (boot)?

Any boot received—cash, debt relief not replaced, or non-like-kind property—is taxable in the year of the exchange, even if the rest of the transaction qualifies for deferral.

Your Next Step

A rough estimate is better than a guess. But an estimate confirmed by qualified professionals—attorneys and tax advisors who understand both the technical requirements and the real-world pressures of getting deals done—is better still.

The calculation method above gives you a starting point. The 1031 Exchange Calculator gives you speed. A conversation with Securitas 1031 gives you certainty—and a secure structure that protects your equity through closing and beyond.

Our team has helped Texas commercial property owners structure exchanges that preserve wealth, avoid preventable errors, and support long-term estate planning goals. Whether you're preparing to sell a single property or planning a multi-generational wealth transfer strategy, we bring the legal, tax, and real estate expertise needed to execute exchanges with precision.

Ready to Start?

Call 713-275-8112 or schedule a free consultation.

Office: 440 Louisiana St, Suite 1100, Houston, TX 77002

For more on building long-term wealth through strategic exchanges, explore our guide: Build Wealth with 1031s. And if you're a real estate professional looking to deepen your expertise, check out our Continuing Education offerings.

This article is for informational purposes only and does not constitute legal or tax advice. Please consult your attorney or tax advisor for guidance specific to your situation.

About the Securitas1031 Insights Team

The Securitas1031 Insights Team provides educational resources for commercial real estate investors navigating tax-deferred exchanges. Our content is developed in collaboration with legal and tax professionals to ensure accuracy and practical relevance. All information is for educational purposes and should not replace professional advice.

Our Editorial Process

Our expert team uses AI tools to help organize and structure initial drafts. Every piece is then extensively rewritten, fact-checked, and enriched with first-hand insights and experience from our human Insights Team to ensure accuracy and clarity.

[^1]: IRS: Unrecaptured Section 1250 Gain

[^2]: IRS: Like-kind exchanges — Real estate tax tips

[^3]: Texas Comptroller: Franchise Tax

[^4]: IRS: Topic No. 559 — Net Investment Income Tax

[^5]: IRS: Instructions for Form 8824

[^6]: IRS: Publication 544 — Sales and Other Dispositions of Assets