Why the 'DIY' Approach to 1031 Exchanges Puts Your Equity at Risk

📌 Key Takeaways

Self-managing a 1031 exchange risks disqualification if proceeds touch an account the property owner controls, even temporarily.

Constructive Receipt Ends Deferrals: Accessing or controlling sale proceeds—even briefly—may trigger immediate taxation under IRS constructive receipt rules.

Deadlines Are Statutory, Not Flexible: The 45-day identification and 180-day closing windows don't extend for weekends, holidays, or documentation delays.

QI Safe Harbor Prevents Fund-Flow Errors: A Qualified Intermediary holds proceeds directly, creating the legal structure that keeps exchangers outside constructive receipt risk.

Self-Management Offers No Error Margin: One missed deadline, vague identification letter, or wiring mistake can convert a tax-deferred exchange into a fully taxable sale.

Early Engagement Prevents Last-Minute Failures: Structuring the exchange at the letter-of-intent or escrow stage—not at closing—provides time to coordinate documentation and align all parties.

The fee protects the deferral; the mistake costs the equity.

Texas commercial property owners weighing whether to hire professional guidance will find risk-concentration analysis and compliance workflows below, preparing them for the detailed security evaluation that follows.

If you're selling a commercial property in Texas, it's natural to look for ways to reduce friction and keep more of your proceeds working for you. The closing documents are ready. Your buyer is eager. And somewhere in the back of your mind, a question lingers: Do I really need to pay someone to handle this exchange?

Property owners cannot safely "do a 1031 exchange yourself" because the process requires keeping you out of the exchange funds flow to avoid constructive receipt risk and meeting strict documentation and deadline requirements. The margin for error is narrow, and the consequences aren't incremental—they're binary.

Understanding this distinction matters because a 1031 exchange isn't a form-filling exercise. It's a legal and tax compliance structure designed to protect your proceeds from a tax bill that could consume up to 40% of your gain. When property owners attempt to manage this process themselves, they typically underestimate three things: the specificity of IRS requirements, the importance of proper fund handling, and the consequences of technical errors.

Think of your equity like water in a bucket you're carrying across a Texas summer desert. The bucket is your exchange structure. Without proper safeguards in place before you sell, that water evaporates—not gradually, but all at once, the moment you make a single misstep with how the funds are handled.

This article walks through the specific ways self-managed exchanges fail, explains the rule that trips up most attempts, and outlines what actually keeps your deferral intact. If you're weighing whether to handle this yourself, you deserve to understand exactly what's at stake.

For a foundational overview of how the process works, start with 1031 exchange basics and how the process works.

The DIY Temptation: Save a Fee, Risk Losing the Whole Deferral

The appeal is obvious. Qualified Intermediary fees feel like an expense you could avoid. You're already coordinating with your broker, your CPA, your closing agent. Adding another party seems like unnecessary overhead.

But this calculation has a blind spot. The fee you're trying to save is a fraction of the tax liability you're trying to defer. For a commercial property sale with substantial appreciation, capital gains taxes—combined with depreciation recapture and applicable state taxes—can represent a significant portion of your proceeds.

The math isn't "fee versus no fee." It's "fee versus potentially losing the entire deferral."

The failure modes aren't dramatic. They're quiet. A wire that hits the wrong account. A document filed three days late. An identification letter that doesn't quite meet the requirements. Each one capable of converting your tax-deferred exchange into a fully taxable sale.

The Rule Most Self-Managed Exchanges Break: You Can't Touch the Money

Here's the compliance principle that derails most self-managed exchanges: if the taxpayer receives, controls, or has the ability to direct the sale proceeds, the IRS may determine "constructive receipt"—and constructive receipt can disqualify your exchange.[^1]

Constructive receipt, in plain English:

If the sale proceeds hit your account, or you can control or access the money—even briefly—the IRS may treat you as having "received" the funds. That can jeopardize tax deferral.

This isn't about intent. It's about structure. The IRS doesn't ask whether you meant to access the funds. The question is whether you could have. If the answer is yes—even theoretically—the deferral may be at risk.

What does this mean for property owners?

The exchange structure must be in place before your sale closes. Not the day of closing. Not the week after. Before the proceeds exist, the mechanism for keeping them out of your hands needs to be documented and operational.

This is why a Qualified Intermediary exists. Under Treasury regulations, a QI provides a "safe harbor"—a structured workflow specifically designed to keep the taxpayer out of the funds flow while still facilitating the exchange.[^2] The QI holds the proceeds. The QI disburses them to acquire replacement property. You never touch the money, so constructive receipt doesn't apply.

Attempting this without a QI isn't impossible in theory. But it requires navigating the same compliance requirements without the safe harbor protection. One procedural error, and you're outside the rules.

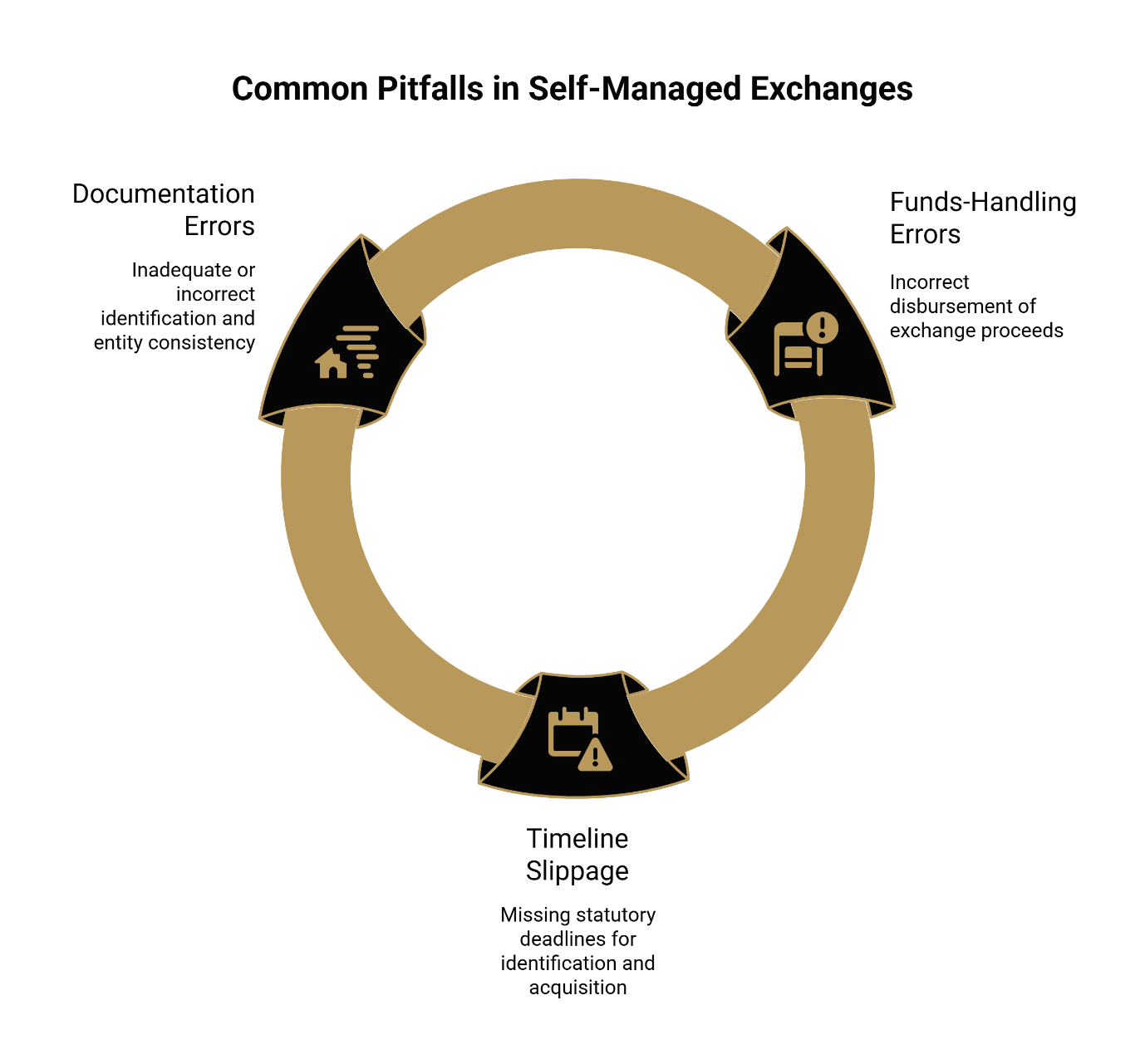

Three Ways Self-Managed Exchanges Fail in Real Deals

The failures aren't exotic. They're predictable. Here are the three patterns that appear repeatedly when property owners attempt to handle exchanges without professional guidance:

1. Funds-handling and escrow errors

What goes wrong: Proceeds get wired to an account the exchanger controls—even temporarily. Or the closing agent, unfamiliar with exchange requirements, disburses funds according to standard procedures rather than exchange protocols.

For example, a Houston-area property owner sells a small retail property and instructs escrow to wire proceeds to an entity operating account "temporarily." That moment of control can jeopardize deferral—even if the funds are later sent to an accommodator.

What it costs you: Potential constructive receipt. The moment those funds touch an account you can access, the structure may be compromised.

How to prevent it: The exchange must be set up with the closing agent before closing. Assignment documents need to be in place. The QI—not the property owner—should be the party receiving the proceeds directly from escrow.

2. Timeline slippage

What goes wrong: The 45-day identification period passes without proper written identification of replacement properties. Or the 180-day exchange period expires before acquisition closes.

What it costs you: A failed exchange. These deadlines are statutory. They don't extend for holidays, weekends, or good intentions.[^3]

How to prevent it: Map your calendar immediately. Day 0 is the day your relinquished property closes. Day 45 is your identification deadline. Day 180 (or your tax return due date, including extensions, if earlier) is your acquisition deadline. Build in margin. Assume delays will happen.

3. Documentation and identification errors

What goes wrong: The identification letter doesn't meet the specificity requirements. The property description is too vague. The letter isn't delivered to the right party by the deadline. Or there's a mismatch between the entity on the relinquished property title and the entity making the exchange.

What it costs you: A technical failure that invalidates the exchange—even if you had every intention of complying.

How to prevent it: Identification requirements are precise. Properties must be "unambiguously described."[^1] For real estate, this typically means a legal description or street address. The identification must be in writing, signed, and delivered to the QI or another qualified party before midnight on Day 45. Entity consistency matters throughout the transaction.

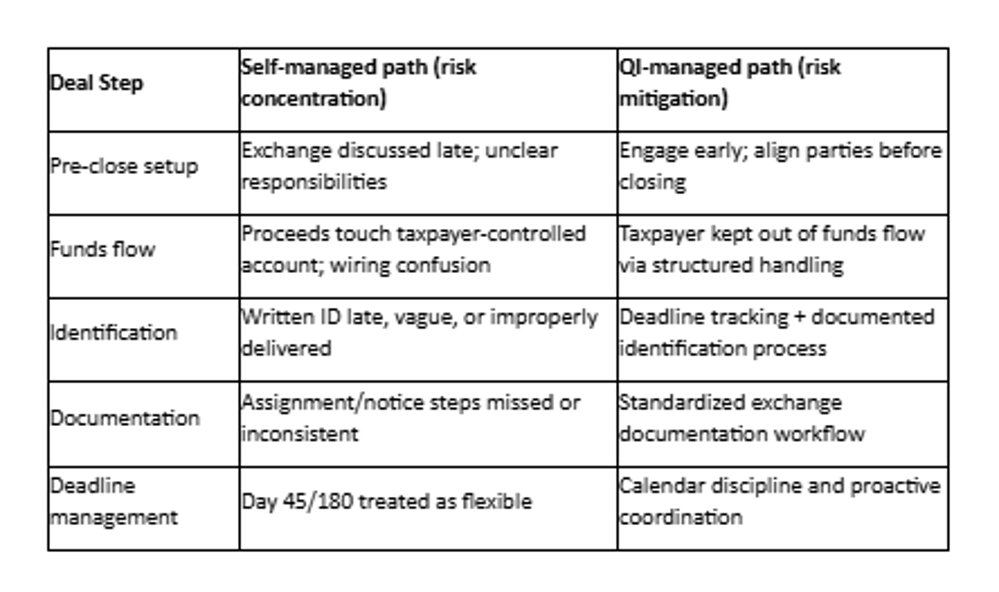

Self-Managed vs QI-Managed: Where the Risk Concentrates

Here's where the failure rate tends to spike in self-managed or cut-corner approaches compared to professionally managed exchanges:

A Qualified Intermediary isn't a magic shield. The point is that the QI-managed workflow is designed around the known failure points—especially keeping the exchanger out of the funds flow.

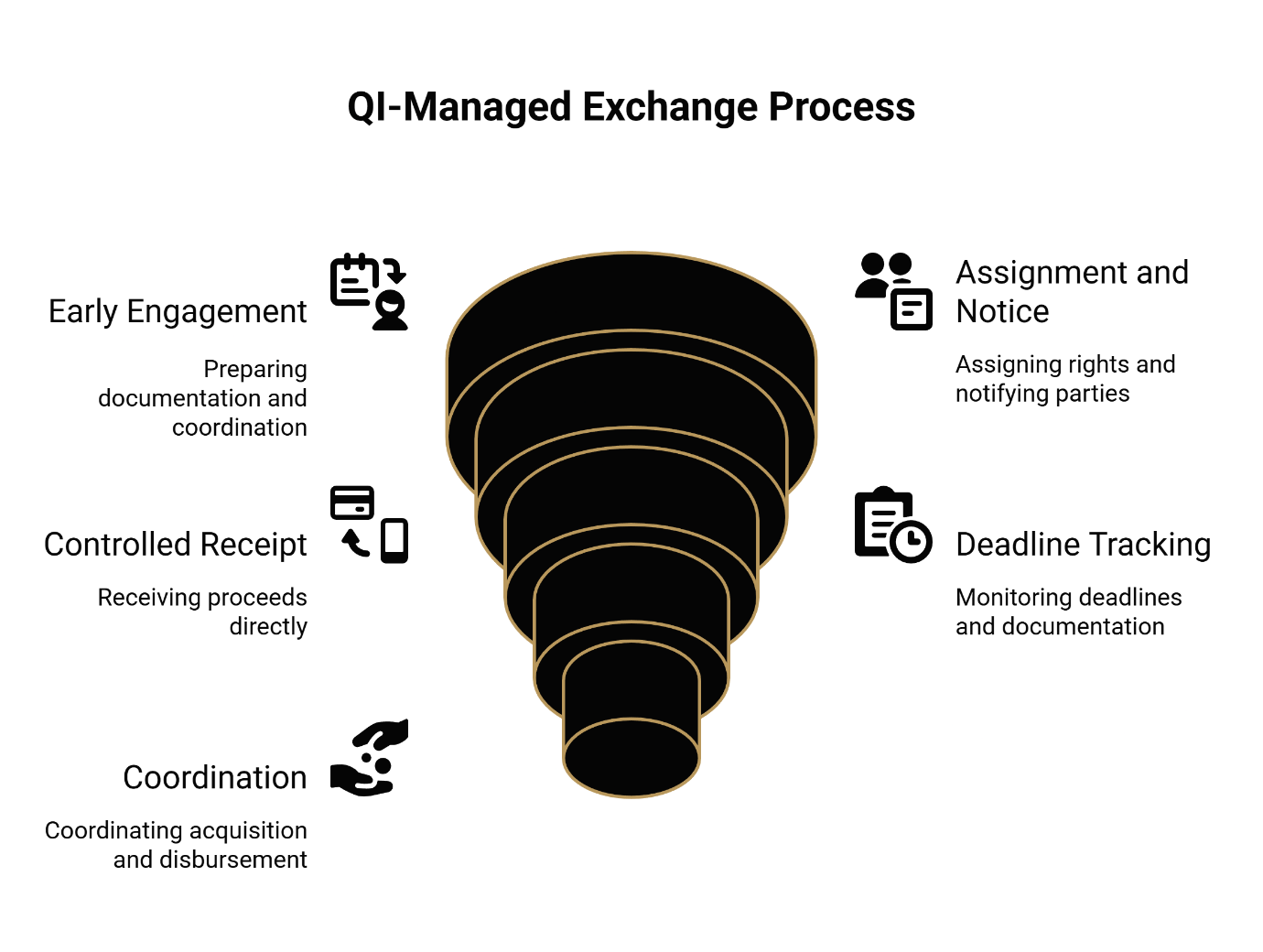

What a Qualified Intermediary Does That Self-Management Can't Replicate

A Qualified Intermediary provides an integrated compliance workflow designed to protect exchangers throughout the process. Think of the QI as the structural safeguard that keeps your equity intact while you focus on finding the right replacement property.

At Securitas 1031, our approach reflects more than three decades of combined experience in real estate law, tax compliance, and commercial transactions. Founder Charles H. Mansour has overseen more than 18,000 closings and $3 billion in transactions, bringing attorney-level precision to every exchange. This depth of experience matters when technical compliance determines whether your deferral succeeds or fails.

Here's what a QI-managed process provides:

Early engagement. The process typically begins at the letter of intent or escrow stage—not at closing. This allows time to prepare documentation, coordinate with closing agents, and ensure everyone understands the exchange requirements.

Assignment and notice preparation. The QI prepares the documents that assign the exchanger's rights in the sale to the intermediary and notifies relevant parties. This paperwork creates the legal structure that keeps you out of the funds flow.

Controlled receipt of proceeds. At closing, the proceeds go directly to the QI—never to the property owner. This is the structural protection against constructive receipt.

Deadline tracking and documentation. The QI maintains the calendar and the paper trail. When Day 45 approaches, you know. When identification letters need to be delivered, the process is clear.

Coordination with closing parties. For the acquisition, the QI coordinates the disbursement of funds to complete your exchange. The goal is reducing friction between the parties while maintaining compliance.

The Federation of Exchange Accommodators provides additional background on the QI role for property owners researching this structure.[^4]

If You're Evaluating Intermediaries, Ask These Security Questions

Securitas takes its name from the Roman goddess of security and stability—and that's not coincidental. When you're entrusting someone with your exchange proceeds for potentially six months, the security of those funds should be your primary concern.

Not all intermediaries operate identically. Due diligence matters.

Key areas to explore: How are exchange funds held and protected? What bonding or insurance is in place? Are funds segregated or commingled? What internal controls govern access to client funds? How responsive is the team when questions arise?

The right QI should welcome these questions. Transparency about fund security isn't a burden—it's a baseline expectation.

For Texas-based property owners, working with a QI who understands local market dynamics and maintains accountability within the state can provide an additional layer of confidence. The Securitas 1031 team includes attorneys and real estate professionals based in Houston with direct experience in commercial exchange transactions.

A Practical "Before You Close" Checklist

If you're approaching a sale and considering a 1031 exchange, here's what needs to happen before closing day:

Talk to a QI early. Don't wait until the week of closing. The escrow or letter-of-intent stage is often the right time. This provides runway to prepare documents and coordinate with other parties.

Map your deadlines immediately. Know your Day 0, Day 45, and Day 180 the moment your sale is scheduled. Work backward from these dates when planning your replacement property search.

Align responsibilities in writing. Your broker, CPA, closing agent, and QI each have a role. Make sure everyone understands who is responsible for what—and document it. Assumptions create gaps. Gaps create failures.

Confirm entity consistency. The taxpayer on the relinquished property should match the taxpayer acquiring the replacement property. If you're using LLCs or partnerships, verify the structure with your tax advisor before closing.

Confirm the funds-flow plan with escrow/title before wiring instructions go out. Ensure everyone understands that proceeds go directly to the QI, not to the property owner.

Consider your long-term strategy. If you're planning for estate preservation or eventual transfer to heirs, discuss this with your tax advisor now. Properly structured exchanges can be part of a broader wealth-building and legacy-planning strategy, allowing you to defer taxes while upgrading properties that better serve your family's long-term goals.

Frequently Asked Questions

Can I do a 1031 exchange without a Qualified Intermediary?

In limited circumstances, yes—but not by handling the funds yourself. Direct exchanges between two parties swapping properties simultaneously don't require a QI. However, the vast majority of exchanges are "delayed" exchanges where the sale and purchase occur at different times. For these, attempting to proceed without a QI means operating outside the safe harbor provisions, which significantly increases the risk of constructive receipt issues.[^2]

Can my attorney or CPA hold the funds instead?

Property owners should be cautious about arrangements that put exchange proceeds in the hands of someone considered their agent or that still give them control or access. Treasury regulations disqualify certain "related parties" from serving as intermediaries, and this typically includes your attorney or accountant if they've provided services to you within a specified period.[^2] Even if they technically could serve, they wouldn't have the specialized systems, documentation, and processes that a professional QI maintains. The correct structure depends on facts, timing, and roles—coordinate with your CPA, attorney, and exchange professional.

What if I already closed and received the proceeds?

If the funds have already been disbursed to you, structuring a valid exchange becomes extremely difficult—and in most cases, isn't possible. This is why timing matters so critically. The exchange structure must be in place before the sale closes, not after. If proceeds have already been received or the exchanger had control over them, the deferral may be jeopardized. Do not assume it's unrecoverable, but treat it as time-sensitive: talk to your CPA, attorney, and a qualified intermediary immediately to evaluate options based on your exact timeline and documentation.

How early should I contact a QI?

As soon as you're seriously considering selling a property and want to explore deferral options. Many property owners reach out at the letter of intent stage or when entering escrow. Earlier engagement provides more flexibility and reduces the risk of last-minute complications.

The Real Question Isn't Whether You Can—It's Whether You Should

Property owners can attempt to navigate the identification rules, the deadline requirements, the documentation standards, and the funds-handling protocols on their own. Some have done it.

But the margin for error is razor-thin. And the cost of a mistake isn't a fee you could have avoided—it's the entire deferral you were trying to protect.

For property owners managing commercial real estate transactions, the calculation is straightforward: professional guidance costs a fraction of what's at stake. The security of knowing the structure is right, the deadlines are tracked, and the proceeds are protected? That's not overhead. That's preservation.

Ready to discuss your specific situation? Schedule an in-person consultation in Houston or call 713-275-8112 to connect with the Securitas 1031 team.

For brokers and real estate professionals looking to deepen their understanding of exchange mechanics, Securitas 1031 offers continuing education courses covering timing, rules, and key concepts—approved for TREC CE credit.

Risk Mitigation Infographic Specification

Format: Mobile-readable flowchart/two-path diagram suitable for blog embed and LinkedIn carousel

Required elements:

Two-column workflow comparison: Self-Managed Path vs Secure/QI-Managed Path

Four labeled self-managed failure points:

Funds touch your account

Late setup before closing

Improper or late identification

Deadline miss (Day 45 / Day 180)

Callout box defining constructive receipt in plain language

Texas-specific illustrative example: "A Houston-area property owner sells a small retail property and instructs escrow to wire proceeds to an entity operating account 'temporarily.' That moment of control can jeopardize deferral—even if the funds are later sent to an accommodator."

Disclaimer: This article is for informational purposes only and does not constitute tax or legal advice. 1031 exchange outcomes depend on your facts and timing. Consult your CPA, attorney, and/or a qualified intermediary before acting.

About the Securitas1031 Insights Team

The Securitas1031 Insights Team provides educational resources for commercial real estate investors navigating tax-deferred exchanges. Our content is developed in collaboration with legal and tax professionals to ensure accuracy and practical relevance. All information is for educational purposes and should not replace professional advice.

Our Editorial Process

Our expert team uses AI tools to help organize and structure initial drafts. Every piece is then extensively rewritten, fact-checked, and enriched with first-hand insights and experience from our human Insights Team to ensure accuracy and clarity.

References

[^1]: IRS Form 8824 (Like-Kind Exchanges)

[^2]: Treasury Regulation 26 CFR 1.1031(k)-1 (Qualified Intermediary Safe Harbor)

[^3]: Instructions for Form 8824

[^4]: Federation of Exchange Accommodators: About Qualified Intermediaries