What Happens if You Miss the 45-Day Deadline? (And How to Prevent It)

📌 Key Takeaways

Missing the 45-day identification deadline typically causes your 1031 exchange to fail, triggering immediate taxation of 30% to 40% or more of your gain.

Deadline Failure Means Full Taxation: When Day 45 passes without valid identification, the IRS treats your transaction as a taxable sale, not a tax-deferred exchange.

Engage Your QI Before Listing: Working with an experienced qualified intermediary before you list your relinquished property prevents most deadline failures through proper timeline structuring.

Use the Three-Property Rule for Protection: Identifying three properties regardless of value gives you meaningful backup options when deals collapse without complex calculation burdens.

Day 30 Is Your Reality Checkpoint: By Day 30, you should have three viable acquisition targets with preliminary due diligence started, not just wishful thinking about potential deals.

Weekend Extensions Exist but Are Risky: While IRS Revenue Ruling 83-116 allows next-business-day filing when deadlines fall on weekends, conservative Qualified Intermediaries treat deadlines as strict to eliminate dispute potential.

Prevention through early planning beats scrambling through last-minute triage every time.

Real estate investors planning or executing 1031 exchanges will gain actionable timeline management strategies here, preparing them for the detailed compliance guidance that follows.

The calendar alert pops up. Day 44. One property fell through last week. The backup deal is stalling. The 45-day identification deadline is tomorrow, and that sinking feeling in your stomach is all too familiar.

For real estate investors attempting a 1031 exchange, few moments carry more weight than this one. The identification deadline isn't a suggestion or a soft target—it's a hard stop that determines whether your exchange succeeds or fails.

Here's what you need to know: if you miss the 45-day identification deadline, your 1031 exchange typically fails, and the sale of your relinquished property becomes fully taxable. There are extremely limited exceptions involving federally declared disasters, but personal circumstances—no matter how compelling—generally won't extend your deadline. The good news? With proper planning and the right qualified intermediary, most deadline failures are preventable.

The 45-Day Rule Explained

Understanding the mechanics of this deadline is the first step toward protecting your exchange.

What "Identification" Actually Means

When the IRS says you must "identify" replacement property, they mean something very specific. You must provide a written document that includes an unambiguous description of each potential replacement property—typically the street address or legal description. This document must be signed by you and delivered to your qualified intermediary or another permitted party before midnight on the 45th day.

A handshake deal won't count. A verbal agreement with your agent won't work. Even a signed purchase contract sitting in your attorney's email isn't sufficient unless proper identification procedures are followed.

The Two Clocks Running Simultaneously

A 1031 exchange operates on two concurrent deadlines that begin the moment your relinquished property closes:

The 45-Day Identification Period: You have exactly 45 calendar days to identify potential replacement properties in writing. This deadline is strict—and while technical exceptions exist for weekends (discussed below), relying on them is risky.

The 180-Day Exchange Period: You must close on your replacement property within 180 calendar days of selling your relinquished property, or by your tax return due date (including extensions), whichever comes first.

These periods run concurrently, not consecutively. If you sell your property on January 15th, your identification deadline is March 1st, and your exchange deadline is July 14th. Miss the first deadline, and the second one becomes irrelevant.

The interaction between these deadlines matters more than many investors realize. The "earlier-of" rule means your exchange period can actually be shorter than 180 days if your tax return due date falls first. For properties sold late in the year, this creates real pressure. A December closing might leave you racing against an April tax deadline rather than enjoying the full six months. This is why coordinating with your CPA from the beginning isn't optional—it's essential to mapping your actual timeline.

Your Identification Rule Options

The IRS provides three distinct paths for identifying replacement properties, each with specific parameters:

The Three-Property Rule: You may identify up to three properties regardless of their combined value. This is the most commonly used rule because it's straightforward and gives you meaningful backup options without complex calculations.

The 200% Rule: You may identify any number of properties as long as their aggregate fair market value doesn't exceed 200% of your relinquished property's value. This works for investors casting a wider net or considering multiple smaller properties.

The 95% Rule: You may identify more than the 200% threshold allows, but you must actually acquire properties representing at least 95% of the total value you identified. This is high-risk in practice—if your acquisitions fall short of 95%, the entire exchange fails regardless of what you did acquire.

Most investors default to the three-property rule because it balances flexibility with simplicity. Identifying three properties—your primary target plus two solid backups—protects you when deals collapse without creating the tracking burden of the 200% rule or the acquisition pressure of the 95% rule.

What Happens When Day 45 Passes Without Proper Identification

The consequences of missing this deadline are significant and, in most cases, irreversible.

The Exchange Fails

When the 45-day deadline passes without a valid identification, the IRS treats the transaction as a straightforward sale rather than a tax-deferred exchange. This triggers immediate tax consequences on any gain from the sale of your relinquished property, including:

Federal capital gains tax (typically 15% or 20% depending on income)

Depreciation recapture tax (up to 25%)

Net Investment Income Tax (3.8% for higher earners)

Applicable state income taxes

For a property with substantial appreciation, this can translate to owing 30% to 40% or more of your gain in taxes—money that would have otherwise remained invested in your next property.

Common Myths That Won't Save Your Exchange

Investors sometimes hold onto hope that certain circumstances will provide a workaround. They won't.

"I can just pick something after day 45." The identification deadline is absolute. Properties acquired after day 45 that weren't properly identified before the deadline do not qualify for 1031 treatment.

"I'll revise my identification list next week." Once day 45 passes, your identification is locked. You can make changes during the 45-day window, but not after it closes.

"The deadline fell on Sunday, so I have until Monday." While often debated, IRS Revenue Ruling 83-116 clarifies that if a deadline falls on a Saturday, Sunday, or legal holiday, the act is generally considered timely if performed on the next succeeding day that is not a weekend or holiday. However, relying on this extension is risky. Best practice—and the policy of many conservative Qualified Intermediaries—is to treat the deadline as strict. If Day 45 falls on a Saturday, aim to deliver your identification by midnight Friday to eliminate any potential for dispute.

Limited Exceptions: When Extensions May Apply

The IRS does provide narrow relief in specific circumstances, but these exceptions are rare and strictly defined.

Federally Declared Disaster Relief

Under Revenue Procedure 2018-58, the IRS may extend 1031 exchange deadlines for taxpayers affected by federally declared disasters. This relief is not automatic—the IRS must issue a specific notice authorizing it, and taxpayers must meet defined criteria.

You may qualify for disaster relief if:

Your relinquished or replacement property is located in a covered disaster area

Your qualified intermediary, lender, or title company is located in a covered disaster area and cannot perform their role

A party to your transaction is killed, injured, or missing due to the disaster

Essential documents are destroyed, or a lender refuses to fund due to disaster-related insurance unavailability

When available, relief typically extends deadlines to the later of 120 days or the general postponement date specified in the IRS notice.

Why Personal Hardship Usually Doesn't Qualify

Illness, family emergencies, financing delays, and deal complications—while genuinely difficult—do not trigger IRS deadline extensions. The tax code treats these as risks inherent to real estate transactions, not grounds for relief.

This is precisely why working with an experienced qualified intermediary from the start matters so much. A good QI helps you structure your timeline with appropriate buffers for the unexpected.

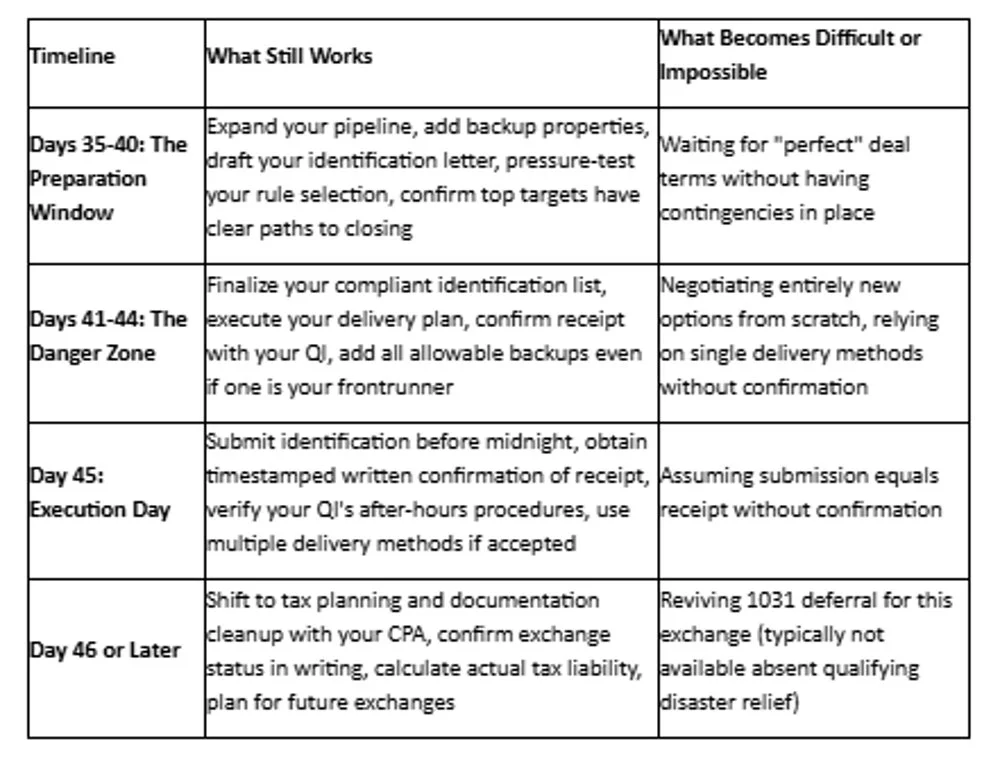

Triage Plans: What to Do Based on Where You Stand

Your options depend entirely on which day you're on. Here's a practical breakdown.

Days 35-40: The Preparation Window

You still have time, but it's tightening. Focus on these priorities:

Confirm your top three property targets have clear paths to closing

Prepare backup identification options using your chosen rule (three-property, 200%, or 95%)

Draft your identification letter now—don't wait until day 44

Coordinate with your agent, lender, and QI to identify any potential closing obstacles

Days 41-44: The Danger Zone

Every hour matters now. Take these steps:

Finalize your identification list immediately

Consider identifying all three allowable properties under the three-property rule, even if one is your clear frontrunner—backups protect you when deals collapse

Confirm the exact delivery method for your identification (email, fax, overnight delivery) and test it

Verify your QI's receipt procedures and after-hours submission process

Day 45: Execution Day

Today is about one thing: getting a valid identification delivered and confirmed. Follow this checklist:

Submit your identification to your qualified intermediary before the deadline (midnight in most cases)

Obtain written confirmation of receipt with a timestamp

Keep copies of everything—the signed identification, the delivery confirmation, and any acknowledgment from your QI

Do not rely on a single delivery method; use email and fax if both are accepted

If It's Day 46 or Later: Your Next Steps

Missing the deadline is painful, but making additional mistakes compounds the damage.

Confirm the Outcome and Quantify the Impact

First, contact your qualified intermediary to confirm whether a valid identification exists. Sometimes investors believe they missed the deadline when they actually submitted in time. Get written confirmation of your status.

If the exchange has indeed failed, work with your CPA or tax advisor to calculate the actual tax liability. Understanding the specific number helps you plan cash flow and evaluate whether any mitigation strategies apply.

Avoid Compounding Mistakes

Do not attempt to "fix" a failed exchange through creative recharacterization. This usually creates additional problems. Common errors include:

Taking receipt of exchange funds before consulting your tax advisor (this creates constructive receipt issues that can trigger immediate taxation)

Attempting to structure a new exchange using the same proceeds

Making investment decisions in a panic rather than with careful analysis

Reset for the Next Exchange

A missed deadline is a setback, not a permanent failure. Many successful real estate investors have experienced this and gone on to execute flawless exchanges afterward. The key is learning from the experience.

Consider what went wrong: Was identification started too late? Were backup properties overlooked? Did you engage your QI early enough? Use these insights to build wealth through your next 1031 exchange.

Preventing Deadline Failures: The Deadline Alert System

Prevention is far simpler than recovery. This systematic approach keeps your exchange on track.

Your Exchange Timeline Checklist

Day 0 (Closing Day): Your exchange calendar officially starts. Confirm the exact date and time your relinquished property transferred. Set calendar reminders for every milestone below.

Day 7: Begin shortlisting property types and target markets. Don't wait until week four to start looking.

Day 30: Narrow to your top three acquisition targets. Verify each property's availability and begin preliminary due diligence. This is your checkpoint for ensuring an identification list will exist, not just wishful thinking about deals in progress.

Day 40: Finalize backup options. Draft your identification letter with your QI. Confirm all property descriptions are unambiguous and comply with your chosen identification rule.

Day 44: Final review of your identification. Confirm delivery method with your QI. Prepare for submission tomorrow.

Day 45: Identification delivered with confirmed receipt. Retain all documentation.

Day 180: Final deadline for closing on replacement property (or earlier tax return due date if applicable).

Engage Your Qualified Intermediary Early

The single most effective way to protect your exchange is working with an experienced QI from the beginning—ideally before you even list your relinquished property. A qualified intermediary helps you understand your timeline, prepare proper documentation, and avoid procedural errors that could invalidate your exchange.

In complex commercial transactions, multiple parties move simultaneously: your broker, lender, attorneys, title company, QI, and CPA all play coordinating roles. That complexity is normal, but deadline pressure shouldn't be. When responsibilities are assumed rather than assigned, timing failures happen. Early QI engagement creates a clear structure where each party knows their role and deadlines are tracked systematically rather than through mental math.

At Securitas 1031, a team of attorneys, tax professionals, and real estate experts provides secure, efficient, and compliant exchange services. The team has overseen thousands of transactions and understands that deadline management is central to every successful exchange.

Why Investors Choose Securitas 1031

Named for Securitas, the Roman goddess of security and stability, Securitas 1031 operates with a singular focus: protecting your exchange.

The firm's founder and CEO, Charles H. Mansour, brings over 30 years of experience as a tax attorney with a JD and LL.M. in Taxation. Under his leadership, the team has overseen more than 18,000 real estate closings representing over $3 billion in transactions. Since 2009, Securitas 1031 has operated in partnership with a Fidelity National Title Fee Attorney office in downtown Houston.

This depth of experience matters when timelines tighten and complications arise. The difference between a successful exchange and a failed one often comes down to having the right guidance at the right moment.

Ready to protect your exchange timeline? Call Securitas 1031 at 713-275-8112 or visit the Houston office at 440 Louisiana St, Suite 1100, Houston, TX 77002 to schedule a consultation.

For real estate professionals, Securitas 1031 offers a free continuing education course covering 1031 exchange timing and rules, eligible for [Confirm current CE credit hours and TREC Provider Status] of TREC CE credit.

Frequently Asked Questions

Can I extend the 45-day identification deadline?

Under normal circumstances, no. The 45-day deadline cannot be extended for personal reasons, financing delays, or deal complications. The only exception involves federally declared disasters where the IRS issues specific relief under Revenue Procedure 2018-58.

What if I identified a property but the deal fell through after Day 45?

If you properly identified multiple properties within the 45-day window using the three-property rule, you can still close on any of your other identified properties. However, you cannot identify new properties after day 45—your list is locked.

Can I identify more than one replacement property?

Yes. The three-property rule allows you to identify up to three properties regardless of their combined value. Alternatively, the 200% rule allows more than three properties if their total fair market value doesn't exceed 200% of your relinquished property's value.

Does the 45-day deadline start at closing or at contract signing?

The 45-day period begins when you transfer the relinquished property—typically the closing date when the deed transfers and proceeds are delivered to your qualified intermediary.

What if I'm doing a reverse exchange—does the 45-day rule still apply?

Yes, but the clock works differently. In a reverse exchange, you acquire replacement property first, then have 45 days to identify which relinquished property you'll sell, followed by 180 days to complete that sale.

What happens to my exchange funds if the exchange fails?

The timing of your refund depends on when the exchange fails. If you do not identify any property by midnight on the 45th day, you have the right to receive your funds on day 46. However, if you do identify property but fail to close on it, IRS regulations (specifically the (g)(6) restrictions) often require the Qualified Intermediary to hold your funds until the 180-day exchange period expires. In either case, once funds are returned, they become fully taxable as boot.

Should I still talk to a QI if I already missed Day 45?

Absolutely. An experienced QI can help you understand your options, coordinate with your tax advisor, and plan for future exchanges. Lessons learned from a failed exchange often lead to more successful transactions later.

How early should I contact a QI before closing?

Contact a qualified intermediary as soon as you decide to pursue a 1031 exchange—ideally before listing your property. This allows time to structure the transaction properly and begin identifying potential replacement properties early.

Disclaimer: This article provides general educational information about 1031 exchanges and does not constitute tax, legal, or investment advice. Tax laws are complex and subject to change. Consult with a qualified tax professional, attorney, or 1031 exchange accommodator regarding your specific situation before making any decisions.

Our Editorial Process

Our expert team uses AI tools to help organize and structure our initial drafts. Every piece is then extensively rewritten, fact-checked, and enriched with first-hand insights and experiences by expert humans on our Insights Team to ensure accuracy and clarity.

Content prepared by the Securitas 1031 team. For expert guidance on your 1031 exchange, contact the Securitas 1031 team.

References

[^1]: Internal Revenue Service. "Instructions for Form 8824: Like-Kind Exchanges." IRS.gov

[^2]: Internal Revenue Service. "Like-Kind Exchanges Under IRC Section 1031." IRS.gov

[^3]: Internal Revenue Service. "Revenue Procedure 2018-58: Disaster Relief for 1031 Exchanges." IRS.gov

Additional authoritative sources: Treasury Regulation 26 CFR §1.1031(k)-1, IRS Publication 544