The Broker's Liability Guide to 1031 Referrals

📌 Key Takeaways

1031 referrals carry both reputational and legal exposure—negligence claims can arise when exchanges fail due to poor QI selection or missed deadlines.

Vet QIs Like Your License Depends on It: Five security questions (fund segregation, bonding coverage, access controls, deadline protocols, dedicated contacts) separate competent QIs from liability risks.

Early Engagement Prevents Deadline Disasters: Introducing the QI before listing or at LOI stage—not days before closing—prevents the rushed identification decisions that trigger exchange failures.

Stay in Your Lane with Process Language: Describing exchange mechanics ("here's how it works") keeps brokers safe; predicting tax outcomes ("you'll defer everything") crosses into advice territory and increases liability.

Document Every Referral: Email recaps naming the QI, confirming CPA involvement, and disclaiming tax advice create the paper trail that proves reasonable care if negligence claims arise.

Prepared referrals protect both the property owner's equity and the broker's professional standing.

Texas commercial real estate brokers representing individual investors will gain a defensible referral framework here, preparing them for the detailed vetting checklist and scripts that follow.

~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~

A familiar scene plays out near the end of a commercial closing: it's Day 44 at 4:45 PM, someone finally says "Can we still do a 1031?", and everyone scrambles for an identification signature. Or it happens earlier—your property owner's $2.3M sale closes Friday, and Tuesday afternoon they casually mention they "might want to do a 1031." You feel your stomach drop.

This guide is written for brokers who represent individual property owners—investors making direct ownership decisions about their personal real estate holdings, not syndication sponsors or fund managers. You know the basics: timelines are strict, a Qualified Intermediary is required, and taxes get deferred if everything goes right. But you also know this: if the exchange fails—missed deadlines, mishandled funds, or a tax surprise—your property owner won't blame the QI or their CPA. They'll remember you were the one who "helped."

Here's the reality: a 1031 referral isn't a casual vendor recommendation. It's a risk transfer decision. The Qualified Intermediary you introduce will hold hundreds of thousands (or millions) of dollars in proceeds, navigate IRS deadlines, and determine whether your property owner's equity stays protected or gets hit with an immediate tax bill. Your reputation is attached to that outcome—even if you never touch the money or give tax advice.

This guide gives you a broker-safe referral framework: how to stay helpful without crossing into tax advice, how to vet a QI like you're protecting your own license, and how to document the process so your role stays defensible.

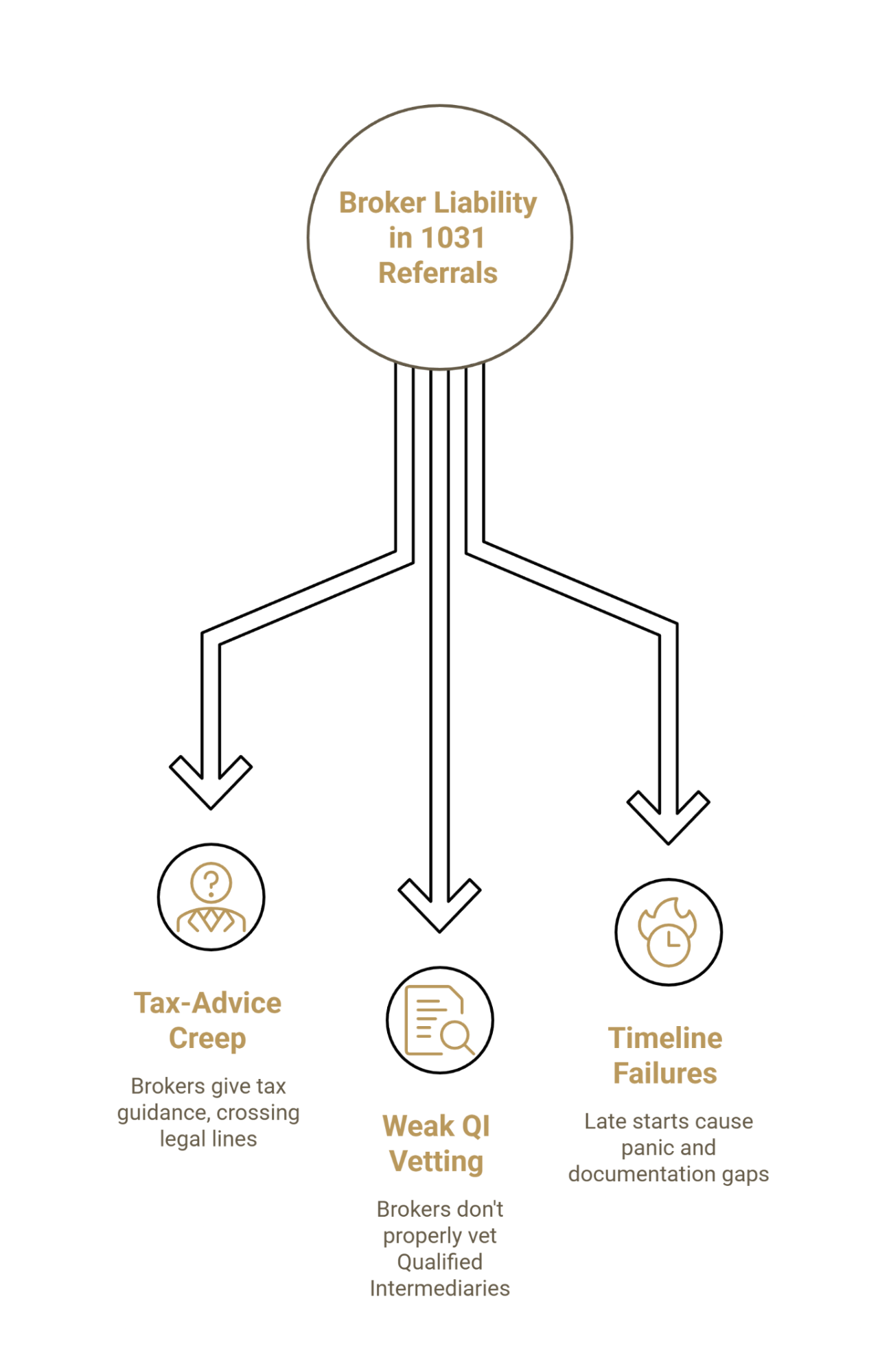

Why 1031 Referrals Feel Risky for Brokers

The broker's liability in a 1031 exchange often manifests as a reputational issue first, but carries significant legal exposure regarding negligence and fiduciary duty. When a deal goes smoothly, the property owner credits their CPA and moves on. When something fails, the broker is often the most visible party—the one who "should have known better" or "should have warned me"—potentially triggering claims of professional negligence.

1031 exchanges are governed by strict timing and process requirements under IRS rules, including the 45-day identification period and 180-day exchange period. Section 1031 of the Internal Revenue Code dictates the strict compliance framework for these transactions.

Here's what brokers control versus what they don't:

What you control:

Timing of the introduction. Engaging a QI early (at listing or letter of intent stage) prevents deadline-driven chaos.

Quality of the referral. Vetting the QI's security controls and operational discipline protects both the property owner and your professional standing.

Boundary clarity. Staying out of tax advice while still being helpful requires specific language (we'll cover the scripts below).

What you don't control:

The property owner's ultimate tax outcome. That's between them, their CPA, and the IRS.

The QI's day-to-day execution. You're not the project manager—but you are responsible for introducing someone competent.

The goal isn't to become a 1031 expert. The goal is to make a referral that won't come back to haunt you.

The 3 Risk Zones That Trigger Broker Problems

Risk Zone #1: "Tax-Advice Creep"

Brokers get pulled into giving tax guidance because property owners ask direct questions: "Will this defer all my taxes?" "Do I have to reinvest everything?" "What if I take some cash out?"

The natural instinct is to be helpful. But the line between process education ("here is how the exchange works") and tax outcomes ("here is what you will save") is thinner than most brokers realize.

The safest approach: describing the process is safer than describing the result. IRS rules govern whether a transaction qualifies, and deal-specific tax outcomes depend on facts a broker typically does not control.

What NOT to say:

"You'll definitely defer all the taxes."

"This is a guaranteed way to avoid capital gains."

"You can take out $50K in cash and still defer the rest."

What TO say instead:

"A 1031 exchange is designed to defer capital gains taxes when structured correctly. Your CPA will calculate your specific tax outcome based on how you reinvest."

"The IRS has strict rules about what qualifies. Let's get your CPA and the QI on a call so they can walk through your scenario."

"I can introduce you to a qualified intermediary who handles the process, but your tax advisor will confirm how this applies to your situation."

The key is process language, not outcome language. You're describing the mechanics, not predicting tax results.

Risk Zone #2: Weak QI Vetting (Security + Controls)

Misconception to correct: "All QIs are the same—they all do the same thing."

Many brokers treat the QI role like a commodity, assuming they can "just use whoever the property owner finds online." That's a dangerous myth and a reputational gamble.

The QI's job is to hold the property owner's sale proceeds in a segregated account, ensure the funds are never constructively received by the exchanger (which would blow the exchange), and manage the 45-day identification and 180-day acquisition deadlines with precision. If the QI mishandles funds, misses a deadline, or operates with weak internal controls, the property owner loses their tax deferral and you lose credibility.

Here's what "weak vetting" looks like:

Assuming all QIs are bonded and insured (they're not all equally covered).

Not asking how funds are held (commingled accounts vs. true segregation).

Referring based on price alone rather than operational discipline.

Example: A broker refers an individual investor who owns a single-family rental property in Houston to a discount QI. The QI misses the 45-day identification deadline because their reminder system failed. The property owner's $180,000 gain becomes immediately taxable—and the broker's name is attached to that failure.

The QI is holding your property owner's equity. Security and process matter more than speed or convenience.

Risk Zone #3: Timeline Failures Caused by Late Starts

The 45-day identification window is triggered on the date the relinquished property closes, with the deadline calculated as 45 calendar days after the transfer date. If the QI is introduced three days before closing—or worse, the day after—the property owner is already behind.

Late engagement creates:

Deadline-driven panic. Rushed identification decisions lead to poor replacement property choices or missed deadlines entirely.

Documentation gaps. The QI needs time to prepare exchange agreements, coordinate with the closing attorney, and set up escrow instructions.

Blame diffusion. When things go wrong, everyone points fingers. The broker looks careless for not starting the process earlier.

Example: A family-owned retail property is under contract. The broker waits until three days before closing to mention the QI requirement. The property owner hasn't started looking at replacement properties. The 45-day clock starts at closing, and the owner scrambles to identify options without proper diligence—or misses the deadline entirely.

The right time to introduce a QI is before the listing goes live or as soon as a letter of intent is signed—not when the closing date is circled on the calendar.

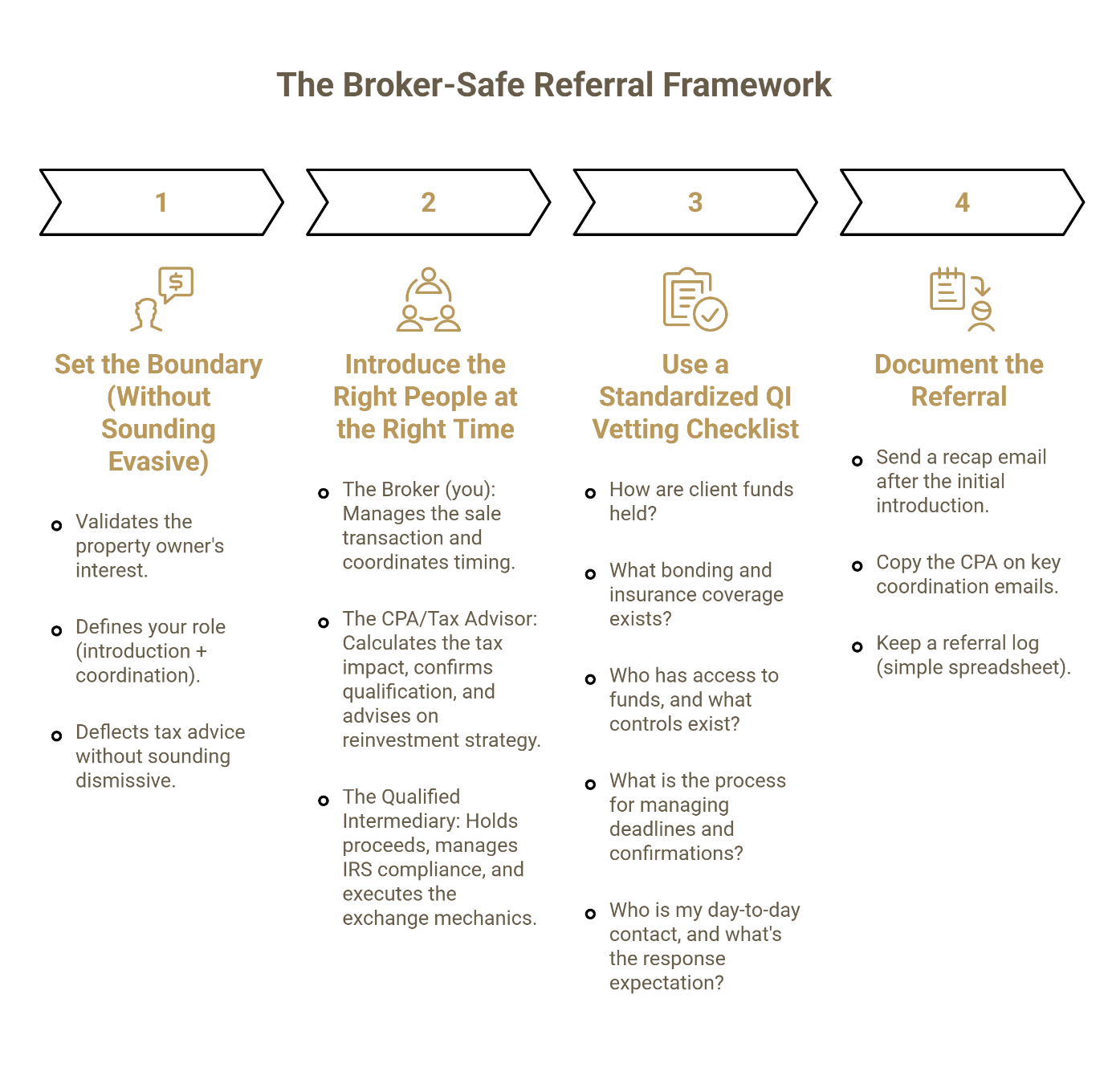

The Broker-Safe Referral Framework: "Stay-in-Your-Lane + Vet-the-Handler"

This is the system that keeps you helpful without exposing you to liability.

Step 1: Set the Boundary (Without Sounding Evasive)

When a property owner mentions a 1031 exchange, your first job is to frame your role clearly.

Use this script:

"I'm glad you're thinking about this. A 1031 exchange can be a smart way to defer capital gains taxes when structured correctly. Here's how I can help: I can introduce you to a qualified intermediary who handles the process, and I'll coordinate timing with your CPA so everyone is aligned. What I can't do is advise on the tax outcome—that's your CPA's role. Does that make sense?"

This script does three things:

Validates the property owner's interest.

Defines your role (introduction + coordination).

Deflects tax advice without sounding dismissive.

Step 2: Introduce the Right People at the Right Time

A successful 1031 exchange requires three parties working together—think of it as a coordination triangle:

The Broker (you): Manages the sale transaction and coordinates timing.

The CPA/Tax Advisor: Calculates the tax impact, confirms qualification, and advises on reinvestment strategy.

The Qualified Intermediary: Holds proceeds, manages IRS compliance, and executes the exchange mechanics.

Your job is to get these three parties talking before closing—ideally within 48 hours of the property owner expressing interest.

The coordination triangle:

Week 1: Introduce the property owner to the QI and confirm the CPA is looped in.

Week 2: Schedule a three-way call (Broker-Property Owner-CPA-QI) to align on timeline and next steps.

Before closing: Confirm the QI has executed the exchange agreement and provided escrow instructions to the closing attorney.

This isn't hand-holding. This is process discipline that prevents last-minute failures.

Step 3: Use a Standardized QI Vetting Checklist

Move from "I know a guy" to "I've documented my due diligence."

Before you refer a QI, answer these five questions:

1. How are client funds held?

Look for: Segregated accounts (each exchanger's funds held separately, not commingled).

Red flag: Pooled accounts or vague answers about "industry-standard practices."

2. What bonding and insurance coverage exists?

Look for: Fidelity bond (protects against employee theft) + Errors & Omissions insurance (covers operational mistakes).

Ask for dollar amounts. "We're insured" is not specific enough.

3. Who has access to funds, and what controls exist?

Look for: Dual-signature requirements, third-party audits, and restricted access.

Red flag: A single person with unilateral authority over client accounts.

4. What is the process for managing deadlines and confirmations?

Look for: Automated reminders, written confirmation receipts, and a documented escalation process.

Red flag: "We'll call you when it's time."

5. Who is my day-to-day contact, and what's the response expectation?

Look for: A dedicated contact (not a call center) and a clear service-level agreement.

Red flag: "Send an email and someone will get back to you."

These questions don't make you a 1031 expert. They make you a professional who vets referral partners.

Step 4: Document the Referral

If something goes wrong, you need to prove you acted responsibly.

Simple documentation process:

Send a recap email after the initial introduction:

"Per our conversation, I've introduced you to [QI Name] at [Company]. They will handle the 1031 exchange process. Please coordinate directly with them and your CPA, [CPA Name], to confirm your tax strategy. Let me know if you need anything from my side to keep the transaction moving."

Copy the CPA on key coordination emails so there's a documented record of collaboration.

Keep a referral log (simple spreadsheet: Property Owner Name | QI Referred | Date | CPA Looped In | Notes).

This isn't paranoia. This is standard professional practice.

What to Tell Property Owners vs. What to Avoid

Safe phrases (use these):

"A 1031 exchange is a process the IRS allows for deferring capital gains taxes when you reinvest in like-kind property."

"The qualified intermediary will walk you through the requirements, and your CPA will confirm how this applies to your tax situation."

"Timing is critical. Let's get your QI and CPA involved now so we don't create deadline pressure later."

Avoid saying (these cross the line):

"You won't owe any taxes if you do this." (You can't guarantee outcomes.)

"Just make sure you buy something worth more, and you'll be fine." (That's tax advice.)

"I've seen this work for other clients, so it'll work for you." (Every situation is different.)

Why Securitas1031 Is a Low-Risk Referral Partner for Texas Brokers

When you refer a QI, you're not just handing off a task—you're entrusting someone with your property owner's equity and your professional reputation.

Securitas1031 is built around attorney-led precision, process discipline, and local accountability—not call-center convenience. The firm emphasizes a security-first posture with direct access to qualified legal and tax professionals based in Houston.

What that means in practice:

Attorney-led compliance. Every exchange is structured with legal precision backed by decades of real estate law experience.

Segregated client accounts. Every property owner's funds are held separately, with documented controls and third-party oversight.

Direct access to qualified professionals. Your property owners work with licensed attorneys and tax professionals, not a rotating support team.

Proactive deadline management. Automated reminders, written confirmation receipts, and clear escalation protocols keep exchanges on track.

Transparent security posture. Bonding, insurance, and audit practices are documented and disclosed upfront.

Leadership credentials:

Charles H. Mansour, BS, JD, LL.M. (Taxation) — Founder & CEO with 30+ years of real estate and tax law experience, 18,000+ closings, and $3 billion in transactions

Richard Jaubert — Chief Financial Officer

Our approach is simple: we treat every exchange like the broker's reputation depends on it—because it does.

Learn more about our team or schedule an in-person consultation.

Next Steps for Brokers

Contact us to request the Broker-Safe 1031 Referral Cheat Sheet (PDF)—includes the 5-Point Vetting Card, email scripts, and liability checklist. You can also inquire about our next TREC CE credit session, "An Overview of 1031 Exchanges," covering timing, rules, and key concepts for brokers serving individual property owners.

Use the 1031 Exchange Calculator to estimate potential tax savings for individual investors. This is a general estimate and does not constitute tax advice—encourage your property owner to review the results with their CPA or tax advisor for transaction-specific guidance.

If your property owner is ready to move forward with their personal real estate investment, call (713) 275-8112 or schedule a consultation to open an exchange before closing.

Disclaimer: This article is for informational purposes only and does not constitute tax, legal, or accounting advice. Always consult your CPA, tax advisor, and legal counsel regarding your specific transaction.

Our Editorial Process:

We write for clarity and compliance. Our content is reviewed for accuracy against authoritative sources (including IRS guidance) and updated when material rules change. We avoid predictions about individual tax outcomes—your CPA or tax advisor should advise on your specific situation.

About Securitas1031

Securitas1031 is a Qualified Intermediary focused on secure, compliant 1031 exchanges for individual real estate investors and direct property owners. Our attorney-led approach prioritizes careful process control, responsive communication, and local accountability—especially for brokers and investors navigating strict timelines.

440 Louisiana St, Suite 1100, Houston, TX 77002

Tel: 713-275-8112

Richard Jaubert: richard@securitas1031.com