How to Choose a Qualified Intermediary: 5 Security Questions to Ask

📌 Key Takeaways

Security infrastructure—not processing speed—determines whether your 1031 Exchange preserves equity or triggers immediate tax liability.

Bonding Protects Capital: Third-party fidelity bonds exceeding $1 million and separate E&O insurance transfer fraud and error risk away from your proceeds onto documented coverage.

Segregated Accounts Prevent Commingling: Individual FDIC-insured accounts titled in your name eliminate constructive receipt risk and shield funds from intermediary creditors during operational failures.

Attorney-Led Execution Reduces Compliance Risk: Legal professionals with documented exchange experience provide immediate guidance on constructive receipt prevention, complex structures, and deadline coordination when commodity processors escalate to call centers.

Local Market Knowledge Accelerates Closings: Houston-based intermediaries with established title company and escrow relationships compress coordination timelines when approaching 45-day identification or 180-day acquisition deadlines.

Standardized Vetting Eliminates Guesswork: Five specific questions about bonding limits, account segregation, complex transaction volume, professional credentials, and local market experience immediately separate compliance guardians from commodity processors.

Professional expertise replaces hope with documented security controls.

Individual commercial property investors and their CPAs evaluating Qualified Intermediary options will gain immediate selection clarity here, preparing them for the detailed vetting framework that follows.

~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~

Beyond the Paperwork: Why Your QI Choice Determines Your Equity's Future

Now that you understand the foundational rules of like-kind property, it's time to evaluate the frameworks for selecting the professional who will guard your capital during the most vulnerable phase of your wealth-building strategy.

You're reviewing the closing statement on a property you've held for 12 years. The appreciation is solid. The buyer is committed. Then your eyes land on the "Estimated Tax" calculation, and your stomach drops. Depending on your adjusted basis and depreciation history, upwards of 20% to 35% of your taxable gain—potentially impacting a significant portion of your net proceeds—could be gone. That's not just a line item. That's a taxable event triggered by inadequate planning.$^1$

A 1031 Exchange is a wealth preservation structure that requires strict compliance with IRS requirements to prevent taxable recognition of your gain. The proceeds from your relinquished property must never pass through your control—a condition known as constructive receipt—or the entire deferral fails.

This is where a Qualified Intermediary comes in—a mandatory third party that facilitates the exchange to keep your money out of the IRS's reach. Think of the Qualified Intermediary as the compliance guardian for your sale proceeds; if their controls are inadequate, your equity becomes exposed to immediate taxation before it reaches your replacement property. By using our security vetting framework, you can ensure your funds are protected by documented safeguards, not marketing promises.

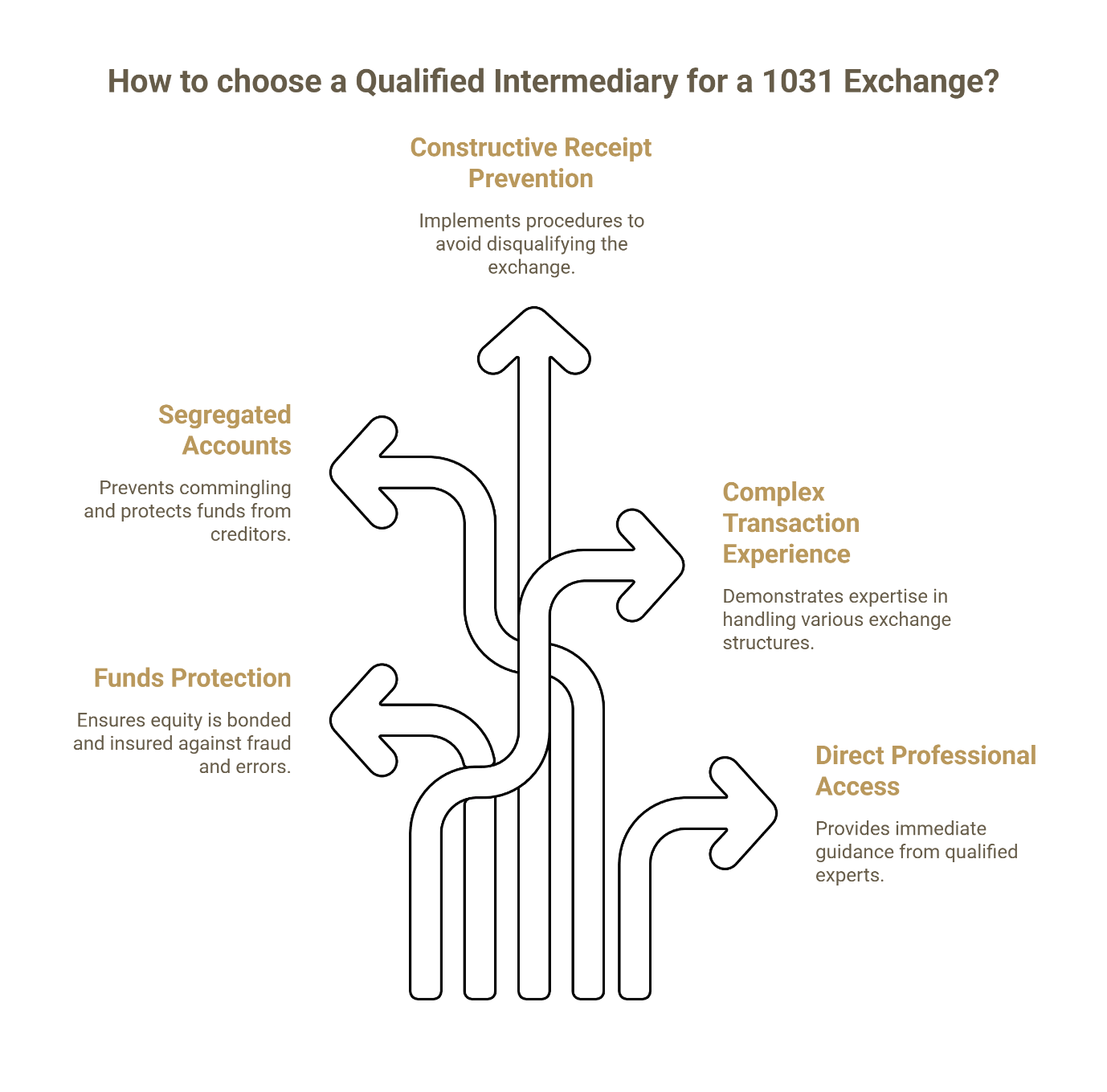

The 5 Essential Security Questions (Quick Reference)

Before diving into the detailed framework, here are the five critical questions every investor must ask:

What bonding and insurance protects my sale proceeds, and what are the policy limits?

Will my funds be held in segregated, clearly titled accounts—and at which bank?

What controls prevent constructive receipt during closing, escrow, and funding?

How many exchanges like mine have you executed—including multi-property and higher-complexity structures?

Can you handle complex needs (construction/improvement, partial exchanges) and provide local, fast support when timing gets tight?

Why Choosing a QI Is Your Most Important 1031 Decision

Fidelity insurance directly protects your sale proceeds during the exchange period. It ensures that even in cases of clerical error or malfeasance, your property equity remains secure throughout the 45-day identification deadline and the full 180-day acquisition requirement.

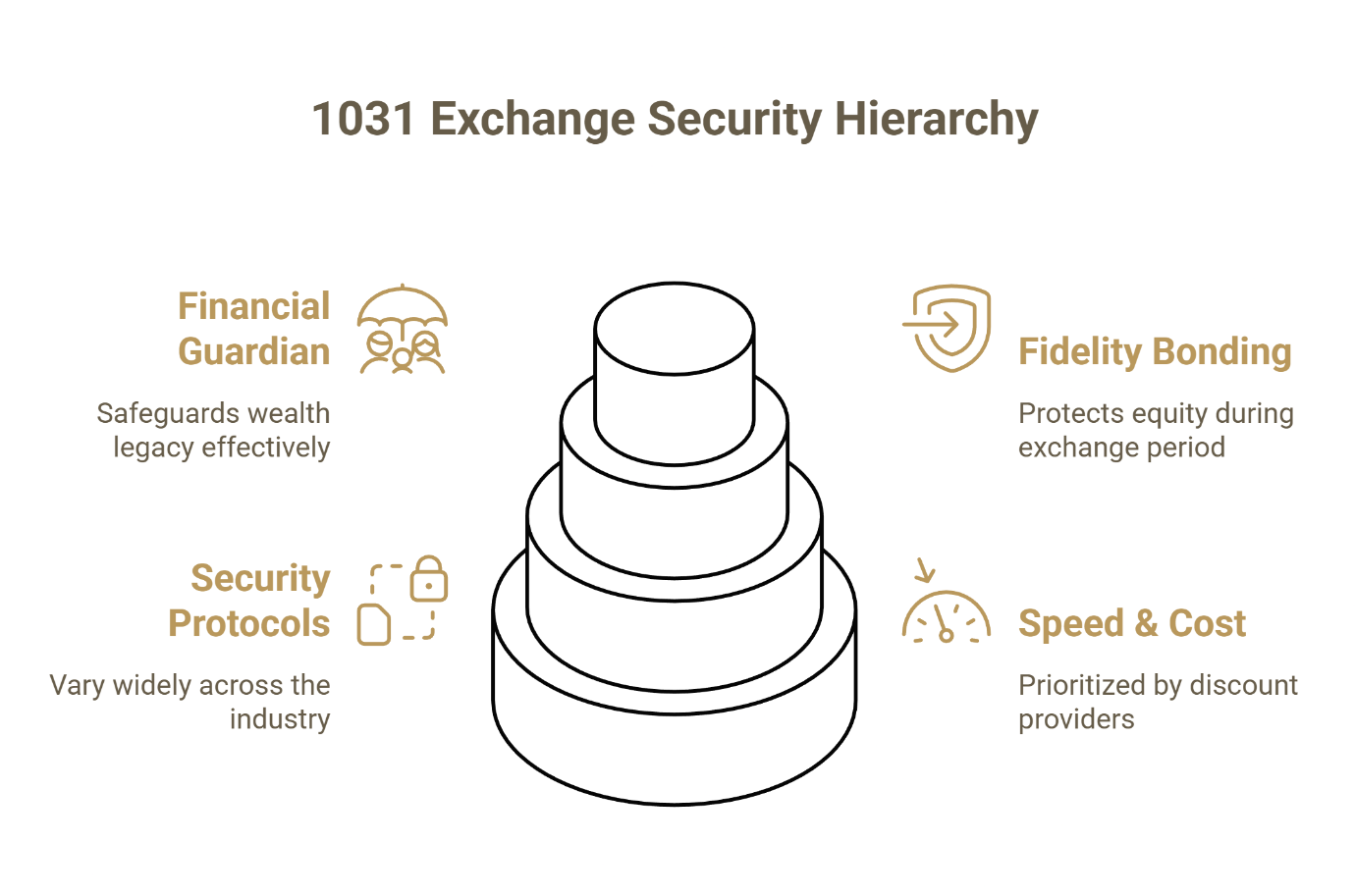

The Qualified Intermediary is the only thing standing between you and a disqualified exchange. Yet many investors treat this selection like choosing a mail forwarding service—prioritizing speed and cost over the security infrastructure that actually safeguards their wealth legacy.

Here's the uncomfortable truth: not all 1031 exchange companies are created equal. Security protocols vary wildly across the industry. A discount provider might process your forms correctly but lack the fidelity bonding required to protect a seven-figure equity position if their operations fail. The difference between a commodity transaction processor and a financial guardian often becomes visible only after something goes wrong—when it's too late to recover your funds.

The Cost of the "Commodity" Mindset

Commodity thinking treats a Qualified Intermediary as a paperwork vendor and increases the risk of exchange failure. It does so by pushing investors to optimize for fees instead of security infrastructure, compliance controls, and execution precision.

Consider a scenario where a commercial investor in Austin closes on a $2.3 million industrial property sale. They select a national online Qualified Intermediary based solely on a $200 lower fee. The exchange funds sit in a pooled account. Sixty-three days later, the intermediary's parent company files for bankruptcy protection. If the investor's proceeds are tied up in litigation beyond the statutory exchange period, the 180-day deadline may expire without a completed exchange. Consequently, the full tax liability could trigger—over $680,000 in federal and state taxes on what should have been a fully deferred exchange.$^4$

That's not a hypothetical fear. It's the real-world consequence that occurs when security infrastructure is treated as optional.

The dangerous misconception many brokers and investors hold is that all Qualified Intermediaries just handle paperwork. The reality? Your intermediary is the custodian of your entire net proceeds during the most legally sensitive period of the transaction. A Qualified Intermediary is not just "processing forms." They control the flow of funds between your closing, your escrow, and the IRS safe-harbor requirements. One missed deadline, one commingled account, one moment of constructive receipt—and the IRS reclassifies your exchange as a taxable sale.

When you wait to engage an accommodator until the closing day, you compress decision time, increase wiring risk, and force your broker and escrow team into last-minute coordination failures—exactly when procedural mistakes happen. If your tax deferral is protecting six or seven figures of gain, the Qualified Intermediary's role is compliance architecture. Your objective is an audit-resilient transaction that withstands IRS scrutiny.

Key Criteria for Decision Making

Financial safeguards protect your exchange funds and preserve your reinvestment capacity. They do so by establishing documented controls around where money sits, who can move it, and what protections exist if operational failures occur.

Use this evaluation framework—especially if you're transitioning from an Austin multifamily sale into another asset where cash-on-cash return depends on keeping every reinvestable dollar working:

Bonding and E&O insurance clarity: Policy limits, carriers, coverage scope, and written proof

Segregated accounts and transparency: Titled accounts, clear reporting, and bank details

Process control at closing: Clean settlement statement instructions, documented escrow coordination, and elimination of constructive receipt risk

Responsiveness under deadline pressure: Documented response timelines, direct access to decision-makers, and same-day problem resolution

Technical expertise: Demonstrated capability to structure complex transactions without improvisation

Local presence and direct access: A local team you can reach directly when signatures, identification, and funding coordination become time-sensitive

The Safe Harbor Verification Framework: 5 Security Questions Every Texas Investor Should Ask

A Qualified Intermediary's financial infrastructure determines whether your equity is genuinely protected or merely promised to be protected. The following framework helps you distinguish between processing services and true compliance guardianship—structured around the attorney-led approach that sophisticated investors require.

Security Question 1: How Are My Funds Bonded and Insured?

Bonding and insurance transfer risk away from your proceeds and onto third-party policies designed to respond to fraud, theft, and professional errors.

Your first question during any vendor evaluation call should focus on two distinct layers of protection: fidelity bonding and errors and omissions insurance.

Fidelity bonding protects you against employee theft or fraud within the intermediary's organization. A legitimate bond should be held by a third-party surety company—not self-insured by the Qualified Intermediary itself. For transactions involving equity positions above $500,000, prudent risk management suggests seeking fidelity coverage of at least $1 million per occurrence. Leading attorney-led providers often maintain bonds exceeding $5 million to cover multiple simultaneous high-value exchanges.$^2$

Errors and omissions insurance covers professional mistakes—missed deadlines, documentation errors, or compliance failures that could invalidate your exchange. This coverage should be separate from the fidelity bond and maintained continuously, not purchased on a per-transaction basis.

Ask for specifics:

Do you carry a third-party fidelity bond (not "internal controls")? What is the limit?

Do you carry Errors & Omissions (E&O) insurance? What does it cover—and what are exclusions?

Who are the carriers, and can you provide written proof of coverage?

A Qualified Intermediary without third-party fidelity bonding is effectively self-insuring with your money. That's not security—that's unquantified risk.

Security Question 2: Are Exchange Funds Held in Segregated Accounts?

Segregated accounts protect your exchange proceeds from commingling risk and increase transparency through separate account titling and clear audit trails.

Segregated accounts ensure your sale proceeds remain separate from the intermediary's operating funds and from other clients' exchanges. This structure provides two critical protections: it prevents commingling (which can trigger constructive receipt and disqualify your entire exchange under IRC Section 1031), and it shields your funds from the intermediary's creditors if they face financial distress.

Ask specifically: "Will my funds be held in an account bearing my name or my entity's name at a federally insured institution?" The correct answer should include confirmation that the account is established at a bank within the FDIC insurance framework and that you receive periodic statements showing the account activity.

Additional questions to ask:

Will my funds be held in a segregated account (not pooled)?

How is the account titled, and does it clearly reflect exchange purpose?

Which bank holds the funds, and what controls exist around wire authorizations and releases?

Pooled accounts—where multiple clients' funds sit in a single account controlled by the intermediary—create unnecessary risk exposure. If the intermediary faces operational problems, your equity becomes entangled with their corporate liabilities. If a provider cannot provide clear documentation of where your money sits and how it's protected, you don't have transparency—you have unverified assurances.

Security Question 3: What Controls Prevent Constructive Receipt?

Process controls eliminate constructive receipt risk by ensuring you never take possession or control of sale proceeds—directly or indirectly—at any point during the exchange timeline.

Constructive receipt is the most common reason exchanges fail IRS scrutiny. It occurs when the exchanger has the ability to access or control the funds, even if they don't physically receive them. Once constructive receipt is established, the entire exchange is disqualified, and full tax liability triggers immediately.

An attorney-led Qualified Intermediary understands the legal nuances of constructive receipt and implements documented procedures to prevent it. This includes precise coordination with title companies and escrow agents to ensure settlement statements contain the correct assignment language and that wire instructions route funds directly to the Qualified Intermediary's control—never to the exchanger's account, even temporarily.

Ask explicitly:

How do you coordinate closing instructions with escrow and title companies?

What specific language do you require on the settlement statement and escrow instructions?

What procedures prevent "temporary control" scenarios where funds might pass through my account?

How do you document the chain of custody for exchange proceeds?

A provider who cannot articulate their constructive receipt prevention procedures with precision lacks the legal framework required for high-stakes transactions. If you want a deeper examination of why direct handling of proceeds—even briefly—disqualifies the exchange, review Why the "DIY" Approach to 1031 Exchanges Puts Your Equity at Risk.

Security Question 4: What Is Your Track Record With Complex Transactions?

Demonstrated experience with complex exchange structures reduces execution risk by replacing improvisation with established procedures and documented precedent.

Technical expertise becomes the deciding factor when your exchange involves structures beyond a simple delayed swap. A sophisticated Qualified Intermediary should have demonstrable experience facilitating reverse exchanges, construction or improvement exchanges, and partial exchanges—the scenarios where procedural precision determines whether your deferral survives IRS scrutiny.

For reverse exchanges, where you acquire the replacement property before selling your relinquished asset, the intermediary must coordinate with an Exchange Accommodation Titleholder (EAT) and manage the parking arrangement within the IRS safe harbor timeline established by Revenue Procedure 2000-37. This requires legal fluency and operational precision that commodity processors simply don't maintain.

Construction exchanges demand even tighter coordination. If you're using exchange proceeds to fund improvements on your replacement property, every dollar must be deployed within the 180-day requirement, and the intermediary must track disbursements with precision to avoid creating taxable boot. One incorrect draw request or poorly timed payment can convert your tax-deferred wealth transfer into a partially taxable event.

Ask for documented evidence:

How many exchanges have you closed in the last 12 months?

Do you support multi-property identifications and compressed timelines?

How many construction exchanges and reverse exchanges has your firm executed in the past 24 months?

How do you handle scenarios that create boot risk (cash retained, debt reduction, or non-like-kind property components)?

A vague answer or referral to a call center suggests the firm lacks the depth required for high-stakes transactions. This is also where waiting until closing day to engage the Qualified Intermediary shows up as a predictable failure pattern: no runway, no backup strategy, no margin for coordination errors.

Security Question 5: Who Will I Actually Speak With During My Exchange?

Direct access to qualified professionals—attorneys or certified exchange specialists who understand Texas real estate markets—provides the decision-support infrastructure you need during time-sensitive moments.

Responsiveness can be the difference between a successful exchange and immediate tax liability. When it's Day 44 of your identification period and you need immediate guidance on whether a property qualifies under the three-property rule or the 200% rule, you don't have time to navigate an automated phone tree or wait for a callback from a rotating pool of processors.

At Securitas 1031, clients work directly with an attorney-led team that includes professionals with over 30 years of experience in real estate law and taxation. This means you have access to decision-makers who can provide immediate guidance on complex scenarios—not scripted responses from a call center.

Ask the provider: "Will I have a dedicated point of contact, and what is their professional background?"

Additional questions to clarify responsiveness:

Who is my direct contact when I'm inside the Day 40–Day 45 identification window—and what is your documented response time?

What professional credentials does my point of contact hold (JD, CPA, certified exchange specialist)?

How many exchanges have you facilitated in the Houston or Austin commercial markets this year?

National call centers might route your inquiry to whoever is available that shift. A Houston-based team led by attorneys who know the difference between Harris County commercial closing procedures and Austin multifamily market dynamics can provide context-aware guidance that generic processing services cannot match.

This isn't about hand-holding. This is about having immediate access to qualified expertise when the stakes are six or seven figures of deferred tax liability.

Local Market Expertise: A Strategic Advantage

Local execution strengthens coordination and improves closing reliability by shortening communication loops between the Qualified Intermediary, escrow, the title company, your broker, and your CPA—when minutes matter.

A Qualified Intermediary with deep roots in Texas commercial real estate understands the closing timelines at Harris County title companies, the typical due diligence periods for industrial properties in Houston's Energy Corridor, and the seasonal patterns that affect multifamily inventory in Austin.

That contextual knowledge translates into better identification strategy guidance and more realistic timeline planning. When your intermediary has facilitated dozens of exchanges involving Houston office buildings or San Antonio retail centers, they've built relationships with the local brokers, attorneys, and title companies who can accelerate your replacement property closing when you're approaching the 180-day deadline.

Ask explicitly:

Can you structure construction/improvement exchanges when the replacement property requires improvements completed within the exchange timeline?

Can you execute partial exchanges when not all proceeds are reinvested?

How many exchanges have you facilitated in the Houston or Austin commercial markets this year?

If you're evaluating providers, review the actual professionals behind the service—not just the marketing materials. For context on the team you'll work with, see 1031 exchange companies and the credentials of experienced exchange accommodators.

National vs Local QIs: Where Execution Certainty Gets Won or Lost

The choice between a national provider and a local attorney-led team isn't simply about geography—it's about the operational architecture that supports your exchange during high-pressure moments.

National call-center model strengths:

Works adequately for straightforward, low-friction exchanges with ample lead time

Standard templates and routine workflows designed for volume processing

Often cost-competitive for simple delayed exchanges

Where national models create execution risk:

Last-minute escrow changes, revised settlement statements, multi-party coordination

Complex exchanges requiring legal judgment rather than scripted responses

Slow escalation procedures when you're inside the Day 40–Day 45 identification window

Generic advice that doesn't account for regional market dynamics or local title company practices

Local, attorney-led model strengths:

Faster coordination with Houston-area escrow and title workflows

Direct access to experienced legal professionals who can resolve edge cases

Better support for brokers managing deadlines and client concerns

Market-specific guidance on replacement property availability and realistic timing expectations

Established relationships with local real estate attorneys, CPAs, and title companies

The difference between commodity processing and professional financial guardianship often comes down to whether you can reach a qualified decision-maker with legal expertise when the compliance clock is ticking.

QI Vetting Script: Your Portable Evaluation Framework

A standardized evaluation script creates consistent answers and improves decision quality. It does so by ensuring providers cannot deflect substantive questions with vague reassurances.

Use this five-question script during your initial consultation calls with potential 1031 exchange accommodators. Bring it to your CPA or broker meeting. The answers you receive will immediately separate genuine compliance guardians from commodity processors.

Question 1: "What is the amount of your third-party fidelity bond, and which surety company issues it?"

Red Flag Response: Vague references to "full coverage" or self-insurance

Green Flag Response: Specific dollar amount ($1M+) and named surety provider with written proof available

Question 2: "Will my exchange funds be held in a segregated, FDIC-insured account in my name?"

Red Flag Response: "Pooled accounts" or "trust accounts" without clear segregation details

Green Flag Response: Confirmation of individual segregated accounts with periodic statements showing your name or entity

Question 3: "How many construction exchanges and reverse exchanges has your firm closed in the past 12 months?"

Red Flag Response: Referral to a different department or inability to provide specific transaction numbers

Green Flag Response: Concrete figures demonstrating regular complex transaction volume with documented experience

Question 4: "Who will be my direct point of contact, and what is their professional background?"

Red Flag Response: "You'll work with our team" or rotating assignment model without named individuals

Green Flag Response: Named individual with relevant credentials (JD, CPA, or certified exchange specialist designation)

Question 5: "How many exchanges have you facilitated in the Houston or Austin commercial markets this year?"

Red Flag Response: Generic claims about "nationwide service" without specific local transaction data

Green Flag Response: Specific local market volume demonstrating regional expertise and established relationships

A provider who cannot answer these questions directly and confidently with documented evidence is signaling that security infrastructure and professional expertise are secondary to their business model. Your equity deserves better.

When Security Becomes Non-Negotiable

The moment your capital gains tax exposure approaches 20% or more of your realized gain—typically on properties with substantial appreciation or significant depreciation recapture—equity preservation shifts from a nice-to-have optimization to a wealth architecture imperative.$^3$

This is the inflection point where the "cheapest" option becomes the most expensive mistake. A $300 fee savings evaporates instantly if procedural failures or inadequate bonding expose even 5% of your proceeds to risk. On a $2 million exchange, that's $100,000 of equity exposed to unquantified operational risk.

The risk compounds for investors managing multiple properties or executing exchanges near year-end when replacement property inventory tightens. In those high-pressure scenarios, the experience gap between a national processing service and a Houston-based attorney-led team with direct market access becomes unmistakable.

Your Safe Harbor Verification Checklist

Verification discipline reduces uncertainty and protects your equity by converting a high-stakes decision into a documented set of proof-based compliance checks.

Before you sign with any provider, confirm:

Written proof of fidelity bond and E&O coverage (policy limits, carriers, coverage scope, current certificates)

Clear written statement on segregated versus pooled accounts, including specific bank name and account titling procedures

Documented closing instructions process showing escrow and settlement statement coordination procedures

Named point of contact with documented professional credentials and response time expectations (especially inside Day 40–Day 45)

Demonstrated technical capability through documented construction/improvement and partial exchange experience

Written timeline protection procedures and identification deadline management protocols

If deadline risk is your primary concern, review What Happens if You Miss the 45-Day Deadline? (And How to Prevent It).

If procedural mistake patterns worry you, review The 3 Most Common 1031 Exchange Mistakes That Trigger a Tax Bill.

Your Path to an Audit-Resilient Transaction

You now have the framework to evaluate Qualified Intermediaries based on the security infrastructure and professional expertise that actually protects your wealth legacy, not the marketing promises that merely describe it. The five-question vetting script transforms vendor selection from a cost-driven commodity decision into a strategic evaluation of compliance guardianship.

The sophisticated investor who doesn't gamble with IRS scrutiny recognizes that a 1031 Exchange isn't paperwork—it's tax compliance architecture. Your choice of Qualified Intermediary determines whether that architecture withstands audit or collapses under procedural shortcuts.

When you're ready to plan your exchange with an attorney-led team that prioritizes documented security controls and local market expertise, use our 1031 Exchange Calculator to estimate your potential tax savings. Then schedule a free in-person consultation with our Houston-based team to discuss how a properly structured 1031 Exchange can preserve your full equity for your next investment.

Disclaimer: This content is for informational and educational purposes only. It does not constitute legal, tax, or financial advice. Consult a qualified tax professional or attorney licensed in your state before making decisions regarding 1031 Exchange transactions, as the tax implications and procedural requirements are highly specific to individual circumstances.

Our Editorial Process

Our expert team uses AI tools to help organize and structure our initial drafts. Every piece is then extensively rewritten, fact-checked, and enriched with first-hand insights and experiences by expert humans on our Insights Team to ensure accuracy and clarity.

About the Securitas 1031 Insights Team

The Securitas 1031 Insights Team is our dedicated engine for synthesizing complex topics into clear, helpful guides. While our content is thoroughly reviewed for clarity and accuracy, it is for informational purposes and should not replace professional advice.