The 45-Day Identification Rule Explained: 3 Rules You Must Know

📌 Key Takeaways

The 45-day identification deadline is an absolute compliance requirement where missing it by even one day collapses the entire tax deferral and triggers immediate capital gains tax.

Day 45 is Non-Negotiable: Missing the deadline—even by hours—disqualifies the exchange and triggers full capital gains tax on your sale.

Choose One Identification Rule: The IRS offers three methods (3-Property, 200%, or 95% Rule), and you must pick one and stay within its limits.

Valid Identification Requires Three Elements: Written and signed documents, unambiguous property descriptions, and proper delivery to your qualified intermediary by Day 45.

Debt Replacement Prevents Boot: Identifying a property with sufficient fair market value isn't enough if you fail to replace your mortgage—extinguished debt creates taxable boot.

Process Discipline Prevents Failures: Most exchanges fail from preventable errors like vague descriptions, unsigned documents, or waiting until Day 44 to finalize identification.

Treat Day 45 as an absolute hard stop—the IRS never grants extensions for market conditions or financing delays.

Individual commercial property investors in Houston and Austin, along with the CPAs and brokers serving them, will gain compliance clarity here, preparing them for the detailed identification requirements and action timeline that follows.

~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~

Day 44. 4:47 PM. The identification document is open on your screen, but the third backup property address isn't finalized yet. Your broker is waiting for your call. The closing on your Houston industrial building happened 44 days ago, and tomorrow is the deadline—a non-negotiable hard stop. Absent a federally declared disaster,[^5] no amount of negotiation or pleading can extend this window.

The 45-day identification requirement is where most 1031 exchanges fail—not from bad strategy or poor market timing, but because the identification step was treated like paperwork instead of a compliance event with strict IRS deadlines.

The 45-day identification rule requires you to designate your replacement property in writing within 45 calendar days of transferring your relinquished property. Miss this deadline—even by a single day—and the entire tax deferral collapses, triggering immediate capital gains tax on your sale.[^1]

This article explains exactly what the rule requires, what counts as valid identification, and which of the three identification methods fits your situation. By the end, you'll have a clear action plan to make your identification audit-defensible and mistake-proof.

What the 45-Day Identification Rule Actually Requires

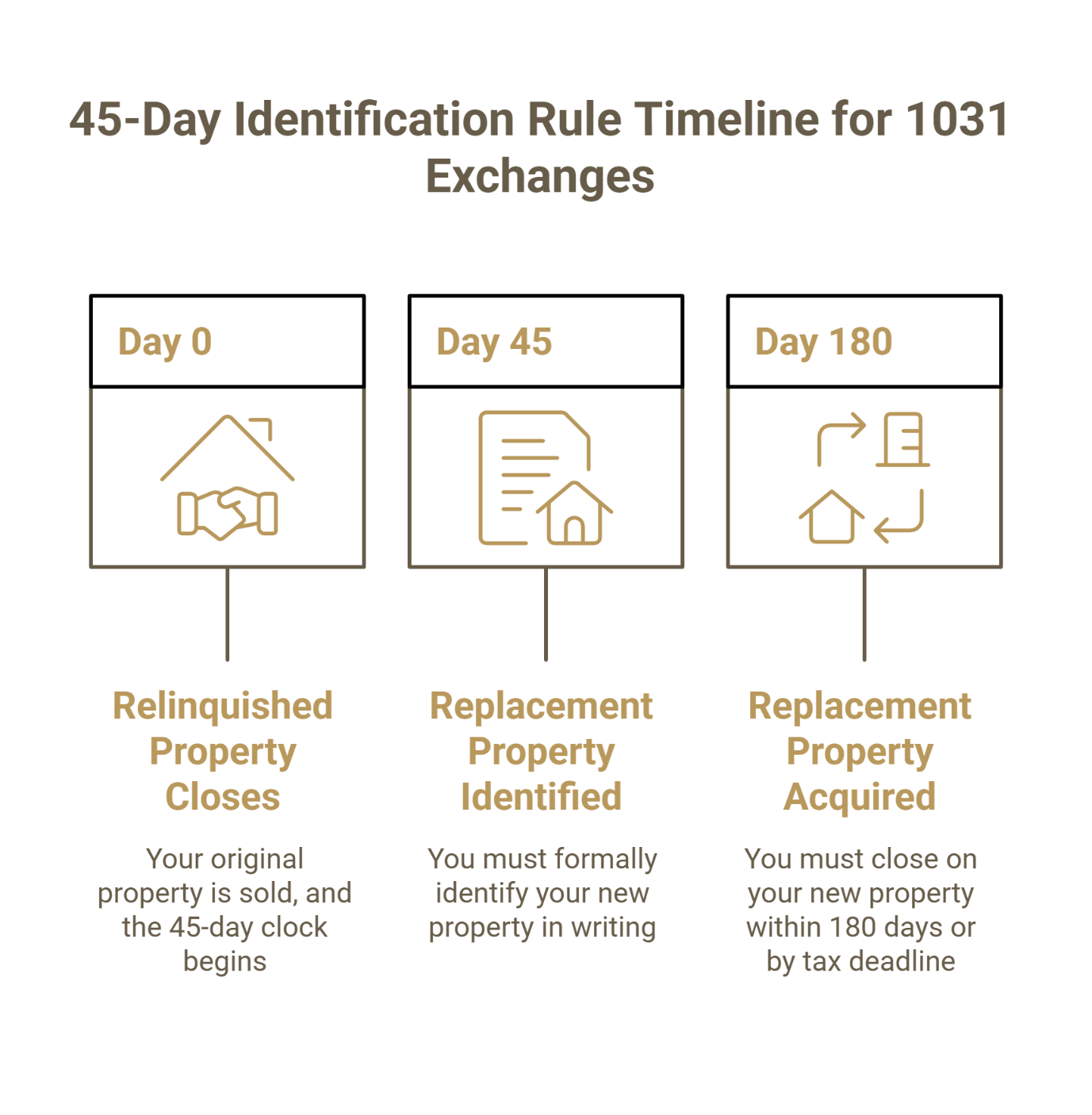

The clock starts ticking the moment your relinquished property transfers—typically at closing. From that point, you have exactly 45 calendar days to identify your replacement property in writing.[^1]

But identification is only half of the timeline. You must also receive your replacement property within 180 calendar days of the transfer or by your tax return due date (including extensions), whichever comes earlier.[^1][^3] This second deadline is critical: if you file your tax return early without an extension, you could inadvertently shorten your exchange window.

Here's what that looks like in practice:

Day 0: Relinquished property closes (Houston industrial warehouse)

Day 45 (hard deadline): Replacement property identified in writing

Day 180 (hard deadline): Replacement property acquisition must close

While IRS regulations technically extend deadlines falling on weekends or legal holidays to the next business day,[^4] relying on this exception is a dangerous strategy. Best practice is to treat the 45th calendar day as an absolute hard stop. The IRS never grants extensions for market conditions, financing delays, or "almost done" deals.

The 45-day window exists to prevent taxpayers from indefinitely deferring the decision while still claiming tax deferral benefits. It forces discipline into the 1031 exchange process—and that discipline is what protects your equity.

What Counts as a Valid Identification (Hint: Not a Text Message)

The IRS has three non-negotiable requirements for a valid identification. All three must be met by 11:59 PM on Day 45.[^1]

IRS requirements for valid identification:[^1]

1. The identification must be in writing and signed

An email to your broker saying "I like that Austin property" doesn't count. A verbal agreement with the seller doesn't count. The identification must be a formal document—either a signed letter or a signed agreement between the parties involved in the exchange.

Most exchanges use a standardized identification form provided by the qualified intermediary, which ensures the format meets IRS requirements.

2. The property must be clearly described

The IRS requires an "unambiguous description" of the replacement property.[^1] Three acceptable formats:

Street address: "1205 Congress Avenue, Austin, TX 78701"

Legal description: "Lot 12, Block 5, River Oaks Subdivision, Harris County, Texas"

Distinguishable name: "Mayfair Apartment Building" (if the name clearly identifies a specific property)

Vague descriptions like "a multifamily property in Austin" or "123 Main Street (pending final address confirmation)" will not hold up under audit. If the IRS cannot identify exactly which property you meant, the identification fails.

3. The document must be delivered properly

The signed identification must be sent to the correct party—typically your qualified intermediary—no later than Day 45. Delivery methods that create a paper trail (email with read receipt, certified mail, fax with confirmation) are strongly recommended.

A common workflow: your QI provides the form, you complete and sign it, and you return it via email with delivery confirmation before the Day 45 deadline. Confirming receipt on Day 44 is far safer than assuming delivery on Day 45.

The 3 Identification Rules (Pick One)

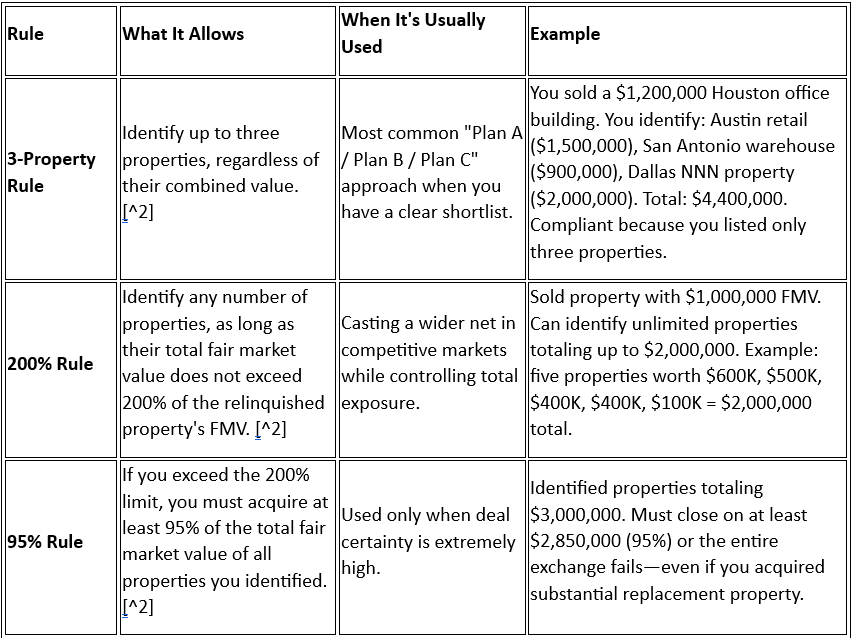

The IRS gives you three ways to identify replacement properties. You must choose one method and stay within its limits. Mixing methods or exceeding the thresholds disqualifies your identification.[^2]

Rule #1 — The 3-Property Rule (Most Common)

This is the most straightforward option and the one most investors use. You can list three addresses—a Plan A, Plan B, and Plan C—without worrying about fair market value calculations.

When to use it: When you have a clear shortlist and want maximum flexibility without value constraints. It's the cleanest, lowest-risk approach.

Rule #2 — The 200% Rule (Wider Net, Controlled Value)

This rule lets you cast a wider net while maintaining discipline on total exposure. You may identify as many properties as you want, but their combined fair market value cannot exceed 200% of your relinquished property's value.

Critical math check: Round up on appraisals and valuations. If you're cutting it close to the 200% threshold, a post-identification appraisal adjustment could push you over and invalidate your entire identification.

When to use it: When the market is competitive, you need multiple backup options, and you want to stay disciplined on total value exposure.

Rule #3 — The 95% Rule (High Stakes)

This is the high-stakes option. It allows unlimited identification, but with a strict compliance requirement: you must close on at least 95% of everything you identified.

If your primary deal falls through and you can only close on $2,500,000 in replacement property when you identified $3,000,000, you fail the identification requirement—even though you received substantial replacement property. The exchange collapses, and the full capital gains tax becomes due.

When to use it: Only when you have near-certain deal certainty on high-value acquisitions. This carries significant risk if any identified deal falls apart.

How to Choose the Right Rule (A Simple Decision Path)

Most exchanges succeed with the 3-Property Rule because it offers the most flexibility with the least compliance risk. Here's a simple decision framework:

If you have 1–3 strong targets and want maximum safety → Use the 3-Property Rule. This is the default for most individual commercial investors. You identify your top choice and two solid backups without worrying about value math.

If you're casting a wider net but need to stay disciplined on total exposure → Use the 200% Rule. This works well in competitive markets where multiple properties might fall through. You maintain optionality while capping your total identified value at twice your relinquished property value.

If you must identify a large portfolio and have near-certain closings → Use the 95% Rule. This is rare and risky. Only use it when you have signed PSAs, financing commitments, and confidence that 95% of your identified deals will close. One major deal failure can blow up the entire exchange.

Broker reality check: In tight markets like Austin, backup properties are not optional. Even strong deals can fall apart due to financing, title issues, or seller changes. Always identify at least two viable alternatives unless your primary deal has already closed.

For a broader timeline that complements this decision process, see Beat the Clock: A Strategic Timeline for a Flawless 1031 Exchange.

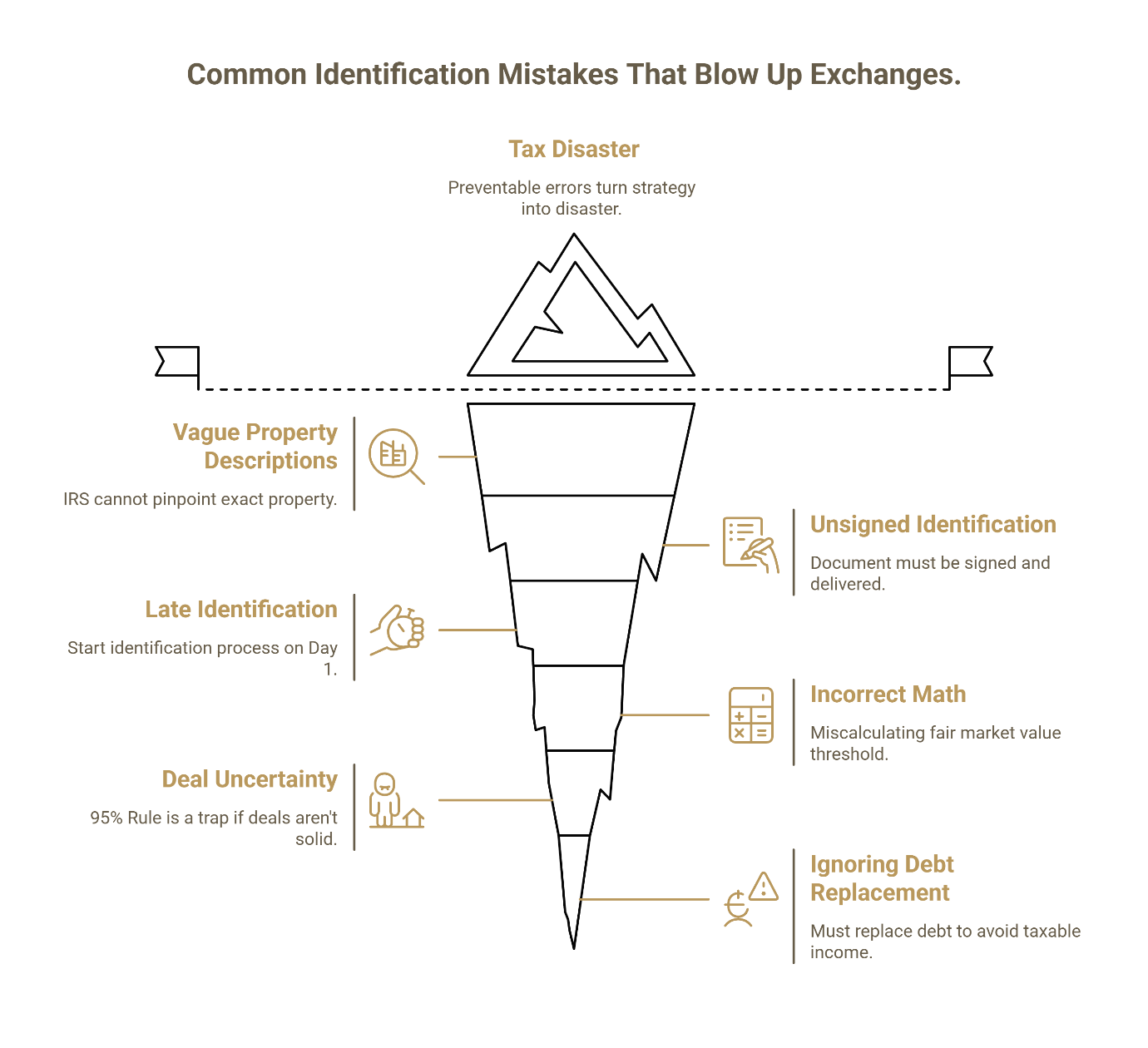

Common Identification Mistakes That Blow Up Exchanges

These are the preventable errors that turn a solid exchange strategy into a tax disaster:

1. Vague property descriptions

"A multifamily building near downtown Houston" is not an unambiguous description.[^1] If the IRS cannot pinpoint exactly which property you meant, the identification fails. Use the full street address, legal description, or a distinguishable property name that clearly identifies a single asset.

2. Unsigned or improperly delivered identification

Sending an unsigned email or failing to confirm receipt on Day 45 is surprisingly common. The document must be signed by you and delivered to the correct party (usually your QI) with proof of delivery.

3. Waiting until Day 44 or 45 to finalize identification

By Day 44, you should be confirming delivery—not still debating property addresses. Start your identification process on Day 1, finalize language by Day 40, and confirm receipt by Day 44.

4. Incorrect 200% math

Miscalculating the fair market value threshold under the 200% Rule can disqualify your entire identification. If you're using this rule, have your QI or CPA verify the math before you sign the document.

5. Attempting the 95% Rule without deal certainty

The 95% Rule looks appealing when you want to identify six or seven properties, but it's a trap if your deals aren't rock-solid. One failed closing can cascade into a failed exchange.

6. Ignoring debt replacement (mortgage boot)

Identifying a property is not enough—you must also replace the debt. If you sell a building with a $500,000 mortgage and identify a replacement that you buy for all cash, the IRS treats the extinguished debt as taxable income ("boot"). This happens even if your identified property meets the 3-Property Rule and has sufficient fair market value. Ensure your identified properties allow for sufficient leverage to match your previous debt load, or plan to bring additional cash to the exchange to offset the mortgage relief.

If you're concerned about missing the deadline, this guide on what happens if you miss the 45-day deadline walks through the consequences and rare exceptions. For a deeper discussion of process failures that can trigger tax exposure, see The 3 Most Common 1031 Exchange Mistakes That Trigger a Tax Bill.

A 45-Day Action Plan (Day 0 → Day 45)

Here's a practical timeline to keep your identification on track:

Day 0–7: Confirm deadlines and start the search immediately

Calculate your Day 45 and Day 180 dates. Set calendar alerts for Day 14, Day 30, Day 40, and Day 44. Begin identifying replacement properties with your broker.

Day 14: Build your shortlist

You should have 5–7 properties under active consideration. Begin preliminary underwriting and site visits. Identify potential deal-killers early (title issues, leasing risk, lender constraints).

Day 30: Lock in Plan A and solid backups

Narrow to your top choice and at least two strong backups. Submit offers or LOIs where appropriate. If you're using the 200% Rule, verify your FMV math at this stage.

Day 40: Finalize identification language

Draft the formal identification document with exact property descriptions (street addresses or legal descriptions). Have your QI review the language for compliance.

Day 44: Confirm delivery and receipt

Sign the identification document and send it to your QI via a trackable method (email with read receipt or certified mail). Confirm receipt before end of business on Day 44. Do not wait until Day 45. The goal is proof of delivery and clean documentation—not last-minute scrambling.

Day 45: Deadline (no exceptions)

Your identification must be signed, properly described, and delivered by 11:59 PM. There are no extensions for any reason.

When a quick estimate helps frame your reinvestment capacity, use the 1031 exchange calculator. The calculator notes results are estimates and not tax or legal advice.

Frequently Asked Questions

Does the 45-day clock start at contract signing or closing?

The identification period begins when your relinquished property is transferred—typically the closing date.[^1] Contract signing does not start the timeline.

Can I change my identified properties after Day 45?

No. Once Day 45 passes, your identification is locked. You cannot add, remove, or modify the properties you listed.[^1] You can, however, choose to acquire fewer properties than you identified (as long as you meet the 95% threshold if using that rule).

Do weekends and holidays count toward the 45 days?

Technically, IRS Section 7503 extends deadlines falling on weekends or legal holidays to the next business day.[^4] However, best practice is to treat the Saturday deadline as absolute to avoid any risk of disqualification. Relying on weekend extensions creates unnecessary compliance uncertainty, especially if your QI or other parties involved in the exchange operate under stricter interpretations. Complete your identification at least one business day early.

Do I have to buy everything I identify?

No. Under the 3-Property Rule and 200% Rule, you only need to acquire at least one of the properties you identified. Under the 95% Rule, you must acquire properties totaling at least 95% of the total FMV you identified.[^2]

What if my replacement deal falls through after Day 45?

If you identified multiple properties (following the 3-Property or 200% Rule), you can pivot to one of your backups. This is why having backup identification matters—especially in competitive markets.

What happens if I miss Day 45?

The exchange fails, and the entire capital gains tax becomes due immediately. There are no extensions, and IRS relief is extremely rare (limited to presidentially declared disasters). Missing Day 45 is one of the costliest mistakes in real estate investing.

How detailed does the property description need to be?

The IRS requires an "unambiguous description."[^1] A street address, legal description, or clearly distinguishable property name will satisfy this requirement. "A warehouse in Houston" will not.

Can I identify more than three properties?

Yes, but you must use the 200% Rule or the 95% Rule.[^2] Under the 200% Rule, your total identified FMV cannot exceed twice your relinquished property's FMV. Under the 95% Rule, you must close on at least 95% of the total FMV you identified.

Your Next Step

The 45-day identification window is where most 1031 exchanges succeed or fail. The difference isn't luck or market timing—it's preparation and process discipline.

Work with an attorney-led qualified intermediary early—ideally before your relinquished property even closes. Securitas1031's team of attorneys and real estate professionals ensures your identification is documented correctly, delivered on time, and structured to survive an IRS audit.

If you're selling commercial property in Houston or Austin, align with your broker, CPA, and QI before Day 0. Use the 1031 exchange calculator to estimate your tax deferral and plan your replacement property budget accordingly.

For brokers, the Continuing Education course offers 1-hour TREC CE credit and covers timing requirements and common pitfalls.

The 45-day deadline doesn't care about good intentions or "almost done" deals. It only cares about what's signed, described, and delivered by 11:59 PM on Day 45.

Disclaimer: This article provides general information about 1031 exchange identification rules and is not tax or legal advice. Consult your CPA, attorney, or qualified intermediary for guidance specific to your situation.

Reviewed by: Charles H. Mansour, Founder & CEO, Securitas1031 (B.S., J.D., LL.M. (Taxation))

About Securitas1031

Securitas1031 is a Houston-based qualified intermediary firm operating since 2009. We've successfully facilitated over 18,000 exchanges totaling more than $3 billion in commercial property transactions. Our exchange funds are held in secure accounts through Fidelity National Title's Fee Attorney Office, providing institutional-grade custody and compliance.

Contact: 713-275-8112 | 440 Louisiana St Suite 1100, Houston, TX 77002 | richard@securitas1031.com

[^1]: IRS, Instructions for Form 8824 (2025), https://www.irs.gov/instructions/i8824

[^2]: 26 CFR § 1.1031(k)-1, https://codes.findlaw.com/cfr/title-26-internal-revenue/cfr-sect-26-1-1031-k-1/

[^3]: IRS, Publication 544 (Sales and Other Dispositions of Assets), https://www.irs.gov/publications/p544

[^4]: IRS, 26 U.S. Code § 7503 (Time for performance of acts where last day falls on Saturday, Sunday, or legal holiday), https://www.law.cornell.edu/uscode/text/26/7503

[^5]: IRS, Revenue Procedure 2018-58 (Guidance for Taxpayers Affected by Federally Declared Disasters), https://www.irs.gov/pub/irs-drop/rp-18-58.pdf