The Investor’s Roadmap: Aligning Your Sale, Your Timeline, and Your Tax Strategy

📌 Key Takeaways

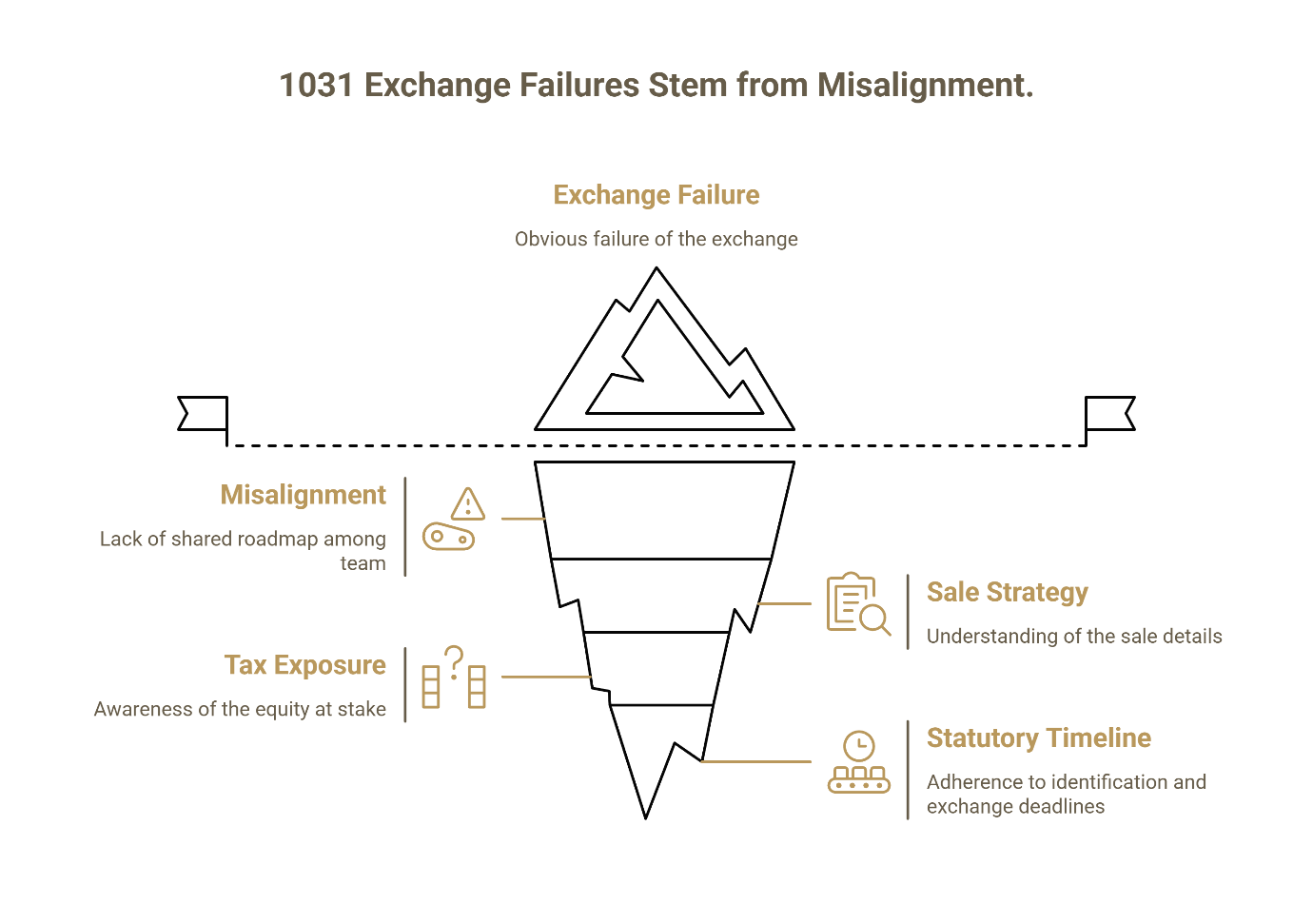

Most 1031 Exchanges fail because the investor, broker, CPA, and Qualified Intermediary operate without a shared roadmap—not because anyone lacks good intent.

Team Misalignment Triggers Failure: Preventable coordination breakdowns between your broker, CPA, and QI cause 30-40% equity loss, not complex tax rules.

Tax Filing Can End Exchanges Early: Your exchange period ends on the earlier of 180 days or your tax return due date under IRC § 1031(a)(3)(B).

Day 45 Demands Written Identification: Submit signed replacement property identification to your QI by 11:59 PM Day 45—verbal conversations don't satisfy IRS requirements.

Touching Proceeds Disqualifies Everything: Constructive receipt occurs if you access sale proceeds even briefly, destroying Safe Harbor protection and triggering full taxation.

Entity Consistency Is Non-Negotiable: Selling as "ABC Holdings, LLC" but buying as an individual disqualifies your exchange—the same taxpayer must execute both transactions.

Alignment across your team before closing transforms a 1031 Exchange from a compliance scramble into straightforward wealth preservation.

Individual commercial property investors planning sales in Houston, Austin, or San Diego will gain a complete coordination framework here, preparing them for the detailed roadmap and implementation template that follows.

~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~

The settlement statement arrives. Your eyes scan down to the "Estimated Tax Due" line. The number is six figures—maybe seven. That equity you spent years building is about to evaporate into federal and state tax liability. Unless you act now.

This is the moment when most investors realize a 1031 Exchange isn't optional—it's essential wealth preservation architecture. But the complexity extends beyond tax strategy. You're managing a team (your broker, your CPA, your Qualified Intermediary), navigating strict statutory requirements (45-day identification and 180-day exchange deadlines with zero extensions), and coordinating a property sale already in motion.

Most 1031 Exchanges that fail don't fail because of bad intent. They fail because of misalignment. The investor assumes the broker is watching the calendar. The broker assumes the CPA is handling the tax math. The CPA assumes the QI will manage the timeline. And by Day 44, everyone is scrambling to identify replacement properties that may not even qualify.

This article provides a single roadmap that keeps everyone aligned—from the sale decision through the final closing—so your equity stays protected and your transaction maintains full IRS compliance.

Why Most 1031 Exchanges Fail: Misalignment, Not Intent

Picture this: It's Day 44 of your 1031 Exchange. Your broker just called. The "perfect" replacement property you've been chasing for three weeks—the one you were certain would close—just fell through. You have less than 24 hours to identify a backup property, and you haven't been seriously looking at alternatives because you were focused on that one deal.

Or consider this moment: You're at the closing table for your relinquished property. The escrow officer slides the settlement statement across the table. There's a line item for a wire transfer—$1.2 million in proceeds—going directly to your business account. You think, "I'll just hold it for a few days while my QI sets up the exchange account." What you don't realize: you've just triggered constructive receipt. Your 1031 Exchange is disqualified before it even starts.

These scenarios happen because there's no shared roadmap. The investor, broker, CPA, and Qualified Intermediary are all working hard—but they're not working from the same plan. The result: preventable failures that cost investors 30-40% of their equity in taxes.

In a delayed (deferred) exchange—the most common 1031 structure—you're managing two hard realities simultaneously: real tax exposure and strict statutory deadlines. Like-kind exchanges can defer gain when you exchange qualifying real property held for business or investment for other qualifying real property. (IRS) The IRC Section 1031 framework includes mandatory identification requirements and exchange period deadlines—miss them, and the exchange fails. (IRS)

A successful 1031 Exchange requires three things to align perfectly:

The Sale Strategy – Understanding what you're selling, when, and to whom

The Tax Exposure – Knowing exactly how much equity is at stake

The Statutory Timeline – Managing the mandatory 45-day identification requirement and 180-day exchange period

When these three elements are synchronized across your entire team, the exchange becomes straightforward. When they're not, you're gambling with your wealth.

Step 1: Start with the Number (Your Tax Exposure)

Before you list your property, before you sign a letter of intent, before you do anything else—you need to know your number. This is the dollar amount of tax liability you're facing if you sell without completing a 1031 Exchange.

Your tax exposure determines your sense of urgency, your replacement property budget, and your negotiating position. If you're facing $400,000 in combined federal and state capital gains tax, that's $400,000 of equity you need to preserve by reinvesting into like-kind replacement property.

To calculate your exposure, you need four pieces of information:

Current market value (estimated sale price)

Original purchase price (your basis)

Capital improvements (additions that increased basis)

Depreciation taken (reduces your basis; must be recaptured)

The formula itself is straightforward, but the details matter. Depreciation recapture, for example, is taxed at a maximum rate of 25% (Section 1250 recapture), distinct from long-term capital gains (15-20% federal, plus state). If you've owned the property for decades, the numbers can be substantial.

Actionable Step: Use a tax savings calculator to estimate your exposure before you list. Estimate your potential tax savings with our 1031 Exchange Calculator. This tool provides a general estimate—always consult your CPA or tax advisor for a precise analysis specific to your situation.

Why calculate this first? Because the number dictates everything that follows. A $50,000 tax bill and a $500,000 tax bill require very different replacement property strategies and very different levels of timeline discipline.

For a detailed walk-through of the tax calculation methodology, see: Calculating Your Potential Capital Gains Tax Savings (Step-by-Step).

Step 2: Know What Starts the Clock (and What Doesn't)

One of the most dangerous misconceptions in 1031 Exchanges for Commercial Properties is the belief that you have "plenty of time" because you're still negotiating the sale. The reality: the clock doesn't start when you think it does—and once it starts, there are no extensions.

Day 0 is the closing date of your relinquished property. Not the day you accept an offer. Not the day you open escrow. The moment you transfer title and the exchange is structured, the IRS timeline begins. You now have 45 calendar days to identify your replacement property, and a maximum of 180 calendar days to close on it. Note that the exchange period ends on the earlier of 180 days after the transfer of the relinquished property or the due date (including extensions) for your tax return for that taxable year. (IRC § 1031(a)(3)(B))

This "tax return due date" limitation catches many investors by surprise. If you sell a property in December, your standard 180-day window would extend into June. However, if you file your tax return on April 15th without an extension, your exchange period ends on April 15th—not June. A replacement property closing scheduled for May would fall outside the exchange period, disqualifying the transaction entirely.

IRC Section 1031 applies a strict calendar-day count. While IRS revenue rulings generally allow deadlines ending on weekends or legal holidays to extend to the next business day (under IRC § 7503), relying on this technicality is a strategic risk best avoided. Deals that fall through on Day 46 obtain no relief.

This creates a critical planning window that most investors miss: the period between signing the purchase agreement and closing. This is your Day -30 to Day 0 window—and it's when you should be doing most of your heavy lifting.

During this window, you should:

Finalize the tax exposure calculations from Step 1

Engage your Qualified Intermediary and execute the exchange agreement

Brief your broker on your replacement property criteria

Alert your CPA that an exchange is coming

Start previewing potential replacement properties (even if informally)

A strong approach is to treat the letter of intent phase as Day -30. You're not "waiting to see what happens." You're building the exchange structure before the statutory timeline begins.

The critical compliance requirement: you cannot touch the sale proceeds. Ever. Not for a day. Not for an hour. This is the constructive receipt rule, and it's absolute. Constructive receipt means if you can access or control the sale proceeds—even briefly—the IRS may treat you as having received the money, which can disqualify the exchange. IRS Publication 544 discusses safe harbors addressing actual and constructive receipt concerns in deferred exchanges. (IRS)

The moment you have the right to receive the funds—even if you don't actually take possession—the exchange is disqualified. Your QI must be in place before closing to receive and hold the funds in a segregated account on your behalf. This Safe Harbor structure protects the exchange by ensuring you never have access to or control over the proceeds during the exchange period.

Think of it like a relay race. You can't complete the handoff after you've already crossed the finish line. The exchange structure must be established before you close on the sale.

For a comprehensive explanation of why self-managing violates Safe Harbor requirements, see: Why the 'DIY' Approach to 1031 Exchanges Puts Your Equity at Risk.

Step 3: Build the 180-Day Roadmap (with Checkpoints)

The 45-day identification requirement and 180-day exchange period are statutory requirements under IRC Section 1031. Missing either deadline means your exchange fails and your full tax liability comes due. The IRS framework provides no extensions or exceptions. (IRS)

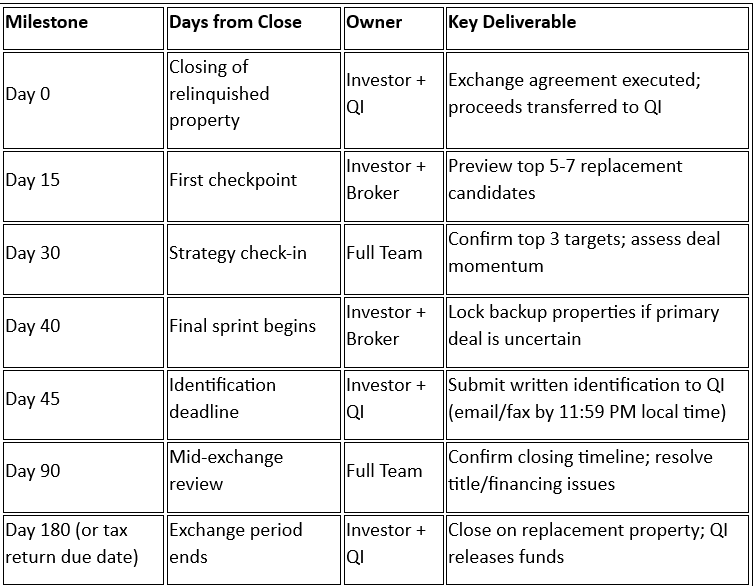

Instead of thinking "45 and 180," consider checkpoints and ownership. The practical timeline looks like this:

Most investors focus obsessively on Day 45—and they should. But the checkpoints at Day 30 and Day 40 are equally important. These are your early-warning signals. If you reach Day 30 and you haven't made offers on at least two properties, you're behind. If you reach Day 40 and your primary deal hasn't firmed up, you need backup properties identified immediately.

Practical Implementation: Set three calendar alerts:

Day 30 (review progress with your team)

Day 40 (finalize backup plan)

Day 44 (final 24-hour window to adjust identification)

For detailed timeline management strategies, see: Beat the Clock: A Strategic Timeline for a Flawless 1031 Exchange.

Step 4: Assign Roles (Investor, Broker, CPA, QI)

A 1031 Exchange requires clear team coordination. When everyone understands their role—and everyone knows who owns each critical milestone—the process runs smoothly. When roles are unclear, critical tasks fall through the cracks.

The responsibility matrix:

Investor (You):

Decide to pursue the exchange (Day -30)

Execute exchange agreement with QI (before Day 0)

Identify replacement properties (by Day 45)

Sign purchase agreements and closing documents (Day 0 to Day 180)

Ensure title/entity consistency: sell as X, buy as X (not X selling and Y buying)

Broker:

Preview replacement properties (Day 0 to Day 30)

Negotiate offers and manage due diligence (Day 0 to Day 45)

Coordinate closings with title companies (Day 45 to Day 180)

Communicate deal status to the team weekly

CPA/Tax Advisor:

Calculate tax exposure and exchange requirements (Day -30)

Confirm like-kind qualification of replacement properties (Day 0 to Day 45)

Review final transaction structure for compliance (Day 90 to Day 180)

Prepare Form 8824 for tax filing (after Day 180)

Critical: Coordinate tax return filing strategy to avoid premature exchange period termination

Qualified Intermediary (Securitas 1031):

Draft and execute exchange agreement (before Day 0)

Hold sale proceeds in segregated escrow (Day 0 to Day 180)

Receive and document property identification (by Day 45)

Coordinate fund disbursement at replacement closing (Day 180)

Ensure full IRS compliance throughout the process

For teams that prefer a more structured approach, you can also use a RACI framework (Responsible, Accountable, Consulted, Informed) to map out who owns each workstream. The key is making ownership visible and explicit—no assumptions about who's handling what.

The most critical coordination point: entity and title consistency. If you sell the relinquished property as "ABC Holdings, LLC," you must purchase the replacement property as "ABC Holdings, LLC." If you sell as an individual and buy as an LLC (or vice versa), the IRS may disqualify the exchange. Confirm this with your CPA and QI before Day 0, not on Day 179.

For a detailed explanation of the tax calculation methodology behind your exchange, see: Calculating Your Potential Capital Gains Tax Savings (Step-by-Step).

Step 5: Build a Backup Plan Before Day 45

Even the most carefully planned deals fall through. The seller changes their mind. Financing doesn't come through. An inspection reveals a structural issue. If this happens after Day 45, and you didn't identify backup properties, your exchange is in jeopardy.

IRC Section 1031 allows you to identify multiple properties as potential replacements. You don't have to close on all of them—you just have to identify them in writing by the deadline. The three most common identification rules are:

Three-Property Rule: Identify up to three properties of any value

200% Rule: Identify any number of properties, as long as their total value doesn't exceed 200% of the relinquished property's sale price

95% Rule: Identify any number of properties of any total value, but you must close on properties representing at least 95% of the total identified value

For most investors, the Three-Property Rule is the simplest and safest approach. Identify your top target and two strong backups. If your primary deal closes, your alternative identifications remain valid documentation. If your primary deal doesn't close, you have alternatives already on record.

Like-Kind Property: For real estate held for business or investment, "like-kind" is about the nature of the property, not whether it's the same exact type. Real property can be like-kind regardless of being improved or unimproved. (IRS) This means you can exchange an office building for vacant land, or a retail center for a multifamily property—as long as both are held for investment or business use.

Before you identify backups, use this resource to confirm qualification requirements: What Qualifies as Like-Kind Property? A Simple Checklist for Texas Investors.

Critical Requirement: Your identification must be submitted to your QI in writing (email or fax is acceptable) by 11:59 PM on Day 45, using your local time zone. A verbal conversation doesn't satisfy the requirement. A text message doesn't satisfy the requirement. The IRS requires a signed, written document that unambiguously describes the replacement properties—typically by street address or legal description.

For complete details on identification requirements, see: What Happens if You Miss the 45-Day Deadline? (And How to Prevent It).

Step 6: The Common Alignment Failures (and How to Prevent Them)

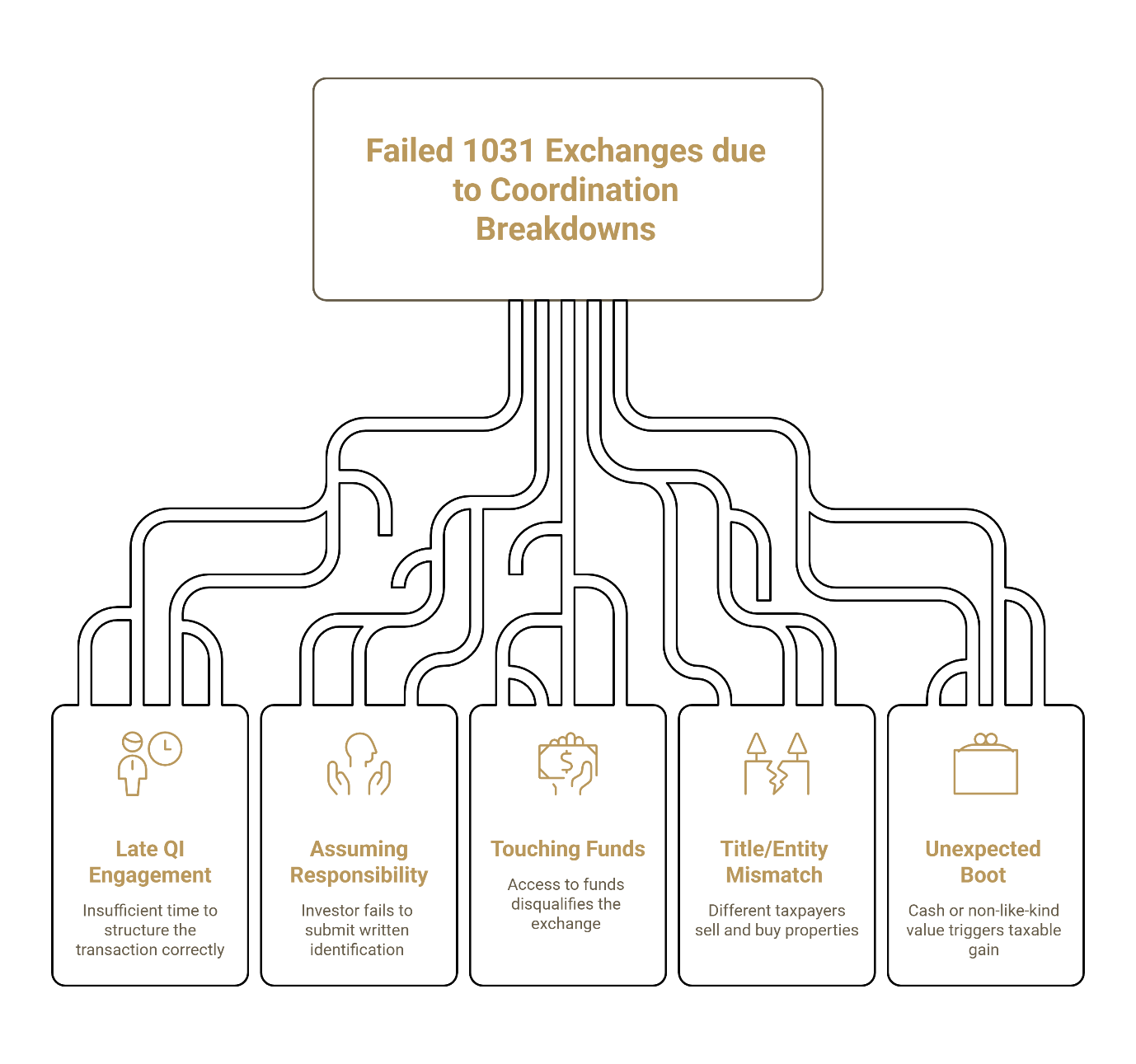

Most 1031 Exchange failures aren't caused by complex tax issues or obscure IRS regulations. They're caused by simple coordination breakdowns. These are the five most common—and most preventable—mistakes:

Failure #1: Waiting to Engage a QI Until Closing Day

Some investors treat the Qualified Intermediary as a last-minute detail—something to handle the week before closing. By then, it's often too late to structure the transaction correctly. Exchange agreements, title instructions, and escrow coordination all need to be in place before the sale closes. Engage your QI at least 10-14 days before closing, ideally when you open escrow. Treat fund handling with controlled access, clear guardrails, and documented steps.

Failure #2: Assuming Someone Else Owns Day 45

On Day 43, the investor calls the broker: "Have you identified the replacement properties yet?" The broker responds: "I thought you were handling that." This is the most dangerous assumption in the entire process. The investor—and only the investor—is responsible for submitting the written identification to the QI by the deadline. Your broker can help you find properties. Your QI can explain the rules. But you must sign and submit the identification document.

For detailed consequences of missing this deadline, see: What Happens if You Miss the 45-Day Deadline? (And How to Prevent It).

Failure #3: Touching the Funds (Constructive Receipt)

Even sophisticated investors sometimes think they can "briefly" hold the proceeds—maybe to cover a short-term expense, or because the exchange account isn't set up yet. The IRS doesn't recognize "brief." The moment you have access to the funds, the exchange is disqualified. IRS Publication 544 addresses safe harbors related to constructive receipt in deferred exchanges. (IRS) Your QI must be the direct recipient at closing, holding the proceeds in a segregated, insulated account until they're deployed into the replacement property.

Failure #4: Title/Entity Mismatch

You sell a property owned by "Smith Family Trust" but purchase the replacement property as "Smith Holdings, LLC." Or you sell as an individual but buy as a partnership. Either way, the IRS may disqualify the exchange because the taxpayer entity changed mid-transaction. The rule is straightforward: the same taxpayer who sells must be the same taxpayer who buys. Confirm this with your CPA and QI before you close on the relinquished property.

Failure #5: Unexpected Boot

Boot is cash or non-like-kind value you receive as part of the exchange. Boot can create taxable gain even if the exchange otherwise qualifies. This often occurs through cash held back at closing, debt reduction, or closing cost prorations that leave you with cash in hand. Even "small" amounts of boot trigger taxable gain on a proportional basis.

Prevention: Coordinate early with your CPA and tax advisor on expected cash, debt changes, prorations, and closing adjustments. Your QI should structure the transaction to minimize or eliminate boot wherever possible.

These failures share a common thread: they result from a lack of alignment and communication. That's why the roadmap exists—to make sure everyone knows the plan, knows their role, and knows what happens next.

Your One-Page Roadmap Template (How to Use It in 15 Minutes)

The strategic alignment tool is designed to be filled out in one sitting and shared immediately with your broker, CPA, and QI. It's not a complex project plan—it's a single-page reference that keeps everyone on the same timeline and working from the same facts.

Implementation Steps:

Fill it out as soon as you accept an offer (or open escrow). Don't wait until closing.

Include:

Pre-exchange launch date (Day -30)

Relinquished property closing date (Day 0)

Day 45 identification deadline (with time zone)

Day 180 exchange deadline (or earlier tax return due date)

Your top 3 replacement property targets (with backup properties)

Team contact info (Investor, Broker, CPA, QI)

Weekly check-in schedule (e.g., "Monday 9 AM team call")

Share it immediately via email or printout with every member of your team. Everyone should have the same version.

Update it weekly. If a deal falls through, if a new property comes on the market, if a timeline shifts—update the roadmap and re-share it. This keeps everyone aligned in real time.

Set one recurring team meeting (even if it's just a 15-minute check-in call) to review progress against the roadmap. This is your accountability mechanism.

The Investor's Roadmap — One-Page Template

A) The Number

Estimated gain/tax exposure: ______________________

Target equity to preserve: ______________________

CPA/tax advisor contact: ______________________

B) The Clock

Pre-Exchange Launch (Day -30): ___ / ___ / _____

Relinquished closing date (Day 0): ___ / ___ / _____

Day 45 identification deadline: ___ / ___ / _____

Day 180 exchange deadline: ___ / ___ / _____

Tax return due date (if earlier than Day 180): ___ / ___ / _____

Alerts set for Day 30 / 40 / 44: ☐ Yes

C) The Plan

Primary replacement targets (top 3):

______________________

______________________

______________________

Backup properties (if primary fails):

______________________

______________________

D) The Team

Investor: ______________________ (phone/email)

Broker: ______________________ (phone/email)

CPA/tax advisor: ______________________ (phone/email)

Qualified Intermediary (QI): ______________________ (phone/email)

E) The Cadence

Weekly check-in day/time: ______________________

Standing agenda:

Replacement pipeline status

Deadline status (Day 45/180/tax return)

Entity/title confirmation

Documentation checklist

The goal is a fully compliant, audit-proof transaction—no surprises, no last-minute scrambling, no preventable technical failures.

Ready to Protect Your Equity?

A successful 1031 Exchange isn't about cutting corners or finding loopholes. It's about precision, discipline, and coordination across your entire team. When you align the sale, the tax strategy, and the statutory timeline before closing, the exchange becomes a straightforward wealth preservation tool.

If you're planning a property sale in Houston, Austin, or San Diego, schedule an in-person consultation with Securitas 1031. We'll review your specific transaction, calculate your tax exposure, and build a custom roadmap that keeps your equity protected and your exchange fully compliant.

Contact Securitas 1031:

Phone: 713-275-8112

Office: 440 Louisiana St Suite 1100, Houston, TX 77002

Contact us online to get started

For a comprehensive overview of how 1031 Exchanges work and how they can help you build long-term wealth, see: From Tax Liability to Wealth Legacy: The Definitive 1031 Exchange Guide for Commercial Investors.

Optional Local Trust Signal:

If you're a Texas broker building confidence in 1031 Exchanges, Securitas 1031 offers a continuing education course, "An Overview of 1031 Exchanges," where you can earn 1 Hour TREC CE Credit. This session covers timing, rules, and key concepts to help you guide your clients effectively.

Disclaimer: This article is for informational purposes only and does not constitute tax or legal advice. Every transaction is fact-specific. Consult your CPA/tax advisor and attorney to evaluate your situation before acting.

Our Editorial Process:

Our expert team uses AI tools to help organize and structure our initial drafts. Every piece is then extensively rewritten, fact-checked, and enriched with first-hand insights and experiences by expert humans on our Insights Team to ensure accuracy and clarity.

About the Author:

Charles H. Mansour, BS, JD, LL.M (Taxation), is the Founder & CEO of Securitas 1031. Since 2009, he has advised commercial real estate investors on compliant 1031 exchange execution, with a focus on equity protection, strict timeline discipline, and risk-controlled documentation. Charles leads a team that has facilitated over 18,000 closings representing more than $3 billion in transactions, operating in partnership with Fidelity National Title. He is a frequent educator for Texas real estate professionals, offering continuing education courses approved for TREC credit.